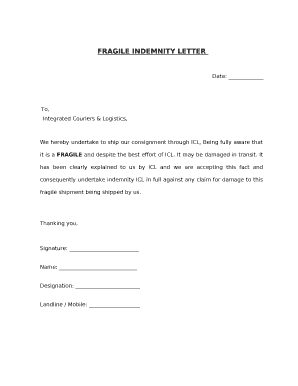

FRAGILE INDEMNITY LETTER Form

What is the fragile indemnity letter?

A fragile indemnity letter is a legal document used to protect one party from potential losses or damages caused by another party's actions. This letter serves as a promise that the party providing the indemnity will compensate the other party for specific losses outlined within the document. It is crucial in various situations, such as contractual agreements, where one party may be exposed to risks associated with the actions of another. The letter of indemnity format ensures that all necessary details are clearly stated, providing legal protection and clarity for both parties involved.

Key elements of the fragile indemnity letter

When drafting a fragile indemnity letter, certain key elements must be included to ensure its effectiveness and legal validity. These elements typically consist of:

- Parties Involved: Clearly identify the parties entering into the indemnity agreement, including their legal names and addresses.

- Description of Indemnity: Provide a detailed description of the circumstances under which indemnity will be granted, including specific actions or events that trigger the indemnity.

- Limitations and Exclusions: Outline any limitations or exclusions related to the indemnity, specifying what is not covered under the agreement.

- Duration: Specify the time frame during which the indemnity is valid, including any conditions for termination.

- Signatures: Ensure that all parties sign the document, as this is essential for the enforceability of the indemnity letter.

Steps to complete the fragile indemnity letter

Completing a fragile indemnity letter involves several important steps to ensure that the document is legally binding and meets the needs of all parties involved. Follow these steps for effective completion:

- Identify the parties: Gather the full legal names and addresses of all parties involved in the indemnity agreement.

- Draft the letter: Use a clear and concise format to outline the terms of the indemnity, including the specific risks covered.

- Review legal requirements: Ensure that the letter complies with relevant laws and regulations applicable in your state.

- Obtain signatures: Have all parties sign the document, either in person or electronically, to validate the agreement.

- Distribute copies: Provide copies of the signed indemnity letter to all parties for their records.

Legal use of the fragile indemnity letter

The legal use of a fragile indemnity letter is vital for protecting parties from potential liabilities. This document is often utilized in various sectors, including construction, real estate, and corporate transactions. It acts as a safeguard, ensuring that if one party incurs losses due to the actions of another, they can seek compensation as outlined in the letter. To ensure legal enforceability, it is essential that the letter adheres to state laws and includes all necessary elements, such as clear definitions and agreement terms.

How to obtain the fragile indemnity letter

Obtaining a fragile indemnity letter can be done through several methods. Many businesses and individuals choose to draft their own letters using templates available online. However, it is advisable to consult with a legal professional to ensure that the document meets all legal requirements and adequately protects your interests. Additionally, legal service providers may offer customized indemnity letters tailored to specific needs, ensuring compliance with state laws and regulations.

Examples of using the fragile indemnity letter

There are various scenarios where a fragile indemnity letter may be used effectively. Common examples include:

- Construction Projects: Contractors often use indemnity letters to protect themselves from claims arising from accidents or damages that occur on-site.

- Real Estate Transactions: Buyers may request an indemnity letter from sellers to cover potential issues related to property title or undisclosed defects.

- Corporate Agreements: Companies may require indemnity letters in contracts with vendors or service providers to safeguard against potential liabilities.

Quick guide on how to complete fragile indemnity letter

Complete FRAGILE INDEMNITY LETTER effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage FRAGILE INDEMNITY LETTER on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign FRAGILE INDEMNITY LETTER without hassle

- Locate FRAGILE INDEMNITY LETTER and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign FRAGILE INDEMNITY LETTER and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fragile indemnity letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample indemnity letter format?

A sample indemnity letter format is a predefined template that outlines the essential elements of an indemnity agreement. It typically includes details such as the parties involved, scope of indemnity, and conditions for claiming indemnity. Using a structured format can help ensure all critical aspects are covered, making it a valuable resource for businesses.

-

How can airSlate SignNow help with indemnity letters?

airSlate SignNow simplifies the process of creating and signing indemnity letters by providing an easy-to-use platform. With the right sample indemnity letter format available, users can quickly fill out necessary information and obtain digital signatures, which streamlines document management and enhances workflow efficiency. This makes it an ideal solution for businesses that regularly deal with indemnity agreements.

-

Is there a cost associated with using airSlate SignNow for indemnity letters?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs when it comes to document management. Choosing the right plan can allow you to utilize templates like the sample indemnity letter format effectively. There are options suitable for both small teams and larger enterprises, ensuring everyone can benefit from its capabilities.

-

Can I customize the sample indemnity letter format in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the sample indemnity letter format according to their specific requirements. You can easily modify sections, add logos, or adjust wording to fit your unique situation, ensuring that the final document aligns perfectly with your business needs.

-

What features does airSlate SignNow offer for indemnity letters?

airSlate SignNow includes various features designed to facilitate the management of indemnity letters. This includes digital signing, template creation, document tracking, and secure storage options. These features ensure that your indemnity letters not only adhere to the sample indemnity letter format but also maintain a high level of security and efficiency.

-

What benefits does using airSlate SignNow provide for my business?

Using airSlate SignNow offers numerous benefits, including faster turnaround times for document signing, reduced paper usage, and improved compliance with legal standards. With easy access to the sample indemnity letter format, your team can complete documents rapidly without sacrificing accuracy. Ultimately, this leads to better productivity and operational efficiency for your business.

-

Does airSlate SignNow integrate with other software and tools?

Yes, airSlate SignNow integrates seamlessly with various third-party applications such as Google Drive, Salesforce, and others. This compatibility allows you to incorporate the sample indemnity letter format into your existing workflow effortlessly. By integrating with other tools, airSlate SignNow enhances overall productivity and ensures a streamlined document management process.

Get more for FRAGILE INDEMNITY LETTER

- Shf new patient forms skin health forever

- Texas divorce waiver form waiver for texas divorce without children texasatj

- Transformation 2013 and pbl and macromolecules

- Rental up form

- Cdph 8610 pfr north app 0609 formcodes cdph ca

- Uniform waste tire manifest form wt 2 coloradogov colorado

- Tank inspection template form

- Visual inspection forms

Find out other FRAGILE INDEMNITY LETTER

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction