Gsis Emergency Loan 40k Form

What is the Gsis Emergency Loan 40k

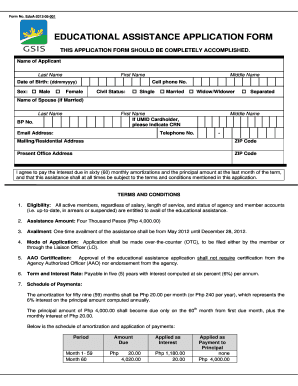

The gsis emergency loan 40k is a financial assistance program designed to support individuals facing unexpected financial challenges. This loan provides up to forty thousand dollars to eligible borrowers, helping them manage expenses during times of crisis, such as natural disasters or personal emergencies. The program aims to alleviate financial burdens and ensure that individuals can meet their essential needs without significant delays.

How to Obtain the Gsis Emergency Loan 40k

To obtain the gsis emergency loan 40k, applicants must first ensure they meet the eligibility criteria set forth by the program. Typically, this includes being a member of the Government Service Insurance System (GSIS) and demonstrating a valid need for financial assistance. Interested individuals should gather necessary documentation, such as proof of income and identification. The application can often be submitted online, making the process more convenient.

Steps to Complete the Gsis Emergency Loan 40k

Completing the gsis emergency loan 40k application involves several key steps:

- Review eligibility requirements to ensure qualification.

- Gather required documents, including identification and income verification.

- Access the online application portal provided by GSIS.

- Fill out the application form accurately, providing all necessary information.

- Submit the application and keep a record of submission for future reference.

Legal Use of the Gsis Emergency Loan 40k

The gsis emergency loan 40k is legally binding, provided that all application requirements and procedures are followed. It is essential for applicants to understand the terms and conditions associated with the loan, including repayment obligations and interest rates. Compliance with relevant laws ensures that the loan is recognized as valid and enforceable in legal contexts.

Eligibility Criteria

Eligibility for the gsis emergency loan 40k typically includes the following criteria:

- Must be a member of the Government Service Insurance System.

- Demonstrate a valid financial need due to an emergency situation.

- Provide necessary documentation to support the application.

Required Documents

When applying for the gsis emergency loan 40k, applicants should prepare the following documents:

- Valid identification, such as a government-issued ID.

- Proof of income, such as pay stubs or tax returns.

- Any additional documentation that may support the need for the loan.

Quick guide on how to complete gsis emergency loan 40k

Complete Gsis Emergency Loan 40k effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Gsis Emergency Loan 40k on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Gsis Emergency Loan 40k with ease

- Find Gsis Emergency Loan 40k and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would prefer to send your form, either via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign Gsis Emergency Loan 40k and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsis emergency loan 40k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GSIS calamity loan?

A GSIS calamity loan is a financial assistance option provided by the Government Service Insurance System for members who are affected by natural disasters. This loan helps members manage their financial burdens during difficult times by offering flexible repayment terms and low interest rates.

-

Who is eligible for the GSIS calamity loan?

Eligibility for the GSIS calamity loan typically includes active members of the GSIS who have made at least three premium contributions. Additionally, members must be affected by a calamity as declared by the appropriate authorities to qualify for this loan.

-

How can I apply for a GSIS calamity loan?

To apply for a GSIS calamity loan, eligible members can visit the GSIS website or an authorized office to submit their application. It's important to prepare necessary documents and provide proof of calamity-affected status to streamline the application process.

-

What are the interest rates for the GSIS calamity loan?

The GSIS calamity loan offers competitive interest rates designed to ease the financial strain on borrowers. Typically, the rates are signNowly lower than those of traditional loans, ensuring that members can repay without excessive burdens.

-

How much can I borrow through the GSIS calamity loan?

The maximum amount you can borrow through the GSIS calamity loan varies based on your insurance contributions and specific guidelines issued by GSIS. Generally, it provides sufficient funds to cover immediate financial needs due to calamity.

-

What are the repayment terms for the GSIS calamity loan?

Repayment terms for the GSIS calamity loan are often flexible, allowing borrowers to pay back in manageable installments. The specific duration generally depends on the amount borrowed and your financial capacity, with options usually spanning several months.

-

Can the GSIS calamity loan be used for any type of expense?

Yes, the GSIS calamity loan can be used to cover various expenses incurred due to a calamity, such as repairs to homes, medical bills, or other unforeseen costs. This flexibility provides relief to members who need immediate assistance.

Get more for Gsis Emergency Loan 40k

- Car travel interruption protection reimbursement form aaa

- Dd form 1348 2

- Community service reporting form all candidates for florida bright futures scholarship awards are required to complete florida

- Etiqa nomination form

- Self declaration of sexual abusesexual harassment form

- Reg31 fillable form

- Student iep cheat sheet great idea for handy reference form

- Docketing statement appeal to the alabama court of civil form

Find out other Gsis Emergency Loan 40k

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online