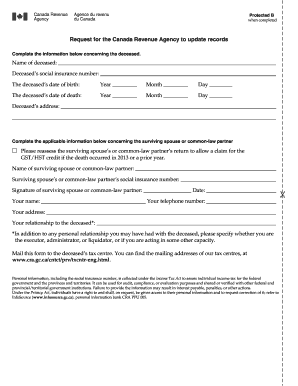

Request for the Canada Revenue Agency to Update Records Form

What is the request for the Canada Revenue Agency to update records?

The request for the Canada Revenue Agency (CRA) to update records is a formal document that individuals or businesses submit to correct or modify their information held by the CRA. This may include changes to personal details, such as name, address, or marital status, as well as updates related to business information, like ownership or operational changes. Ensuring that your records are accurate is crucial, as it affects your tax filings, benefits, and overall compliance with Canadian tax laws.

Steps to complete the request for the Canada Revenue Agency to update records

Completing the request for the CRA to update records involves several important steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information: Collect all relevant personal or business details that need updating.

- Obtain the correct form: Access the appropriate CRA form for updating records, which can typically be found on the CRA website.

- Fill out the form: Carefully complete the form, ensuring all information is accurate and clearly presented.

- Review the form: Double-check for any errors or omissions before submission.

- Submit the form: Send the completed form to the CRA through the designated method, whether online, by mail, or in-person.

Legal use of the request for the Canada Revenue Agency to update records

When submitting a request for the CRA to update records, it is essential to understand the legal implications. This document serves as a formal request and must be filled out truthfully and accurately. Providing false information can lead to penalties, including fines or legal action. The CRA may require supporting documentation to validate the changes, so it is advisable to include any necessary proof, such as identification or business registration documents, to strengthen your request.

Required documents for the request for the Canada Revenue Agency to update records

To successfully submit a request for the CRA to update records, specific documents may be required. These can include:

- Government-issued identification (for personal updates)

- Business registration documents (for business-related updates)

- Proof of address (such as utility bills or lease agreements)

- Any other relevant documentation that supports the requested changes

Having these documents ready can expedite the processing of your request and ensure compliance with CRA regulations.

Form submission methods for the request for the Canada Revenue Agency to update records

There are several methods available for submitting the request for the CRA to update records. These methods include:

- Online submission: Many forms can be completed and submitted electronically through the CRA's online portal.

- Mail: You can print the completed form and send it via postal service to the appropriate CRA office.

- In-person: Some individuals may prefer to submit their requests in person at a local CRA office, where they can receive immediate assistance.

Choosing the right submission method can depend on personal preference and the urgency of the request.

Examples of using the request for the Canada Revenue Agency to update records

Examples of situations where you might need to submit a request for the CRA to update records include:

- Changing your address after moving to a new home.

- Updating your marital status following a marriage or divorce.

- Modifying business ownership details after a sale or transfer of assets.

- Correcting errors in your Social Insurance Number (SIN) or other identification details.

These examples illustrate the importance of keeping your records current to avoid potential issues with tax filings and benefits.

Quick guide on how to complete request for the canada revenue agency to update records

Complete Request For The Canada Revenue Agency To Update Records effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage Request For The Canada Revenue Agency To Update Records on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based tasks today.

How to modify and eSign Request For The Canada Revenue Agency To Update Records effortlessly

- Find Request For The Canada Revenue Agency To Update Records and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information carefully and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Request For The Canada Revenue Agency To Update Records and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for the canada revenue agency to update records

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRA request to update records in airSlate SignNow?

A CRA request to update records refers to the process of submitting updates to your customer records through airSlate SignNow. This streamlined feature ensures that any changes to your account information are handled securely and efficiently, enhancing your overall document management experience.

-

How can I submit a CRA request to update records using airSlate SignNow?

To submit a CRA request to update records in airSlate SignNow, simply log into your account, navigate to the record you wish to update, and follow the prompts to fill out the necessary forms. The platform’s user-friendly interface will guide you seamlessly through the process.

-

What are the pricing options for using airSlate SignNow for CRA requests?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including pricing tiers that accommodate CRA requests to update records. You can choose a plan that suits your volume of documents and required features, ensuring cost effectiveness for your organization.

-

Does airSlate SignNow offer features specifically for CRA requests to update records?

Yes, airSlate SignNow includes several features designed to facilitate CRA requests to update records. These features include document templates, automated notifications, and secure e-signature capabilities to streamline the updating process and maintain compliance.

-

What are the benefits of using airSlate SignNow for CRA requests to update records?

Using airSlate SignNow for CRA requests to update records provides numerous benefits, such as enhanced security, improved efficiency, and seamless integration with other business tools. This means you can manage updates more effectively, minimizing errors and saving time.

-

Can I integrate airSlate SignNow with other applications for processing CRA requests?

Absolutely! airSlate SignNow offers robust integrations with various applications, making it easy to process CRA requests to update records alongside your existing tools. Popular integrations include CRM systems, cloud storage services, and project management apps.

-

Is technical support available for users handling CRA requests to update records?

Yes, airSlate SignNow provides dedicated technical support for users. Whether you have questions about submitting a CRA request to update records or encounter any issues, our support team is available to assist you promptly and efficiently.

Get more for Request For The Canada Revenue Agency To Update Records

- Redifix tile adhesive additive form

- Printable articulation worksheets form

- City mill credit application form

- Dever dental child patient intake form

- Scoring sheet20111017 form

- Cpe certificate template form

- How to fill nsnp 200 form for nova scotia pnp

- Technical service consulting agreement template form

Find out other Request For The Canada Revenue Agency To Update Records

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors