Nebraska Form 458

What is the Nebraska Form 458?

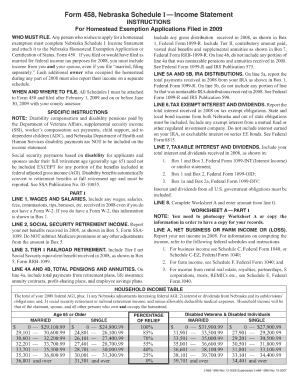

The Nebraska Form 458, also known as the Nebraska Homestead Exemption Form, is a crucial document for residents seeking to claim a property tax exemption on their primary residence. This form allows qualifying individuals, including seniors, disabled persons, and low-income homeowners, to reduce their property tax burden. The exemption can significantly lower the assessed value of the property, resulting in substantial savings on property taxes.

How to use the Nebraska Form 458

Using the Nebraska Form 458 involves several steps to ensure proper completion and submission. First, individuals must verify their eligibility based on age, disability status, or income level. Once eligibility is confirmed, the form can be filled out with necessary personal information, property details, and the specific exemption being claimed. After completing the form, it should be submitted to the appropriate county assessor's office for processing.

Steps to complete the Nebraska Form 458

Completing the Nebraska Form 458 requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including proof of age or disability, and income statements.

- Fill out personal information, including your name, address, and contact details.

- Provide information about the property, including its location and assessed value.

- Indicate the specific exemption being claimed and any supporting details.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Nebraska Homestead Exemption, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old, permanently disabled, or meet income restrictions. The property must be the applicant's primary residence, and the exemption applies only to the assessed value of the home. It is essential to check the latest guidelines from the Nebraska Department of Revenue to confirm eligibility, as requirements may change.

Form Submission Methods

The Nebraska Form 458 can be submitted through various methods to accommodate different preferences. Residents can choose to file the form online through the Nebraska Department of Revenue's website, or they may opt to submit a paper version via mail or in person at their local county assessor's office. Each method has its own processing times, so individuals should consider their preferred timeline when selecting a submission method.

Key elements of the Nebraska Form 458

The Nebraska Form 458 includes several key elements that are vital for successful completion. These elements typically encompass:

- Applicant's personal information (name, address, contact details)

- Property details (location, assessed value)

- Eligibility criteria (age, disability status, income level)

- Specific exemption being claimed

- Signature and date of submission

Legal use of the Nebraska Form 458

The Nebraska Form 458 is legally binding once completed and submitted according to state regulations. It is essential for applicants to provide accurate information, as any discrepancies may lead to penalties or denial of the exemption. The form must be submitted by the specified deadlines to ensure eligibility for the tax year in question. Understanding the legal implications of the form helps applicants navigate the process confidently.

Quick guide on how to complete nebraska form 458

Complete Nebraska Form 458 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without interruptions. Handle Nebraska Form 458 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Nebraska Form 458 without hassle

- Acquire Nebraska Form 458 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Nebraska Form 458 and ensure effective communication at all stages of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 458

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 458 Nebraska and why is it important?

Form 458 Nebraska is a crucial document for businesses that need to request approval for certain services and exemptions in the state. Understanding this form is essential for ensuring compliance with state regulations. airSlate SignNow simplifies the process of filling and eSigning Form 458, making it more manageable for your business.

-

How does airSlate SignNow help with Form 458 Nebraska?

airSlate SignNow provides an intuitive platform to facilitate the completion of Form 458 Nebraska. With features like templates and electronic signatures, you can streamline the submission process, ensuring that all required fields are completed efficiently. Our solution minimizes errors and saves time for your team.

-

Is there a cost associated with using airSlate SignNow for Form 458 Nebraska?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. These plans provide access to all necessary features for handling Form 458 Nebraska, including eSigning and cloud storage. The cost is competitive, allowing even small businesses to utilize our services without breaking the bank.

-

What features does airSlate SignNow offer for Form 458 Nebraska?

Key features of airSlate SignNow for handling Form 458 Nebraska include customizable templates, team collaboration tools, and secure cloud storage. Additionally, the platform supports eSigning, which speeds up the approval process signNowly. These features greatly enhance the efficiency of managing your documents.

-

Can I integrate airSlate SignNow with other software for managing Form 458 Nebraska?

Absolutely! airSlate SignNow easily integrates with various popular software tools and applications, facilitating a seamless workflow for managing Form 458 Nebraska. These integrations help you connect your existing systems, ensuring that all data is synchronized and accessible across platforms.

-

What benefits will my business gain from using airSlate SignNow for Form 458 Nebraska?

Using airSlate SignNow for Form 458 Nebraska comes with multiple benefits, including increased efficiency, reduced processing time, and enhanced accuracy in document handling. Additionally, eSigning allows for faster approval cycles, improving overall productivity. These advantages foster better compliance and customer satisfaction.

-

How secure is the airSlate SignNow platform for handling Form 458 Nebraska?

The airSlate SignNow platform prioritizes security, ensuring that all documents, including Form 458 Nebraska, are protected with encryption and secure access controls. We comply with industry standards to safeguard your sensitive information. This commitment to security allows you to confidently manage critical documents.

Get more for Nebraska Form 458

Find out other Nebraska Form 458

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself