Form Schedule R F 990 Schedule R F 990 Related 2022

What is the Form Schedule R (Form 990)

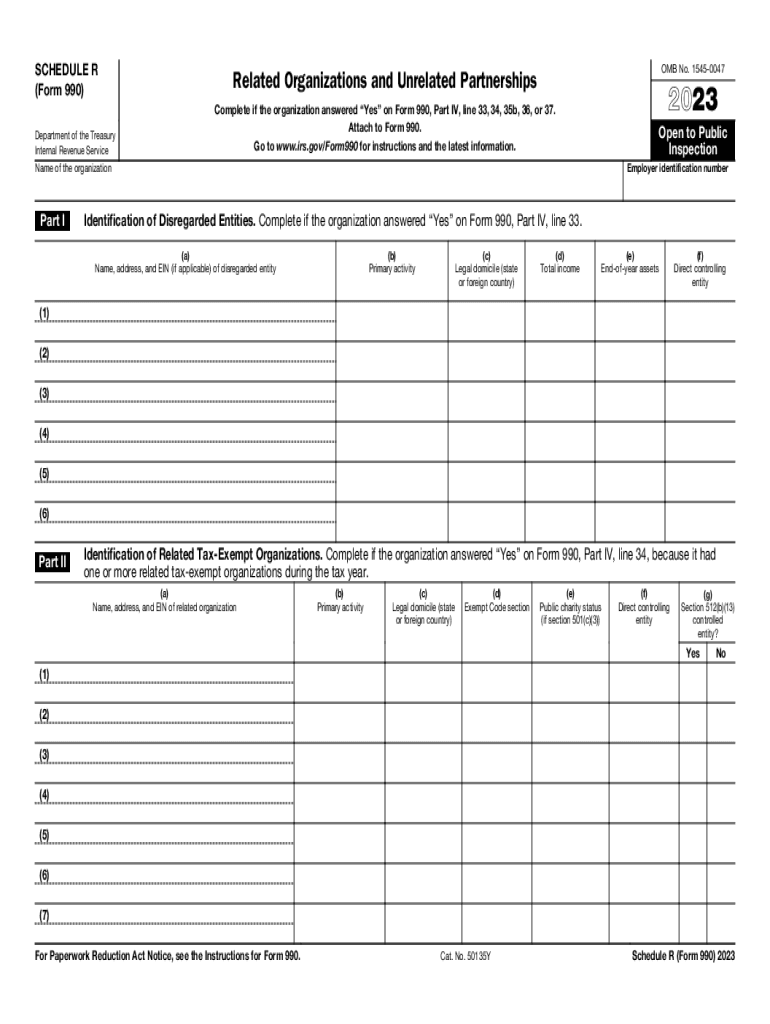

The Form Schedule R (Form 990) is a supplemental form used by certain tax-exempt organizations in the United States to provide detailed information about related organizations. This form is part of the larger Form 990, which is the annual information return that tax-exempt organizations must file with the IRS. Schedule R helps to clarify the relationships between organizations, ensuring transparency in their operations and financial dealings.

How to use the Form Schedule R (Form 990)

To use Form Schedule R, organizations must first determine if they are required to file it based on their relationships with other organizations. If applicable, they should complete the form by providing information such as the names of related organizations, the nature of the relationships, and any financial transactions that occurred between them. This information must be accurately reported to comply with IRS regulations and to maintain tax-exempt status.

Steps to complete the Form Schedule R (Form 990)

Completing Form Schedule R involves several steps:

- Identify if your organization has related organizations that require disclosure.

- Gather necessary information about each related organization, including their names, addresses, and tax identification numbers.

- Detail the nature of the relationship with each organization, including any financial transactions.

- Complete the form by entering the gathered information in the appropriate sections.

- Review the completed form for accuracy before submission.

Key elements of the Form Schedule R (Form 990)

Key elements of Form Schedule R include:

- Identification of related organizations: This includes the names and EINs of all related entities.

- Nature of relationships: Organizations must describe how they are related, such as through control or significant influence.

- Financial transactions: Any transactions between the organizations must be disclosed, including grants, loans, or payments.

Filing Deadlines / Important Dates

The filing deadline for Form Schedule R aligns with the due date for Form 990, which is typically the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations with a fiscal year ending December 31, the deadline would be May 15. Extensions may be available, but organizations should ensure timely filing to avoid penalties.

Penalties for Non-Compliance

Failure to file Form Schedule R when required can result in significant penalties. Organizations may face fines for each month the form is late, and continued non-compliance could jeopardize their tax-exempt status. It is crucial for organizations to understand their filing obligations and ensure they meet all requirements to avoid these consequences.

Quick guide on how to complete form schedule r f 990 schedule r f 990 related

Effortlessly Prepare Form Schedule R F 990 Schedule R F 990 Related on Any Device

Managing documents online has gained traction with businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Handle Form Schedule R F 990 Schedule R F 990 Related on any platform using airSlate SignNow's Android or iOS applications and streamline any documentation process today.

Steps to Modify and eSign Form Schedule R F 990 Schedule R F 990 Related with Ease

- Find Form Schedule R F 990 Schedule R F 990 Related and then click Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools offered by airSlate SignNow tailored for such purposes.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether it be by email, text message (SMS), invitation link, or to download it onto your computer.

Eliminate concerns about lost or scattered files, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Form Schedule R F 990 Schedule R F 990 Related and ensure outstanding communication throughout every phase of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form schedule r f 990 schedule r f 990 related

Create this form in 5 minutes!

How to create an eSignature for the form schedule r f 990 schedule r f 990 related

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Schedule R F 990 Schedule R F 990 Related?

Form Schedule R F 990 Schedule R F 990 Related is an IRS form used by nonprofit organizations to provide detailed information on their related organizations. It helps ensure transparency regarding any relationships with other entities that may have financial implications or operational influence.

-

How does airSlate SignNow assist with Form Schedule R F 990 Schedule R F 990 Related?

airSlate SignNow offers a streamlined platform for your organization to manage the signing and sharing of Form Schedule R F 990 Schedule R F 990 Related. With our user-friendly interface, businesses can easily collaborate on documents, ensuring all necessary signatures are obtained in a timely manner.

-

Is there a cost associated with using airSlate SignNow for Form Schedule R F 990 Schedule R F 990 Related?

Yes, airSlate SignNow provides various pricing plans tailored to the needs of different organizations. These plans are cost-effective and designed to ensure that filing and signing Form Schedule R F 990 Schedule R F 990 Related remains budget-friendly for nonprofit entities.

-

What features does airSlate SignNow offer for managing Form Schedule R F 990 Schedule R F 990 Related?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form Schedule R F 990 Schedule R F 990 Related. These features promote efficiency and accountability in the document management process, making it easier for organizations to stay compliant.

-

Can we integrate airSlate SignNow with other software for Form Schedule R F 990 Schedule R F 990 Related?

Absolutely! airSlate SignNow offers integrations with a variety of other software applications, facilitating seamless management of Form Schedule R F 990 Schedule R F 990 Related. Connecting with your existing systems can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Form Schedule R F 990 Schedule R F 990 Related?

Using airSlate SignNow for Form Schedule R F 990 Schedule R F 990 Related simplifies the document signing process and enhances security. Additionally, our platform allows organizations to track document status in real-time, ensuring that you meet all filing deadlines efficiently.

-

How secure is airSlate SignNow when handling Form Schedule R F 990 Schedule R F 990 Related documents?

Security is our top priority at airSlate SignNow. When handling Form Schedule R F 990 Schedule R F 990 Related documents, we employ advanced encryption and security protocols to protect your data, ensuring that sensitive information remains confidential and secure.

Get more for Form Schedule R F 990 Schedule R F 990 Related

Find out other Form Schedule R F 990 Schedule R F 990 Related

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple