Delaware Monthly Withholding Form Division of Revenue Revenue Delaware

What is the Delaware Monthly Withholding Form?

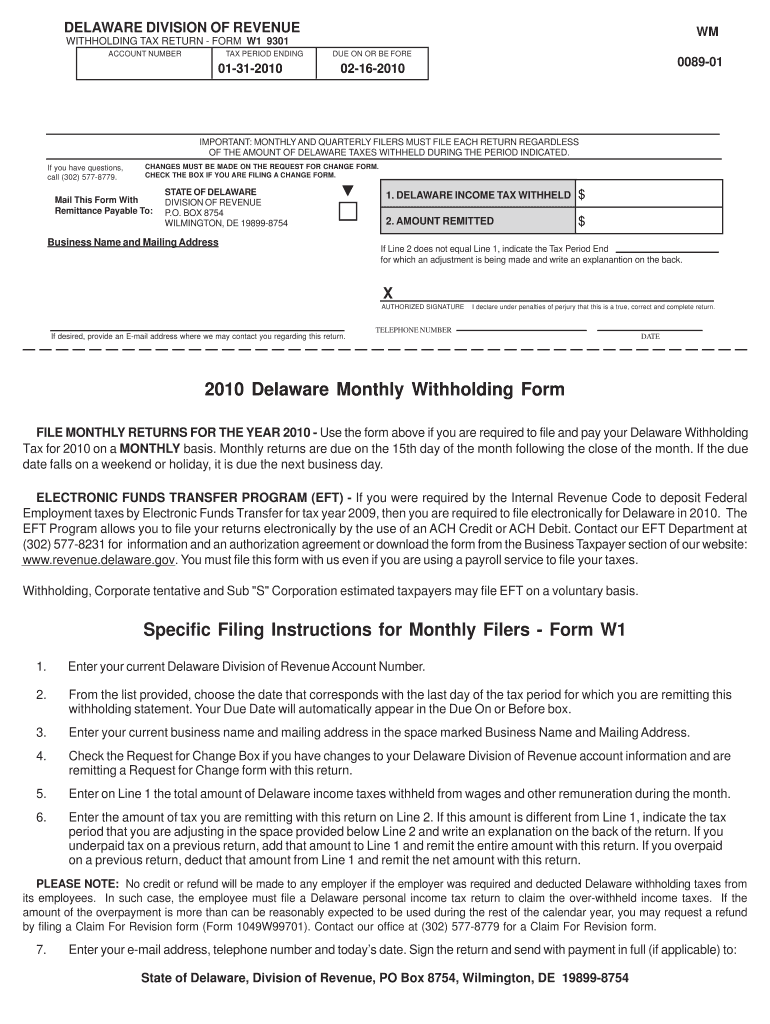

The Delaware Monthly Withholding Form, often referred to as the W-1 form, is a crucial document used by employers in Delaware to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax regulations and is submitted to the Delaware Division of Revenue. Employers must accurately complete this form to reflect the total amount of state tax withheld during the month, which is then used by the state for revenue purposes.

Steps to Complete the Delaware Monthly Withholding Form

Completing the Delaware Monthly Withholding Form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information: Collect employee wage information and the total amount of state tax withheld for the reporting month.

- Fill out the form: Enter the employer's information, including name, address, and Federal Employer Identification Number (FEIN).

- Report withholding amounts: Accurately input the total state tax withheld from all employees for the month.

- Review for accuracy: Double-check all entries to ensure there are no errors before submission.

- Submit the form: Choose your preferred method of submission, whether online, by mail, or in person.

How to Obtain the Delaware Monthly Withholding Form

The Delaware Monthly Withholding Form can be easily obtained from the Delaware Division of Revenue's official website. Employers can download the form directly in a printable format. Additionally, forms may be available at local government offices or by contacting the Division of Revenue directly for assistance. It is essential to ensure you have the most current version of the form to comply with state regulations.

Legal Use of the Delaware Monthly Withholding Form

The Delaware Monthly Withholding Form is legally binding when completed and submitted according to state guidelines. To ensure its validity, employers must adhere to the requirements set forth by the Delaware Division of Revenue, including accurate reporting of withheld amounts and timely submission. Failure to comply with these regulations may result in penalties or fines, emphasizing the importance of proper form use.

Filing Deadlines for the Delaware Monthly Withholding Form

Timely filing of the Delaware Monthly Withholding Form is critical for compliance. Employers must submit this form by the last day of the month following the reporting period. For example, the form for January must be filed by February 28. It is advisable to keep track of these deadlines to avoid late fees and ensure that all tax obligations are met promptly.

Penalties for Non-Compliance

Employers who fail to file the Delaware Monthly Withholding Form on time or submit inaccurate information may face penalties from the Delaware Division of Revenue. These penalties can include fines and interest on unpaid taxes. It is crucial for employers to understand the implications of non-compliance and to take steps to ensure that all forms are submitted accurately and on time.

Quick guide on how to complete 2010 delaware monthly withholding form division of revenue revenue delaware

Complete Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Handle Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The most effective way to modify and eSign Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware with ease

- Find Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How much should it cost to hire an accountant for annual tax filing for a 2-year-old non revenue generating SaaS startup, registered as a C-Corp in Delaware with small team of 5?

Assuming you have your bookkeeping records in reasonable order $350 for the federal return and Delaware franchise return.Since not many people actually operate their business from Delaware add another $100 for the return in the state where you failed to register as actually operating the business, but do need to file a tax return.

-

As non revenue generating, non-operational startup registered as C-Corp in Delaware, how much should we expect to be paying in franchise tax for 10 million shares at a value of .0001?

In Delaware it can be anywhere from $200 (minimum) to $180,000 per year. These is also a $50 annual report fee.If you would like a free tax consultation please feel free to schedule one at the below link,Contact Us | Eco-Tax, INCThanksGabriel

-

If you earn $10000 out of every $2000 monthly in revenue, how much overall income would be enough for you to quit your current job?

Thanks for the A2A. I wish I could give you an answer with figures but I can't. Only you can decide that for yourself. Ask yourself these questions:Quit your job and do what? How much money do you need for that?If you want to pursue higher studies, how much is the tuition fees, how long does it last, will you get a loan for that?Travel? Start a company of your own? How long (if) you will be unemployed?Do you have any dependency? Family to be looked after?Loans to be paid off?Do you have a contingency fund in case of emergencies?What is the kind of lifestyle you lead?Where do you live? Is it is an expensive place?You get the drift, right?

-

Out of curiosity, I would like someone to know how much sales revenue zappos.com (shoesite.com back then) made in their first 12 months of operation?

You can find sales numbers up until the acquisition here. http://about.zappos.com/zappos-s...

-

How do you respond if within the first month of a job you find out the company misled, or even lied, to you about things such as their success, revenues, expected future compensation, etc?

If you feel what they lied or misled you to believe is important enough you can quit. Or you can suck it up. You can also seek clarification from someone you have a good relationship with at the company as it could be a perception issue. But whatever you choose don't sour your relationships at work to prove a point if you intend to stay there.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the 2010 delaware monthly withholding form division of revenue revenue delaware

How to generate an eSignature for the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware in the online mode

How to generate an electronic signature for the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware in Google Chrome

How to create an electronic signature for putting it on the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware in Gmail

How to generate an electronic signature for the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware right from your smartphone

How to generate an electronic signature for the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware on iOS devices

How to make an eSignature for the 2010 Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware on Android OS

People also ask

-

What is the Delaware Monthly Withholding Form from the Division of Revenue?

The Delaware Monthly Withholding Form is a tax document required by the Division of Revenue in Delaware for businesses that withhold state income tax from employees' wages. This form helps ensure compliance with Delaware tax regulations and allows for accurate reporting of withheld amounts to the Revenue Delaware.

-

How can airSlate SignNow help with the Delaware Monthly Withholding Form?

airSlate SignNow offers an easy-to-use platform that allows businesses to electronically sign and send the Delaware Monthly Withholding Form. With our solution, you can streamline the submission process, ensuring that your documents are securely signed and submitted efficiently to the Division of Revenue in Delaware.

-

Is there a cost associated with using airSlate SignNow to manage the Delaware Monthly Withholding Form?

Yes, airSlate SignNow provides various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions enable you to manage documents like the Delaware Monthly Withholding Form without breaking the bank, ensuring you have access to the tools necessary for compliance with Revenue Delaware.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignatures, document templates, and secure storage, all of which facilitate the management of important forms like the Delaware Monthly Withholding Form. These features simplify the process of preparing, signing, and storing documents while ensuring compliance with Delaware's regulations.

-

Can I integrate airSlate SignNow with other software for handling the Delaware Monthly Withholding Form?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easier to manage your Delaware Monthly Withholding Form alongside your existing software tools. This capability enhances workflow efficiency and ensures that all your documents are synchronized seamlessly.

-

What are the benefits of using airSlate SignNow for the Delaware Monthly Withholding Form?

Using airSlate SignNow for the Delaware Monthly Withholding Form provides a range of benefits, including increased speed, enhanced security, and improved organization. Our platform enables you to complete and submit forms quickly while maintaining compliance with the Division of Revenue in Delaware.

-

Is airSlate SignNow secure for handling sensitive documents like the Delaware Monthly Withholding Form?

Yes, airSlate SignNow prioritizes the security of your documents, including the Delaware Monthly Withholding Form. Our platform uses advanced encryption and secure storage solutions to protect sensitive information, ensuring that your submissions to the Revenue Delaware are safe and confidential.

Get more for Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware

Find out other Delaware Monthly Withholding Form Division Of Revenue Revenue Delaware

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document