Nyc 204 Ez Instructions Form 2013

What is the Nyc 204 Ez Instructions Form

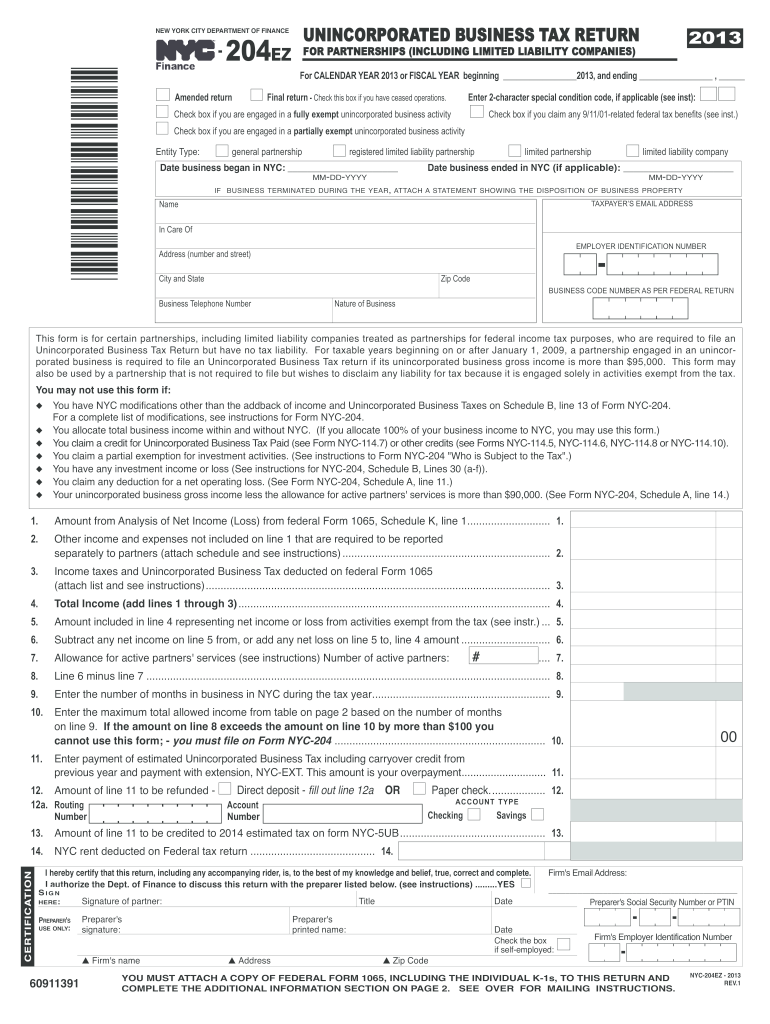

The Nyc 204 Ez Instructions Form is a simplified tax document designed for specific taxpayers in New York City. It allows eligible individuals and businesses to report their income and calculate their tax liability efficiently. This form is particularly beneficial for those who meet the criteria for filing a simplified return, making the tax process more accessible and less time-consuming.

How to use the Nyc 204 Ez Instructions Form

Using the Nyc 204 Ez Instructions Form involves several straightforward steps. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, download the form from a reliable source or access it through a digital platform. Fill in the required fields accurately, ensuring that all information aligns with your financial records. Once completed, review the form for any errors before submitting it according to the specified guidelines.

Steps to complete the Nyc 204 Ez Instructions Form

Completing the Nyc 204 Ez Instructions Form can be broken down into a few essential steps:

- Gather necessary documents, such as W-2s and 1099s.

- Download the form from a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions.

- Calculate your tax liability based on the instructions provided.

- Review the form for accuracy before signing and dating it.

- Submit the completed form via your preferred method.

Legal use of the Nyc 204 Ez Instructions Form

The Nyc 204 Ez Instructions Form is legally recognized for tax reporting purposes within New York City. It complies with state and federal regulations, provided it is filled out correctly and submitted on time. Using this form ensures that taxpayers can fulfill their legal obligations while benefiting from a streamlined filing process. It is important to retain a copy of the submitted form for your records in case of future inquiries or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc 204 Ez Instructions Form typically align with the federal tax deadlines. Taxpayers should be aware of key dates, such as:

- April 15: Standard deadline for individual tax returns.

- October 15: Extended deadline for those who filed for an extension.

It is crucial to submit the form by these deadlines to avoid penalties and interest on any owed taxes.

Form Submission Methods

The Nyc 204 Ez Instructions Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through authorized e-filing platforms.

- Mailing a paper copy to the appropriate tax authority address.

- In-person submission at designated tax offices, if applicable.

Each method has its advantages, and taxpayers should choose the one that best fits their needs and circumstances.

Quick guide on how to complete nyc 204 ez instructions 2013 form

Your assistance manual on how to prepare your Nyc 204 Ez Instructions Form

If you’re curious about how to produce and transmit your Nyc 204 Ez Instructions Form, here are some concise directions to simplify the tax submission process.

To get started, all you need to do is register your airSlate SignNow account to modify how you handle documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to edit, create, and complete your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to amend information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the guidelines below to finish your Nyc 204 Ez Instructions Form in a matter of minutes:

- Create your account and start working on PDFs swiftly.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Nyc 204 Ez Instructions Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any discrepancies.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that paper filing can lead to increased errors and delay refunds. Importantly, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc 204 ez instructions 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the nyc 204 ez instructions 2013 form

How to generate an electronic signature for your Nyc 204 Ez Instructions 2013 Form in the online mode

How to generate an electronic signature for your Nyc 204 Ez Instructions 2013 Form in Chrome

How to generate an electronic signature for signing the Nyc 204 Ez Instructions 2013 Form in Gmail

How to create an eSignature for the Nyc 204 Ez Instructions 2013 Form straight from your mobile device

How to generate an eSignature for the Nyc 204 Ez Instructions 2013 Form on iOS

How to create an eSignature for the Nyc 204 Ez Instructions 2013 Form on Android OS

People also ask

-

What is the Nyc 204 Ez Instructions Form?

The Nyc 204 Ez Instructions Form is a simplified tax form designed for smaller businesses in New York City. It streamlines the process of submitting necessary tax information, making it quicker and easier for users to comply with local regulations.

-

How can airSlate SignNow assist with the Nyc 204 Ez Instructions Form?

airSlate SignNow provides a user-friendly platform to electronically sign and send the Nyc 204 Ez Instructions Form. This digital solution ensures that your forms are securely delivered without the hassle of printing, scanning, or mailing.

-

What are the benefits of using airSlate SignNow for the Nyc 204 Ez Instructions Form?

Using airSlate SignNow for the Nyc 204 Ez Instructions Form enables businesses to save time and reduce paperwork. The platform also enhances collaboration by allowing multiple parties to sign documents simultaneously, speeding up the completion process.

-

Is there a cost associated with using airSlate SignNow for the Nyc 204 Ez Instructions Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Each plan provides features that support effective management of the Nyc 204 Ez Instructions Form and other documents, helping users choose according to their budget.

-

Can I integrate airSlate SignNow with other software while using the Nyc 204 Ez Instructions Form?

Absolutely! airSlate SignNow supports numerous integrations with popular software like Google Drive, Dropbox, and CRM systems. This capability allows users to seamlessly manage the Nyc 204 Ez Instructions Form and other documents directly from their existing tools.

-

What features does airSlate SignNow offer for the Nyc 204 Ez Instructions Form?

airSlate SignNow includes robust features such as document tracking, templates for the Nyc 204 Ez Instructions Form, and advanced security measures. These tools ensure that users can send and manage forms confidently while maintaining compliance.

-

Is it easy to learn how to use airSlate SignNow for the Nyc 204 Ez Instructions Form?

Yes, airSlate SignNow prioritizes user experience with an intuitive interface. Users can quickly familiarize themselves with the platform, making it simple to handle the Nyc 204 Ez Instructions Form and other document needs without extensive training.

Get more for Nyc 204 Ez Instructions Form

- Kentucky assignment of mortgage by individual mortgage holder form

- Assignment mortgage corporate 481379648 form

- Kentucky notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial form

- Kentucky assignment form

- Kentucky trust form

- Ky assignment form

- Kentucky letter to lienholder to notify of trust form

- Lead based paint disclosure rental form

Find out other Nyc 204 Ez Instructions Form

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now