Per Diem Receipt Template 2012-2026

What is the Per Diem Receipt Template

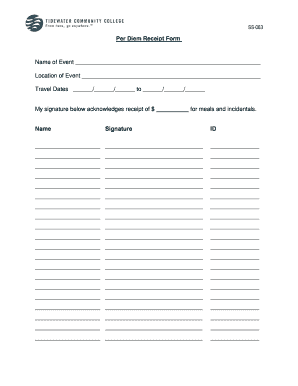

The per diem receipt template is a standardized document used by employees to request reimbursement for travel-related expenses incurred while conducting business on behalf of their employer. This template typically includes sections for detailing the nature of the expenses, dates of travel, locations, and the amounts spent. It serves as a formal record that helps both the employee and employer track expenditures and ensures compliance with company policies and IRS regulations.

How to use the Per Diem Receipt Template

Using the per diem receipt template is straightforward. First, download the template in your preferred format, such as PDF or Word. Next, fill in the required information, including your name, the purpose of travel, and the specific expenses incurred. Be sure to attach any supporting documents, such as receipts or invoices, to substantiate your claims. Once completed, submit the form to your supervisor or the finance department for approval and processing.

Key elements of the Per Diem Receipt Template

The per diem receipt template should include several key elements to ensure it is comprehensive and effective. These elements typically include:

- Employee Information: Name, department, and contact details.

- Travel Details: Dates of travel, destination, and purpose.

- Expense Breakdown: Itemized list of expenses, including meals, lodging, and transportation.

- Total Amount: Sum of all expenses claimed.

- Signatures: Employee and supervisor signatures for approval.

Steps to complete the Per Diem Receipt Template

Completing the per diem receipt template involves a few essential steps:

- Download the template from a reliable source.

- Fill in your personal and travel information accurately.

- Itemize each expense, providing details such as date, description, and amount.

- Attach any necessary receipts or documentation to support your claims.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate department for processing.

Legal use of the Per Diem Receipt Template

The legal use of the per diem receipt template is crucial for ensuring compliance with tax regulations and company policies. To be considered valid, the completed form must adhere to IRS guidelines, which stipulate that expenses must be ordinary and necessary for business purposes. Additionally, the template should be filled out truthfully, and all claims must be supported by proper documentation to avoid potential penalties for non-compliance.

IRS Guidelines

The IRS provides specific guidelines regarding per diem reimbursements, which are essential for both employees and employers to understand. According to IRS regulations, per diem payments must be substantiated with adequate records, including travel itineraries and receipts. Employers can choose to use the federal per diem rates or establish their own, but they must ensure that the rates are reasonable and reflect actual expenses incurred during business travel.

Quick guide on how to complete per diem receipt template

Effortlessly Prepare Per Diem Receipt Template on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Per Diem Receipt Template on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Per Diem Receipt Template with Ease

- Obtain Per Diem Receipt Template and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional wet signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Per Diem Receipt Template and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the per diem receipt template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a per diem form template?

A per diem form template is a document used by employees to report costs incurred while traveling for business purposes. It helps streamline the process of reimbursement for travel expenses such as lodging, meals, and other incidentals. By utilizing a per diem form template, businesses can ensure expenses are documented clearly and efficiently.

-

How can I create a per diem form template with airSlate SignNow?

Creating a per diem form template with airSlate SignNow is simple and user-friendly. You can start with a pre-existing template and customize it to fit your company's specific needs. This allows you to create a tailored per diem form template that captures all required details for reimbursement.

-

Is there a cost associated with using the per diem form template?

Yes, airSlate SignNow offers various pricing plans to access features, including the ability to create and manage a per diem form template. The plans are designed to be cost-effective, providing flexibility based on your business size and requirements. You can review the pricing options on our website to find the best fit for your needs.

-

What features are included in the per diem form template?

The per diem form template from airSlate SignNow includes features such as customizable fields for expenses, automated calculations, and digital signature capabilities. These features streamline the process for employees and finance teams alike. Additionally, our templates allow for easy tracking and organization of travel expenses.

-

Can I integrate the per diem form template with other software?

Absolutely! airSlate SignNow's per diem form template can be easily integrated with various software solutions such as accounting software and HR management systems. This integration allows for seamless data transfer and better tracking of travel expenses, making management more efficient.

-

How does using a per diem form template benefit my business?

Using a per diem form template offers numerous benefits, including time savings and accuracy in expense reporting. It reduces the administrative burden on employees and finance teams by standardizing the process of reporting travel expenses. Consequently, this leads to faster reimbursements and better financial oversight.

-

Can I access the per diem form template on mobile devices?

Yes, airSlate SignNow's per diem form template is accessible on mobile devices, allowing employees to fill out and submit their forms on the go. This enhances convenience and ensures that employees can report their expenses even while traveling. Mobile access helps keep the process efficient and streamlined.

Get more for Per Diem Receipt Template

- Mathcounts chapter competition target round problems 1 and 2 name school do not begin until you are instructed to do so form

- Inferences worksheet 4 answer key form

- Momentary time sampling form

- G0851 form

- Firefighter jpr template form

- School recommendation form fiitjee

- Chipotle order form

- Dtmb 460 michigan form

Find out other Per Diem Receipt Template

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template