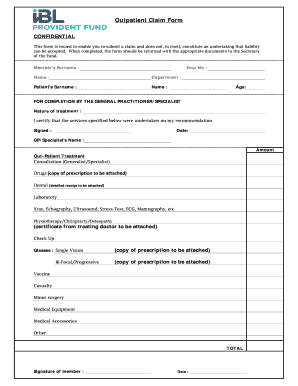

Ibl Provident Fund Form

What is the Ibl Provident Fund

The Ibl Provident Fund is a retirement savings scheme designed to provide financial security for employees upon retirement or in the event of unforeseen circumstances. This fund allows individuals to contribute a portion of their earnings, which is then managed and invested to grow over time. The primary objective is to ensure that members have access to a lump sum payment or regular income after they retire, helping them maintain their standard of living.

How to use the Ibl Provident Fund

Utilizing the Ibl Provident Fund involves several steps, including enrolling in the program, making regular contributions, and understanding the benefits available. Members can access their account online to track contributions and growth. Additionally, the fund offers various options for withdrawal, including lump sum payments upon retirement or periodic withdrawals in case of emergencies. It's important for members to familiarize themselves with the fund's rules and regulations to maximize their benefits.

Steps to complete the Ibl Provident Fund

Completing the Ibl Provident Fund involves a straightforward process:

- Enrollment: Sign up for the fund through your employer or directly via the Ibl website.

- Contribution Setup: Decide on the percentage of your salary to contribute, which can be adjusted as needed.

- Account Management: Regularly check your account for updates on contributions and fund performance.

- Withdrawal Process: When eligible, submit a withdrawal request online or via the designated form to access your funds.

Eligibility Criteria

To be eligible for the Ibl Provident Fund, individuals typically must be employed and meet specific age requirements. Contributions are usually mandatory for employees, while self-employed individuals may have the option to join voluntarily. Additionally, eligibility may vary based on the employer's policies and the specific terms outlined by the fund. It's essential for potential members to review these criteria to ensure compliance and maximize their benefits.

Required Documents

When enrolling in the Ibl Provident Fund or making a claim, certain documents are necessary to verify identity and eligibility. Commonly required documents include:

- Proof of identity (e.g., driver's license, passport)

- Proof of employment (e.g., employment letter, pay stub)

- Completed application forms specific to the Ibl Provident Fund

- Any additional documents as specified by the fund guidelines

Legal use of the Ibl Provident Fund

The Ibl Provident Fund operates under specific legal frameworks that govern retirement savings and employee benefits. Compliance with these regulations ensures that the fund is managed properly and that members' rights are protected. Understanding the legal implications of contributions, withdrawals, and fund management is crucial for all members. This includes being aware of tax obligations and potential penalties for non-compliance.

Quick guide on how to complete ibl provident fund

Effortlessly Prepare Ibl Provident Fund on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Ibl Provident Fund across any platform using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

The easiest method to modify and electronically sign Ibl Provident Fund without effort

- Locate Ibl Provident Fund and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether via email, text message (SMS), invite link, or download it to your computer.

Put an end to misplaced or lost documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ibl Provident Fund to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ibl provident fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IBL Provident Fund?

The IBL Provident Fund is a retirement savings scheme designed to help employees save for their future. It provides individuals with the opportunity to build a financial cushion over time, ensuring financial security upon retirement. By participating in the IBL Provident Fund, employees can take advantage of tax benefits and employer contributions.

-

How does the IBL Provident Fund work?

The IBL Provident Fund operates by allowing employees to contribute a portion of their salary into a savings account managed by the fund. Employers may also match contributions, amplifying the savings potential. Funds accumulate over time, earning interest, and can typically be accessed upon retirement or under specific conditions.

-

What are the benefits of the IBL Provident Fund?

Participating in the IBL Provident Fund offers several benefits, including tax advantages, employer matching contributions, and the potential for compound interest. It is an effective way to secure financial stability for retirement. Additionally, funds can sometimes be withdrawn for specific emergencies, adding flexibility to the savings plan.

-

What are the fees and costs associated with the IBL Provident Fund?

While the IBL Provident Fund generally promotes low-cost management of your savings, there may be administrative fees involved. It's essential to review the fee structure to understand how it affects your overall savings. Comparing these costs with other retirement savings options can help you make informed decisions.

-

How can I enroll in the IBL Provident Fund?

Enrolling in the IBL Provident Fund typically requires your employer to provide you with the necessary enrollment forms. You will need to provide personal information and choose your contribution rate. Ensure to discuss with your HR or finance team about any specific requirements or deadlines for enrollment.

-

Can I change my contribution amount to the IBL Provident Fund?

Yes, participants can often adjust their contribution amounts to the IBL Provident Fund, depending on their financial situation and goals. Changing your contribution can provide greater flexibility and help you save more as your income increases. Be sure to check with your employer for any specific processes related to modifying contributions.

-

What is the process for withdrawing funds from the IBL Provident Fund?

Withdrawing funds from the IBL Provident Fund usually requires a formal request under specific conditions, such as retirement or financial emergencies. It's essential to understand the withdrawal rules and potential penalties associated with early withdrawals. Consulting your fund's guidelines can provide clarity on the process.

Get more for Ibl Provident Fund

- Nolan house albury form

- Father daughter dance registration form word

- 504ada self evaluation questionnaire form

- Visa request entry form team

- N11b defense form online

- Double elimination tournament flow chart 32 playpool com form

- Notice of waiver of va compensation or pension to receive military pay and allowances form

- Salary reduction agreement template 787747170 form

Find out other Ibl Provident Fund

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure