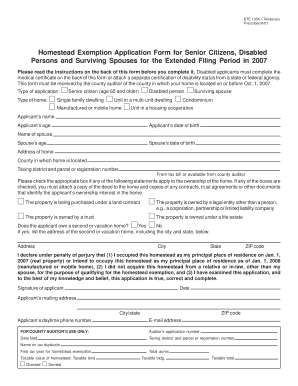

Richland County Ohio Homestead Exemption Form

What is the Richland County Ohio Homestead Exemption

The Richland County Ohio Homestead Exemption is a program designed to provide property tax relief to eligible homeowners. This exemption allows qualifying individuals to reduce the taxable value of their primary residence, thereby lowering their property tax bill. Typically, the exemption is available to senior citizens, individuals with disabilities, and certain veterans. Understanding this exemption can help homeowners save money and better manage their finances.

Eligibility Criteria for the Richland County Ohio Homestead Exemption

To qualify for the Richland County Ohio Homestead Exemption, applicants must meet specific criteria. Generally, homeowners must be at least sixty-five years old or permanently disabled. Additionally, applicants must occupy the property as their primary residence and meet income limits set by the state. It is essential to review these criteria to determine eligibility before applying.

Steps to Complete the Richland County Ohio Homestead Exemption

Completing the Richland County Ohio Homestead Exemption involves several straightforward steps. First, gather necessary documents such as proof of age or disability and income verification. Next, fill out the Richland County Homestead Exemption form accurately, ensuring all information is complete. After completing the form, submit it to the Richland County Tax Auditor's office either online, by mail, or in person. It is crucial to adhere to any filing deadlines to ensure timely processing of the exemption.

Required Documents for the Richland County Ohio Homestead Exemption

When applying for the Richland County Ohio Homestead Exemption, certain documents are necessary to support your application. These typically include:

- Proof of age (such as a birth certificate or driver's license) or documentation of disability.

- Income verification, which may include tax returns or pay stubs.

- Proof of residency, such as a utility bill or lease agreement.

Having these documents ready can streamline the application process and help ensure that your exemption is processed without delays.

Form Submission Methods for the Richland County Ohio Homestead Exemption

The Richland County Ohio Homestead Exemption form can be submitted through various methods, providing flexibility for applicants. Homeowners can choose to apply online through the Richland County Tax Auditor's website, which offers a convenient digital option. Alternatively, forms can be mailed to the Tax Auditor's office or submitted in person. It is important to select the method that best suits your needs and to keep a copy of the submitted form for your records.

Legal Use of the Richland County Ohio Homestead Exemption

The legal framework surrounding the Richland County Ohio Homestead Exemption ensures that the program is administered fairly and transparently. Homeowners must comply with state laws and regulations when applying for the exemption. This includes providing accurate information and maintaining eligibility throughout the year. Understanding the legal aspects of the exemption can help homeowners navigate the process and avoid potential issues.

Quick guide on how to complete richland county ohio homestead exemption

Prepare Richland County Ohio Homestead Exemption effortlessly on any device

Online file management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Richland County Ohio Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to change and eSign Richland County Ohio Homestead Exemption with ease

- Obtain Richland County Ohio Homestead Exemption and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing out new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Edit and eSign Richland County Ohio Homestead Exemption while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the richland county ohio homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Richland County Ohio Homestead Exemption?

The Richland County Ohio Homestead Exemption is designed to reduce property taxes for eligible homeowners, including senior citizens and disabled individuals. By applying for this exemption, you can signNowly lower your property tax burden. It's important to check local regulations to ensure you meet the qualifications for the Richland County Ohio Homestead Exemption.

-

Who qualifies for the Richland County Ohio Homestead Exemption?

Eligible applicants for the Richland County Ohio Homestead Exemption typically include homeowners who are 65 or older or permanently disabled. Additionally, there are income limits that applicants must meet to qualify for the exemption. It’s crucial to review the specific eligibility criteria set forth by Richland County.

-

How can I apply for the Richland County Ohio Homestead Exemption?

To apply for the Richland County Ohio Homestead Exemption, you need to complete an application form available from the county auditor's office. Make sure to provide necessary documentation like proof of age or disability. The application must be filed before the deadline to ensure you receive the benefit for the current tax year.

-

What documents are needed for the Richland County Ohio Homestead Exemption application?

When applying for the Richland County Ohio Homestead Exemption, you typically need to provide a valid government-issued ID, proof of income, and any relevant documentation that verifies your age or disability status. Gathering these documents ahead of time can help streamline your application process.

-

How does the Richland County Ohio Homestead Exemption affect my property taxes?

The Richland County Ohio Homestead Exemption can signNowly lower your property taxes by reducing the taxable value of your home. This tax reduction can lead to substantial savings each year, making it easier for eligible homeowners to manage their finances. It’s advisable to review your tax bill after applying to see the effects of the exemption.

-

Is there a cost associated with applying for the Richland County Ohio Homestead Exemption?

There are no fees charged for applying for the Richland County Ohio Homestead Exemption. Homeowners can submit their application at no cost, ensuring that everyone who qualifies can take advantage of this valuable tax relief. However, it’s essential to ensure that your application is complete and submitted on time.

-

When should I apply for the Richland County Ohio Homestead Exemption?

You should apply for the Richland County Ohio Homestead Exemption as soon as you meet the eligibility requirements, preferably before the annual deadline, which is usually set by the county auditor. The earlier you apply, the sooner you can start benefiting from the tax reduction. Be sure to check with the county for specific dates related to your application.

Get more for Richland County Ohio Homestead Exemption

- Home health aide renewal california form

- Patient change form state of michigan michigan

- Kc2832a employee application assurant employee benefits form

- Contents tompkins cortland community college p o form

- Ppe hazard assessment form pdf

- Michigan state university certification office 620 form

- Student data form pdf cerritos college cms cerritos

- Notification of rights under ferpa for delaware state university students desu form

Find out other Richland County Ohio Homestead Exemption

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement