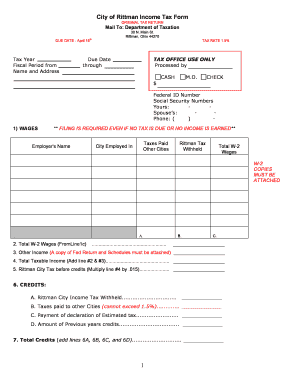

Rittman Income Tax Form

Understanding the Rittman Income Tax

The Rittman income tax is a municipal tax levied on individuals and businesses residing or operating within the city of Rittman, Ohio. This tax is calculated based on the income earned by residents and is designed to support local services and infrastructure. The current rate is typically a percentage of the taxpayer's gross income, and it is important for residents to understand how this tax impacts their overall financial obligations.

Steps to Complete the Rittman Income Tax

Completing the Rittman income tax involves several key steps to ensure compliance and accuracy. Here is a general outline of the process:

- Gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements.

- Determine your total taxable income by summing all sources of income.

- Apply the appropriate tax rate to your taxable income to calculate your tax liability.

- Complete the required city of Rittman tax forms accurately, ensuring all information is correct.

- Submit the completed forms by the designated deadline, either online or via mail.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Rittman income tax to avoid penalties. Typically, the tax year aligns with the calendar year, and the deadline for filing is April fifteenth of the following year. Extensions may be available, but it is essential to check local regulations to understand the process and any potential penalties for late submissions.

Required Documents for Rittman Income Tax

When preparing to file the Rittman income tax, several documents are necessary to ensure a complete and accurate submission. These documents include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Previous year’s tax return for reference.

Form Submission Methods

Residents of Rittman have various options for submitting their income tax forms. The following methods are commonly used:

- Online Submission: Many residents prefer to file electronically through secure platforms that ensure compliance with local regulations.

- Mail: Taxpayers can send their completed forms via postal service to the designated city tax office.

- In-Person: Individuals may also choose to submit their forms in person at the local tax office, where assistance may be available.

Penalties for Non-Compliance

Failing to comply with Rittman income tax regulations can result in significant penalties. Common consequences include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete rittman income tax

Effortlessly Complete Rittman Income Tax on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow offers all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Rittman Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The Easiest Method to Modify and eSign Rittman Income Tax with Ease

- Obtain Rittman Income Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Edit and eSign Rittman Income Tax to guarantee effective communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rittman income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current tax rates for the city of Rittman?

The city of Rittman taxes are determined based on various income levels, property values, and local assessments. For individuals and businesses, it is essential to stay informed about current tax rates, which are available on the official city website. Keeping track of these rates can help you budget accordingly and avoid potential penalties.

-

How can I file my city of Rittman taxes online?

You can conveniently file your city of Rittman taxes online through the city’s tax portal. The process typically requires creating an account, entering your financial information, and submitting your tax return electronically. Utilizing online filing can streamline your tax submission and ensure that your documents are processed quickly.

-

What documents do I need to prepare my city of Rittman taxes?

To prepare your city of Rittman taxes, you will need your W-2 forms, any 1099 forms, previous tax returns, and documentation for any relevant deductions or credits. Having these documents organized can expedite the preparation process and ensure accuracy. It’s advisable to review the city’s tax guidelines for any specific requirements related to local taxes.

-

Are there any tax exemptions available in the city of Rittman?

Yes, certain tax exemptions may be available for residents of the city of Rittman, including those for seniors, veterans, and low-income individuals. Additionally, specific exemptions might apply to businesses based on local economic development programs. It's best to consult with the city’s tax office to determine your eligibility for any available exemptions.

-

What are the penalties for late city of Rittman taxes?

If city of Rittman taxes are not filed or paid by the deadline, penalties may be imposed. Typically, this includes late fees and interest on outstanding balances. To avoid these penalties, it's crucial to be aware of the filing deadlines and consider seeking assistance if you're having trouble meeting them.

-

Can I set up a payment plan for my city of Rittman taxes?

Yes, the city of Rittman may offer payment plans for individuals or businesses that are struggling to pay their taxes in full. To set up a payment plan, you will need to contact the local tax office and provide details about your situation. This option can help ease the financial burden of large tax bills.

-

How does airSlate SignNow assist with city of Rittman taxes?

airSlate SignNow offers a streamlined platform for electronic signatures, which can be invaluable for businesses managing city of Rittman taxes. By facilitating the signing of tax documents electronically, you can ensure a faster, paperless workflow, thus improving compliance and efficiency in your tax-related processes.

Get more for Rittman Income Tax

- Generator checklist weekly form

- Chemistry form ws5 7 1a answer key

- Ottawa self injury inventory non suicidal self injury in youth insync group form

- Travel expense form the sea cadets

- Oklahoma bus driver physical form

- Documentation of observation hours form www2 cohpa ucf

- Student employment application york college of pennsylvania ycp form

- Financial office 2500 north state street jackson form

Find out other Rittman Income Tax

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement