Worksheet 34 Gross Pay with Overtime Answer Key Form

What is the Worksheet 34 Gross Pay With Overtime Answer Key

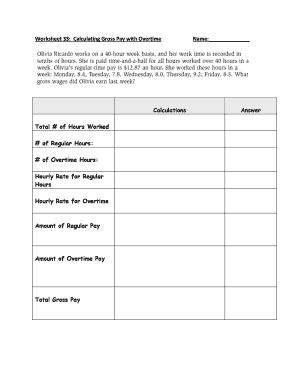

The Worksheet 34 Gross Pay With Overtime Answer Key is a resource designed to help individuals accurately calculate their gross pay, including overtime compensation. This worksheet serves as a guide for understanding how to determine total earnings based on regular hours worked and any additional hours that qualify for overtime pay. It is particularly useful for employees who want to ensure they are being compensated fairly for their work hours, especially in industries where overtime is common.

How to use the Worksheet 34 Gross Pay With Overtime Answer Key

Using the Worksheet 34 Gross Pay With Overtime Answer Key involves several steps. First, gather your pay rate and the number of hours worked during the pay period. Next, identify how many of those hours are regular hours and how many qualify as overtime hours. The worksheet provides a structured format to input this data, allowing you to calculate your gross pay accurately. By following the instructions outlined in the answer key, you can ensure that all calculations are performed correctly, leading to a precise understanding of your earnings.

Steps to complete the Worksheet 34 Gross Pay With Overtime Answer Key

Completing the Worksheet 34 Gross Pay With Overtime Answer Key requires a systematic approach:

- Gather necessary information: pay rate, hours worked, and overtime hours.

- Input regular hours into the appropriate section of the worksheet.

- Input overtime hours, ensuring you apply the correct overtime rate, typically one and a half times the regular rate.

- Perform calculations as guided by the worksheet to determine total gross pay.

- Review your entries to confirm accuracy before finalizing your calculations.

Key elements of the Worksheet 34 Gross Pay With Overtime Answer Key

The Worksheet 34 Gross Pay With Overtime Answer Key includes several key elements that facilitate accurate calculations:

- Regular Pay Calculation: A section dedicated to calculating pay based on standard hours worked.

- Overtime Pay Calculation: Guidelines for determining pay for hours worked beyond the standard workweek.

- Summary Section: An area to consolidate the total gross pay for easy reference.

- Examples: Sample scenarios that illustrate how to use the worksheet effectively.

Legal use of the Worksheet 34 Gross Pay With Overtime Answer Key

The Worksheet 34 Gross Pay With Overtime Answer Key is legally valid when used in accordance with labor laws governing overtime pay. In the United States, the Fair Labor Standards Act (FLSA) outlines the requirements for overtime compensation. Using this worksheet helps ensure compliance with these regulations, allowing employees to accurately track their earnings and report any discrepancies to their employers. It is important to retain copies of completed worksheets for personal records and potential disputes regarding pay.

Examples of using the Worksheet 34 Gross Pay With Overtime Answer Key

Examples can clarify how to effectively use the Worksheet 34 Gross Pay With Overtime Answer Key. For instance, if an employee earns twenty dollars per hour and works forty hours in a week, their regular pay would be eight hundred dollars. If they work ten additional hours at the overtime rate of thirty dollars per hour, their total earnings would be one thousand dollars. These examples illustrate how to apply the worksheet to real-life scenarios, ensuring accurate gross pay calculations.

Quick guide on how to complete worksheet 34 gross pay with overtime answer key

Complete Worksheet 34 Gross Pay With Overtime Answer Key effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Worksheet 34 Gross Pay With Overtime Answer Key on any platform with the airSlate SignNow mobile applications for Android or iOS, and simplify any document-related task today.

The easiest way to modify and eSign Worksheet 34 Gross Pay With Overtime Answer Key without any hassle

- Find Worksheet 34 Gross Pay With Overtime Answer Key and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or cover sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Modify and eSign Worksheet 34 Gross Pay With Overtime Answer Key and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the worksheet 34 gross pay with overtime answer key

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the worksheet 34 gross pay with overtime answer key?

The worksheet 34 gross pay with overtime answer key is designed to help users accurately calculate gross pay, including overtime. This resource simplifies complex payroll calculations, ensuring that employees receive proper compensation. Businesses can benefit from increased accuracy and efficiency using this tool.

-

How can I obtain the worksheet 34 gross pay with overtime answer key?

You can easily access the worksheet 34 gross pay with overtime answer key by visiting our website. It is available for download, and you can integrate it with airSlate SignNow for seamless document management. This allows you to streamline your payroll processes effectively.

-

Is there a cost associated with the worksheet 34 gross pay with overtime answer key?

The worksheet 34 gross pay with overtime answer key is offered as part of our services, designed to provide added value without hidden fees. By utilizing airSlate SignNow, you can access this resource at an affordable price, enhancing your business's operational efficiency. Contact us for specific pricing details.

-

What features does the worksheet 34 gross pay with overtime answer key include?

The worksheet 34 gross pay with overtime answer key encompasses various features aimed at simplifying payroll calculations. It provides formulas for calculating gross pay with overtime, ensuring compliance with labor laws. Additionally, users can customize the worksheet to suit their business needs.

-

How does airSlate SignNow enhance the use of the worksheet 34 gross pay with overtime answer key?

AirSlate SignNow enhances the use of the worksheet 34 gross pay with overtime answer key by providing an intuitive platform for document management. You can easily sign and send the completed worksheets securely. This integration helps streamline your workflow, making payroll processes more efficient.

-

Can the worksheet 34 gross pay with overtime answer key be integrated with other software?

Yes, the worksheet 34 gross pay with overtime answer key can be integrated with various accounting and payroll software. This ensures that you can maintain consistency across all your financial documents. AirSlate SignNow offers API integrations, allowing you to connect seamlessly with your existing systems.

-

What benefits can businesses expect from using the worksheet 34 gross pay with overtime answer key?

Using the worksheet 34 gross pay with overtime answer key can lead to greater accuracy in payroll calculations, minimizing errors and compliance issues. Businesses can save time and resources by streamlining their payroll processes. Overall, it enhances operational efficiency and employee satisfaction.

Get more for Worksheet 34 Gross Pay With Overtime Answer Key

Find out other Worksheet 34 Gross Pay With Overtime Answer Key

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself