Form 1811AC 0905 Division of Revenue Delaware Revenue Delaware

What is the Form 1811AC 0905 Division of Revenue Delaware?

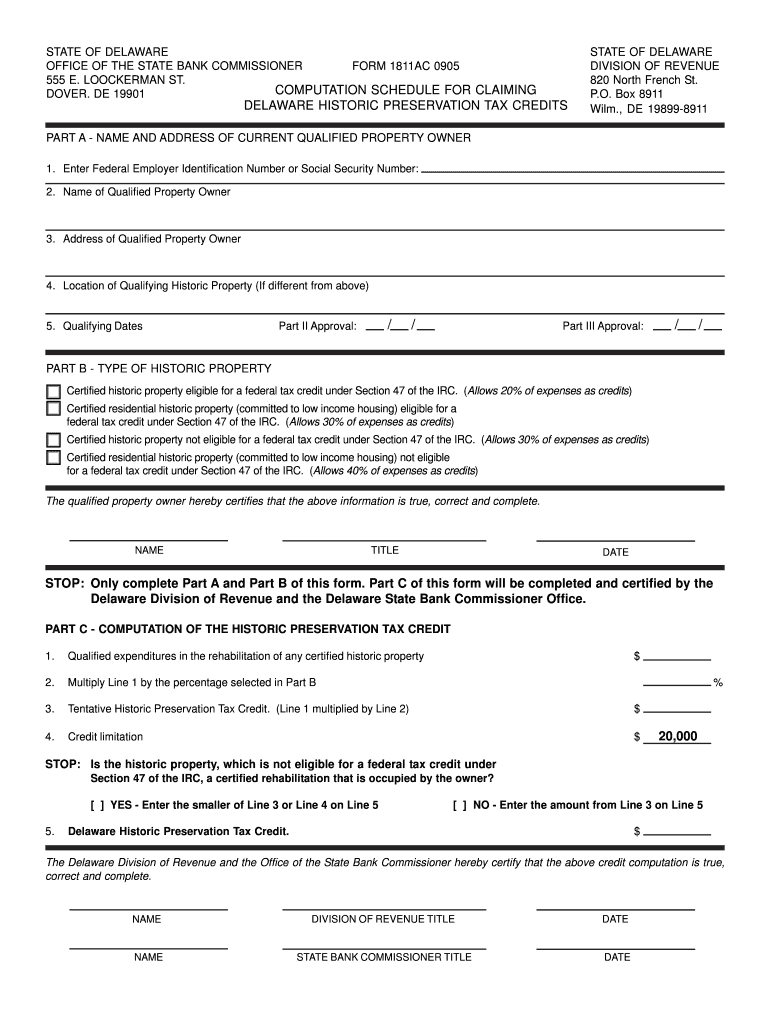

The Form 1811AC 0905 is a specific document utilized by the Delaware Division of Revenue for various tax-related purposes. This form is essential for individuals and businesses operating within the state to report their income and fulfill their tax obligations. It serves as a formal declaration to the state regarding revenue earned, ensuring compliance with Delaware tax laws. Understanding the purpose and requirements of this form is crucial for accurate and timely tax reporting.

Steps to Complete the Form 1811AC 0905 Division of Revenue Delaware

Completing the Form 1811AC 0905 requires careful attention to detail. Here are the steps to ensure proper completion:

- Gather necessary information, including personal identification details and financial records.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate the information provided.

- Submit the form through the appropriate channels, either electronically or via mail.

How to Obtain the Form 1811AC 0905 Division of Revenue Delaware

The Form 1811AC 0905 can be obtained directly from the Delaware Division of Revenue's official website or by visiting their office. It is available in both digital and paper formats, allowing users to choose the method that best suits their needs. For those preferring to complete the form electronically, accessing it online ensures that the most current version is used.

Legal Use of the Form 1811AC 0905 Division of Revenue Delaware

The legal use of the Form 1811AC 0905 is governed by Delaware state tax laws. This form must be filled out accurately to ensure compliance with tax regulations. The information provided on the form is legally binding, and any discrepancies can lead to penalties or audits. Therefore, it is essential to understand the legal implications of the information reported and to keep records of submissions for future reference.

Key Elements of the Form 1811AC 0905 Division of Revenue Delaware

Key elements of the Form 1811AC 0905 include:

- Taxpayer identification information, such as name and Social Security number.

- Details regarding income sources and amounts.

- Signature and date fields to validate the submission.

- Instructions for completion and submission methods.

Form Submission Methods for the 1811AC 0905 Division of Revenue Delaware

The Form 1811AC 0905 can be submitted through various methods, including:

- Online submission via the Delaware Division of Revenue's electronic filing system.

- Mailing a completed paper form to the designated address.

- In-person submission at a local Division of Revenue office.

Quick guide on how to complete division of revenue delaware

Effortlessly Prepare division of revenue delaware on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage delaware division of revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign division of revenue delaware with Ease

- Obtain revenue delaware and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether through email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign delaware division of revenue to guarantee exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs division of revenue delaware

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How much should it cost to hire an accountant for annual tax filing for a 2-year-old non revenue generating SaaS startup, registered as a C-Corp in Delaware with small team of 5?

Assuming you have your bookkeeping records in reasonable order $350 for the federal return and Delaware franchise return.Since not many people actually operate their business from Delaware add another $100 for the return in the state where you failed to register as actually operating the business, but do need to file a tax return.

-

As non revenue generating, non-operational startup registered as C-Corp in Delaware, how much should we expect to be paying in franchise tax for 10 million shares at a value of .0001?

In Delaware it can be anywhere from $200 (minimum) to $180,000 per year. These is also a $50 annual report fee.If you would like a free tax consultation please feel free to schedule one at the below link,Contact Us | Eco-Tax, INCThanksGabriel

Related searches to revenue delaware

Create this form in 5 minutes!

How to create an eSignature for the delaware division of revenue

How to create an electronic signature for the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware online

How to create an eSignature for the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware in Google Chrome

How to make an eSignature for putting it on the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware in Gmail

How to create an eSignature for the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware right from your smart phone

How to create an electronic signature for the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware on iOS

How to make an electronic signature for the Form 1811ac 0905 Division Of Revenue Delaware Revenue Delaware on Android OS

People also ask revenue delaware

-

How does airSlate SignNow help with the Delaware Division of Revenue processes?

airSlate SignNow provides an efficient platform for managing documents required by the Delaware Division of Revenue. By digitizing your documents and facilitating eSigning, businesses can streamline their tax submission processes and ensure compliance with state regulations.

-

What features does airSlate SignNow offer for interacting with the Delaware Division of Revenue?

Our platform includes features such as customizable templates, automated workflows, and secure eSignature options, all of which are beneficial for dealing with forms and submissions to the Delaware Division of Revenue. This simplifies the paperwork, enabling users to focus on their core business activities.

-

Is there a free trial available for airSlate SignNow if I'm dealing with Delaware Division of Revenue documentation?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, making it easier to handle your Delaware Division of Revenue documents. This is an excellent way to assess how our tool can enhance your document workflow before committing to a plan.

-

Can airSlate SignNow integrate with accounting software for handling Delaware Division of Revenue filings?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage your Delaware Division of Revenue filings. This integration ensures that your documents are automatically updated and correctly formatted.

-

What security measures does airSlate SignNow take to protect Delaware Division of Revenue data?

airSlate SignNow employs advanced security measures, including data encryption and secure cloud storage, to protect your documents related to the Delaware Division of Revenue. This ensures your sensitive information remains confidential and secure during transmission and storage.

-

What is the pricing structure for airSlate SignNow when focusing on Delaware Division of Revenue compliance?

airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring affordable access to essential features needed for Delaware Division of Revenue compliance. You can choose from various tiers based on the number of users and the required functionalities.

-

How can airSlate SignNow improve my efficiency in dealing with the Delaware Division of Revenue?

By automating document management and eSigning processes, airSlate SignNow signNowly enhances your efficiency when dealing with the Delaware Division of Revenue. This means faster turnaround times for approvals and reduced administrative burdens.

Get more for delaware division of revenue

- Heartsaver aid roster form

- Cigna fmla form

- Finra form 211

- Nevada ama form

- Vtr 52 a form

- Criminal witness subpoena chatham county ga court system chathamcourts form

- You may click here to download an application san diego county sdsheriff form

- Fei jumping event hosting packet the united states equestrian usef form

Find out other division of revenue delaware

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple