Fedloan Credit Dispute Form

What is the Fedloan Credit Dispute Form

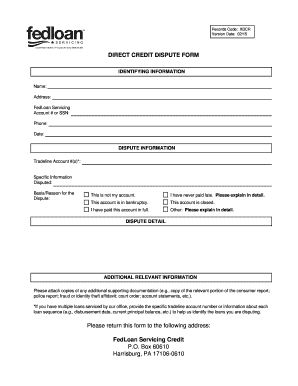

The Fedloan credit dispute form is a document used by borrowers to formally dispute inaccuracies in their credit reports related to their federal student loans serviced by FedLoan Servicing. This form allows individuals to communicate discrepancies and seek corrections, ensuring their credit history accurately reflects their financial obligations. It is essential for borrowers to address any errors promptly to maintain their creditworthiness and avoid potential negative impacts on their financial future.

How to Use the Fedloan Credit Dispute Form

Using the Fedloan credit dispute form involves several straightforward steps. First, gather all relevant information regarding your loan, including account numbers and details of the discrepancies you wish to dispute. Next, fill out the form accurately, providing clear descriptions of the errors. Once completed, submit the form as instructed, either online or via mail, ensuring that you keep copies for your records. Following submission, monitor your credit report and communications from FedLoan Servicing for updates on your dispute.

Steps to Complete the Fedloan Credit Dispute Form

Completing the Fedloan credit dispute form requires careful attention to detail. Here are the steps to follow:

- Obtain the Fedloan credit dispute form from the official source.

- Provide your personal information, including your name, address, and contact details.

- Clearly identify the account or loan number related to the dispute.

- Describe the specific inaccuracies in your credit report.

- Attach any supporting documents that validate your claims.

- Review the form for accuracy before submission.

- Submit the form according to the provided instructions.

Legal Use of the Fedloan Credit Dispute Form

The Fedloan credit dispute form is legally recognized as a formal request for correction under the Fair Credit Reporting Act (FCRA). When submitted correctly, it obligates FedLoan Servicing to investigate the claims made and respond within a specified timeframe. This legal framework ensures that borrowers have the right to challenge inaccuracies and seek corrections, protecting their credit rights and financial integrity.

Key Elements of the Fedloan Credit Dispute Form

Several key elements are crucial to the Fedloan credit dispute form. These include:

- Borrower Information: Personal details such as name, address, and contact information.

- Account Information: Specific loan or account numbers related to the dispute.

- Description of Dispute: A clear explanation of the inaccuracies being reported.

- Supporting Documentation: Any evidence that supports the dispute, such as payment records or correspondence.

- Signature: A signature or electronic signature to validate the submission.

Form Submission Methods

The Fedloan credit dispute form can be submitted through various methods to accommodate borrower preferences. These methods include:

- Online Submission: Many borrowers prefer to submit the form electronically through the FedLoan Servicing website for convenience.

- Mail Submission: Alternatively, the form can be printed and mailed to the designated address provided by FedLoan Servicing.

- In-Person Submission: In some cases, borrowers may choose to deliver the form in person at a FedLoan Servicing office, if applicable.

Quick guide on how to complete fedloan credit dispute form

Complete Fedloan Credit Dispute Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and efficiently. Manage Fedloan Credit Dispute Form across any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Fedloan Credit Dispute Form with ease

- Locate Fedloan Credit Dispute Form and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or disorganized files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow streamlines your document management in just a few clicks from any device of your choice. Edit and eSign Fedloan Credit Dispute Form and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fedloan credit dispute form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fedloan credit dispute form and how do I use it?

The fedloan credit dispute form is a specific document you can utilize to address errors on your credit report related to FedLoan Servicing. To use the form, simply fill it out with accurate details regarding the discrepancies in your account, then submit it through the designated channels. It's important to follow the guidelines closely to ensure your dispute is processed efficiently.

-

How can airSlate SignNow help with the fedloan credit dispute form?

AirSlate SignNow allows you to easily create, send, and eSign the fedloan credit dispute form securely. By utilizing our platform, you ensure that your documents are legally binding and can be tracked for status updates. This feature helps streamline the dispute process, providing peace of mind that your submissions are handled properly.

-

Is there a cost associated with using the fedloan credit dispute form through airSlate SignNow?

While the fedloan credit dispute form itself is free to fill out, using airSlate SignNow to eSign and manage the document may involve a subscription fee. However, our pricing model is competitive and offers various plans to suit different needs, making it a cost-effective solution for managing your documents.

-

What benefits does airSlate SignNow offer for submitting the fedloan credit dispute form?

Using airSlate SignNow to submit your fedloan credit dispute form offers numerous benefits, including enhanced security, time-saving features like templates, and unlimited document storage. Additionally, our platform enables you to collaborate with others and obtain quick signatures, accelerating the dispute process signNowly.

-

Can I integrate airSlate SignNow with other software for managing the fedloan credit dispute form?

Yes, airSlate SignNow integrates seamlessly with a wide range of software applications, enhancing your ability to manage the fedloan credit dispute form effectively. This means you can connect with CRM systems, project management tools, and more, allowing for a streamlined workflow that keeps all your documents organized in one place.

-

How do I track the status of my fedloan credit dispute form submission?

AirSlate SignNow provides comprehensive tracking features that allow you to monitor the status of your fedloan credit dispute form submissions. You will receive status updates via email and can view real-time progress within your account dashboard. This transparency ensures you stay informed about your dispute's resolution timeline.

-

What should I include when filling out the fedloan credit dispute form?

When filling out the fedloan credit dispute form, ensure to include your personal information, details about the disputed entry, and any supporting documentation you have. Providing thorough and accurate information helps expedite the review process by FedLoan Servicing. Be sure to review the guidelines for necessary components before submitting your form.

Get more for Fedloan Credit Dispute Form

Find out other Fedloan Credit Dispute Form

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now