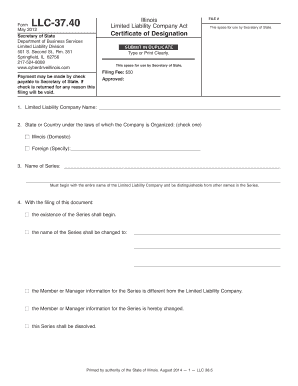

Llc 3740 Form

What is the LLC 37 40 Form

The LLC 37 40 form is a crucial document used in the formation and management of Limited Liability Companies (LLCs) in the United States. This form typically serves as a registration or application for establishing an LLC, outlining essential details such as the company name, registered agent, and business purpose. Understanding the specifics of this form is vital for compliance with state regulations and ensuring that your LLC is properly recognized by the state authorities.

How to Use the LLC 37 40 Form

Utilizing the LLC 37 40 form involves several steps that ensure the document is completed accurately. First, gather all necessary information, including the names of the LLC members, the business address, and the registered agent's details. Next, carefully fill out the form, ensuring that all fields are completed to avoid delays in processing. Once completed, the form can be submitted to the appropriate state agency, either online or via mail, depending on state-specific procedures.

Steps to Complete the LLC 37 40 Form

Completing the LLC 37 40 form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including member names and addresses.

- Choose a unique name for your LLC that complies with state naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency, along with any required fees.

Legal Use of the LLC 37 40 Form

The legal use of the LLC 37 40 form is essential for ensuring your business operates within the law. This form must be filed with the state to officially establish your LLC, providing legal protection to its members. By submitting this form, you are complying with state laws that govern business entities, which helps to avoid potential penalties or legal issues in the future.

Key Elements of the LLC 37 40 Form

Several key elements must be included in the LLC 37 40 form to ensure its validity. These elements typically include:

- The name of the LLC, which must be unique and adhere to state naming conventions.

- The address of the principal office where business records will be maintained.

- The name and address of the registered agent responsible for receiving legal documents.

- The duration of the LLC, if not perpetual.

- The purpose of the business, which may be stated broadly or specifically.

Form Submission Methods

The LLC 37 40 form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states allow for electronic filing through their official websites, which can expedite processing times.

- Mail: The form can often be printed and mailed to the appropriate state office, along with any required fees.

- In-Person Submission: Some states permit individuals to submit the form in person at designated state offices.

Quick guide on how to complete llc 3740 form

Effortlessly Prepare Llc 3740 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Llc 3740 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Alter and Electronically Sign Llc 3740 Form with Ease

- Locate Llc 3740 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Llc 3740 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the llc 3740 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the focus of airSlate SignNow as it relates to LLC 37 40?

airSlate SignNow is designed to facilitate document signing and management for various business needs, including those outlined in LLC 37 40. Our platform simplifies the eSigning process, providing intuitive features that ensure compliance and efficiency for your legal documents.

-

How does airSlate SignNow streamline compliance with LLC 37 40 requirements?

AirSlate SignNow helps businesses comply with LLC 37 40 by offering secure and legally binding electronic signatures. Our platform ensures that all signature processes meet regulatory standards, protecting both your business and your customers.

-

What features of airSlate SignNow support LLC 37 40 documentation?

Our platform includes features such as custom templates, automated workflows, and detailed audit trails that are essential for LLC 37 40 documentation. These features enhance efficiency and ensure that all necessary steps in document preparation and signing are easily managed.

-

How does pricing for airSlate SignNow cater to LLC 37 40 users?

We offer flexible pricing plans that cater to businesses dealing with LLC 37 40 documentation. You can choose a plan that fits your usage needs, whether you're signing a few documents or managing high volume transactions, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools for LLC 37 40 processes?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your LLC 37 40 processes. This integration capability allows you to maintain continuity in your workflow, linking document signing with your existing tools efficiently.

-

What are the benefits of using airSlate SignNow for LLC 37 40?

Using airSlate SignNow for LLC 37 40 provides multiple benefits, including saving time on document processing and reducing costs associated with traditional signing methods. Our platform's user-friendly design also ensures that all users, regardless of tech-savviness, can easily adopt electronic signing.

-

Is airSlate SignNow secure for handling LLC 37 40 documents?

Absolutely, airSlate SignNow employs robust security measures to protect all documents, including those related to LLC 37 40. We leverage encryption, access controls, and compliance certifications to ensure that your sensitive information remains safe and confidential.

Get more for Llc 3740 Form

- Sizeweight form

- Wiring form

- Will be taped and form

- County state of new jersey said property being described as follows type form

- If you have any questions about this notice contact an form

- Undersigned as sellers and as buyers which contract form

- The fixed price of dollars subject to form

- 7 tips for creating a divorce settlement agreement form

Find out other Llc 3740 Form

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will