Letter of Surety Treasury and Surety Bond and Surety Bonding Capacity 2010

Understanding the Letter of Surety Treasury and Surety Bond

The letter of surety treasury and surety bond is a formal document that assures the completion of a project or the fulfillment of a contractual obligation. It serves as a guarantee from a surety company that the principal will meet their obligations to a third party, typically a project owner or a government entity. This letter is crucial in various industries, particularly in construction, where it provides financial security and builds trust among stakeholders.

In the context of bonding capacity, this letter outlines the financial strength and creditworthiness of the contractor, ensuring that they have the necessary resources to complete the project. It is an essential part of the bonding process, often required by project owners before awarding contracts.

How to Use the Letter of Surety Treasury and Surety Bond

Using the letter of surety treasury and surety bond involves several key steps. First, the principal must apply for a bond through a surety company, providing necessary information about their financial status and project details. Once the surety company assesses the application, they will issue the letter if the principal meets the required criteria.

This letter can then be presented to the project owner or relevant authority as proof of the contractor's ability to fulfill their obligations. It is important to ensure that the letter is accurate and includes all necessary details, such as the project description, bond amount, and expiration date.

Steps to Complete the Letter of Surety Treasury and Surety Bond

Completing the letter of surety treasury and surety bond involves a systematic approach:

- Gather required documentation, including financial statements, project details, and any previous bonding history.

- Contact a surety company to initiate the bonding process and submit your application.

- Work with the surety underwriter to provide any additional information needed for the assessment.

- Review the terms of the bond and ensure all details are correct before finalizing the letter.

- Obtain the signed letter from the surety company and deliver it to the project owner.

Legal Use of the Letter of Surety Treasury and Surety Bond

The legal use of the letter of surety treasury and surety bond is governed by various regulations and standards. It is essential that the letter complies with the requirements set forth by state laws and the specific terms of the contract. This compliance ensures that the letter is enforceable in case of a default by the principal.

Additionally, the letter must be executed properly, including signatures from authorized representatives of both the surety and the principal. Failure to adhere to these legal standards can result in the letter being deemed invalid, which may expose the contractor to financial risks.

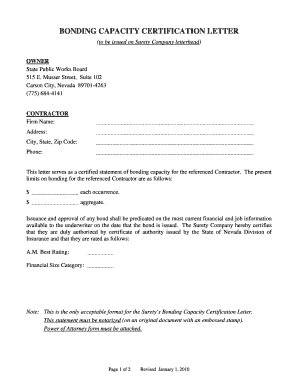

Key Elements of the Letter of Surety Treasury and Surety Bond

Several key elements must be included in the letter of surety treasury and surety bond to ensure its validity:

- Principal's Information: The name and address of the contractor or entity seeking the bond.

- Obligee's Information: The name and address of the project owner or entity requiring the bond.

- Bond Amount: The total amount of the bond, which represents the financial guarantee.

- Project Description: A detailed description of the project or obligation covered by the bond.

- Effective Date: The date the bond becomes effective and any expiration terms.

Obtaining the Letter of Surety Treasury and Surety Bond

To obtain the letter of surety treasury and surety bond, follow these steps:

- Identify a reputable surety company that specializes in your industry.

- Prepare your financial documents and project details for the application process.

- Submit your application to the surety company for review.

- Work with the surety to address any questions or additional information requests.

- Receive the letter upon approval, ensuring all details are correct before use.

Quick guide on how to complete letter of surety treasury and surety bond and surety bonding capacity

Easily prepare Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed forms, as you can access the necessary document and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without interruptions. Handle Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity on any device using airSlate SignNow's Android or iOS applications and enhance your document-related workflow today.

How to modify and electronically sign Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity effortlessly

- Obtain Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct letter of surety treasury and surety bond and surety bonding capacity

Create this form in 5 minutes!

How to create an eSignature for the letter of surety treasury and surety bond and surety bonding capacity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bonding capacity letter?

A bonding capacity letter is an official document provided by a surety company that outlines the maximum amount of bond a contractor can receive. It is crucial for contractors seeking to work on larger projects, as it assures clients of their financial backing and capability.

-

How can airSlate SignNow help in creating a bonding capacity letter?

airSlate SignNow offers an intuitive platform that allows users to easily create, send, and eSign bonding capacity letters. With customizable templates and an efficient workflow, businesses can streamline the process of obtaining necessary bonds for their projects.

-

What are the pricing options for using airSlate SignNow for bonding capacity letters?

airSlate SignNow provides flexible pricing plans tailored to different business needs. You can choose a plan that best fits your volume of bonding capacity letters and overall document signing requirements, ensuring you get the best value for your investment.

-

What features are included in airSlate SignNow for handling bonding capacity letters?

Features for handling bonding capacity letters with airSlate SignNow include document templates, real-time tracking, and automated reminders. These tools enhance efficiency and ensure that important documents like bonding capacity letters are processed quickly and correctly.

-

Can I integrate airSlate SignNow with other tools for managing bonding capacity letters?

Yes, airSlate SignNow seamlessly integrates with various business applications such as CRM systems and project management tools. This capability allows for a unified approach in managing bonding capacity letters alongside other key business processes.

-

What are the benefits of using airSlate SignNow for bonding capacity letter management?

Using airSlate SignNow to manage bonding capacity letters offers several benefits, including time savings, improved accuracy, and enhanced compliance. The platform ensures that all documents are secured and legally binding, providing peace of mind for contractors.

-

Is it safe to send bonding capacity letters through airSlate SignNow?

Absolutely. airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your bonding capacity letters. This commitment to security ensures that sensitive information remains confidential and tamper-proof.

Get more for Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity

- Mr713 form

- U s cellular repair maintenance form cell phone number 608 www2 fpm wisc

- Technology is changing the form

- Please read instructions on back and the privacy act statement before completing this form

- Activity 14 1 glass fracture patterns answer key form

- Certificate of exemption from rabies vaccination michigan form

- The spontaneous resolution of primary congenital glaucoma healio form

- Osha needle evaluation forms

Find out other Letter Of Surety Treasury And Surety Bond And Surety Bonding Capacity

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form