Tax Forms Oregon

What is the Tax Forms Oregon

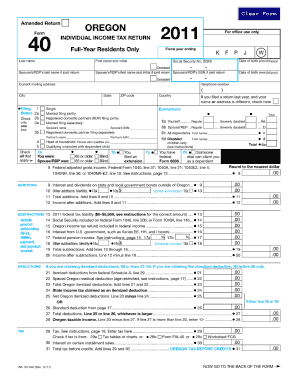

The Tax Forms Oregon refer to the various documents required for individuals and businesses to report income, claim deductions, and fulfill tax obligations to the state of Oregon. These forms are essential for ensuring compliance with state tax laws and regulations. Common forms include the Oregon Individual Income Tax Return (Form 40) and the Oregon Corporation Excise Tax Return (Form 20). Each form serves a specific purpose and must be filled out accurately to avoid penalties.

How to obtain the Tax Forms Oregon

Tax Forms Oregon can be obtained through several channels. The most straightforward method is to visit the Oregon Department of Revenue's official website, where forms are available for download in PDF format. Additionally, forms can be requested via mail or picked up at local tax offices. It is important to ensure that you have the most current version of the forms, as updates may occur annually.

Steps to complete the Tax Forms Oregon

Completing the Tax Forms Oregon involves several key steps:

- Gather all necessary documentation, including income statements, deductions, and credits.

- Download the appropriate form from the Oregon Department of Revenue website.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions.

- Sign and date the form where required.

- Submit the form either electronically or by mail, depending on the submission method chosen.

Legal use of the Tax Forms Oregon

The legal use of Tax Forms Oregon is governed by state tax laws. It is crucial that individuals and businesses use these forms for their intended purposes, such as reporting income and claiming deductions. Failure to comply with legal requirements can result in penalties or audits. Utilizing a trusted electronic signature solution can enhance the legal validity of submitted forms, ensuring compliance with regulations such as the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for Tax Forms Oregon vary depending on the type of form and the taxpayer's situation. Typically, individual income tax returns are due on April 15, while corporate returns may have different deadlines. It's important to stay informed about any changes to these dates, as extensions may be available under certain circumstances. Marking these deadlines on your calendar can help ensure timely submissions and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Tax Forms Oregon can be submitted using various methods, including:

- Online: Many forms can be filed electronically through the Oregon Department of Revenue's e-filing system.

- Mail: Completed forms can be sent via postal service to the designated address provided on the form.

- In-Person: Taxpayers may also submit forms at local tax offices during business hours.

Quick guide on how to complete tax forms oregon

Complete Tax Forms Oregon seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Forms Oregon on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Tax Forms Oregon effortlessly

- Obtain Tax Forms Oregon and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Mark pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Forms Oregon and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax forms oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of Tax Forms Oregon can I electronically sign with airSlate SignNow?

airSlate SignNow allows you to electronically sign a variety of Tax Forms Oregon, including W-2s, 1099s, and other essential tax documents. This ensures that you can manage all your tax-related paperwork efficiently. The platform is designed to facilitate the signing process while maintaining compliance with state regulations.

-

How does airSlate SignNow ensure the security of my Tax Forms Oregon?

Security is a top priority for airSlate SignNow, especially for sensitive Tax Forms Oregon. The platform utilizes advanced encryption technology and compliance with industry standards to protect your documents throughout the signing process. You can trust that your information will remain confidential and secure.

-

Can I integrate airSlate SignNow with other apps for Tax Forms Oregon?

Yes, airSlate SignNow offers seamless integrations with popular applications that can help with managing Tax Forms Oregon. Whether you need to connect with CRM systems, accounting software, or document management platforms, airSlate SignNow ensures smooth interoperability to enhance your workflow.

-

What are the pricing options for using airSlate SignNow for Tax Forms Oregon?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs regarding Tax Forms Oregon. You can choose from various subscription options based on your requirements and the frequency with which you need to send or eSign tax documents. Pricing is competitive, providing good value for the features offered.

-

Is airSlate SignNow suitable for small businesses handling Tax Forms Oregon?

Absolutely! airSlate SignNow is a cost-effective solution tailored for businesses of all sizes, including small businesses that need to handle Tax Forms Oregon. The user-friendly interface simplifies the eSigning process, making it easier for small businesses to manage their tax documentation without extensive resources.

-

What are the benefits of using airSlate SignNow for Tax Forms Oregon?

Using airSlate SignNow for Tax Forms Oregon streamlines the signing process, saves time, and reduces paperwork. It provides a convenient way to ensure that all parties can sign documents from anywhere, enhancing efficiency and productivity. Additionally, having an electronic trail enhances your record-keeping for tax compliance.

-

Can I track the status of my sent Tax Forms Oregon in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your sent Tax Forms Oregon. You can see when documents are viewed, signed, or completed, which helps ensure that no important steps are missed in your tax document management process.

Get more for Tax Forms Oregon

- Orlando health doctors note form

- Vertex to standard form worksheet with answers

- State farm declaration page form

- 3 squares vt printable application form

- Utah notary practice test form

- Alberta auto bill of sale form

- Startup nonprofit business plan template pdf form

- Vehicle registrationtitle application for ny dmv form

Find out other Tax Forms Oregon

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document