Form Vat 605

What is the Form VAT 605

The Form VAT 605 is a document used for specific tax-related purposes within the United States. It serves as a declaration for certain transactions and is essential for compliance with tax regulations. Understanding its purpose is crucial for individuals or businesses that engage in activities requiring this form. The form helps ensure that all necessary information is accurately reported to the relevant tax authorities.

How to use the Form VAT 605

Using the Form VAT 605 involves several steps to ensure proper completion and submission. First, gather all necessary information related to the transaction that requires reporting. This includes details such as the nature of the transaction, parties involved, and any applicable tax rates. Next, fill out the form accurately, ensuring that all fields are completed as required. Once completed, review the form for any errors before submission to avoid delays or issues with processing.

Steps to complete the Form VAT 605

Completing the Form VAT 605 requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant information regarding the transaction.

- Access the Form VAT 605 from an official source.

- Fill in the required fields, ensuring accuracy in all entries.

- Double-check the form for any mistakes or missing information.

- Sign and date the form as necessary.

- Submit the form according to the specified submission methods.

Legal use of the Form VAT 605

The legal use of the Form VAT 605 is defined by specific regulations that govern tax reporting in the United States. To be considered legally binding, the completed form must adhere to these regulations, including proper signatures and accurate information. Utilizing reliable electronic tools for completing and submitting the form can enhance its legal standing, ensuring compliance with applicable laws and regulations.

Key elements of the Form VAT 605

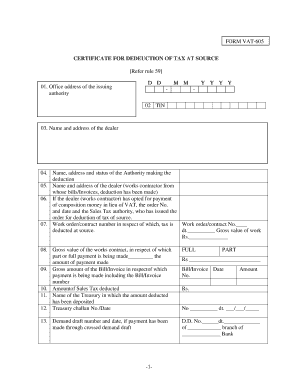

Key elements of the Form VAT 605 include essential information that must be accurately reported. These elements typically encompass:

- The name and address of the taxpayer.

- The nature and details of the transaction.

- The applicable tax identification numbers.

- Signature and date fields for verification.

Each element plays a critical role in ensuring that the form is processed correctly and complies with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form VAT 605 can vary based on the specific circumstances of the transaction. It is essential to be aware of these deadlines to avoid penalties or compliance issues. Generally, forms should be submitted by the end of the reporting period for which the transaction is being reported. Keeping track of these important dates can help ensure timely submission and adherence to tax obligations.

Form Submission Methods

The Form VAT 605 can be submitted through various methods, depending on the requirements set forth by the relevant tax authorities. Common submission methods include:

- Online submission through designated tax portals.

- Mailing a physical copy to the appropriate tax office.

- In-person submission at designated locations.

Choosing the correct submission method is vital for ensuring that the form is received and processed in a timely manner.

Quick guide on how to complete form vat 605

Complete Form Vat 605 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the correct template and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Form Vat 605 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Form Vat 605 with ease

- Obtain Form Vat 605 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Form Vat 605 and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form vat 605

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form vat 605 and how can airSlate SignNow help with it?

Form VAT 605 is a tax document required for VAT reporting purposes. With airSlate SignNow, you can easily create, send, and eSign your form VAT 605, streamlining your tax documentation process and ensuring compliance.

-

How does airSlate SignNow improve the process of handling form vat 605?

By using airSlate SignNow, businesses can automate the tedious tasks of managing form VAT 605. Our platform offers customizable templates and eSignature capabilities that simplify document workflows and enhance productivity.

-

What are the pricing options for using airSlate SignNow for form vat 605?

airSlate SignNow offers multiple pricing plans tailored to various business sizes and needs. This scalability ensures that even small businesses can manage form VAT 605 efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing form vat 605?

Absolutely! airSlate SignNow offers robust integrations with various applications that streamline the management of form VAT 605. This allows you to centralize your workflows and enhance collaboration across your team.

-

Is airSlate SignNow secure for processing form vat 605?

Yes, airSlate SignNow is committed to protecting your sensitive information. Our platform employs advanced security measures, including encryption and secure access controls, ensuring your form VAT 605 data remains confidential.

-

What features should I look for when managing form vat 605 with airSlate SignNow?

Key features include customizable templates, real-time tracking of document status, and seamless eSignature capabilities. These features not only simplify the process of managing form VAT 605 but also enhance compliance and efficiency.

-

How can I access support for issues related to form vat 605 on airSlate SignNow?

airSlate SignNow offers comprehensive customer support, including live chat and email assistance. Whether you have questions about form VAT 605 or need technical help, our dedicated team is here to support you.

Get more for Form Vat 605

- Preauthorization request form injury management organization inc

- Ppat task 1 examples form

- Xisx form

- Ri 009 form

- Waiver of confidentiality for candidate for aliyahreturn to israelolim form

- Westmoreland county community college scholarships all form

- Request for conviction history lara mi department of dleg state mi form

- Tm r2 052919 6 form

Find out other Form Vat 605

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple