Nys it 2105 Fillable Form

What is the NYS IT 2105 Fillable?

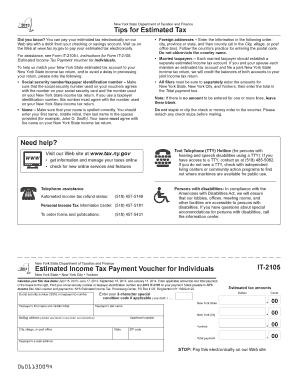

The NYS IT 2105 is a form used for estimated tax payments in New York State. It is specifically designed for individuals who expect to owe tax of $300 or more when they file their personal income tax return. The fillable version allows taxpayers to complete the form electronically, making it easier to input information accurately and efficiently. This form is essential for ensuring that individuals meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season.

Steps to Complete the NYS IT 2105 Fillable

Completing the NYS IT 2105 fillable form involves several key steps:

- Gather all necessary financial information, including income, deductions, and credits.

- Access the fillable form online through the New York State Department of Taxation and Finance website.

- Input your personal information, including your name, address, and Social Security number.

- Calculate your estimated tax liability based on your expected income for the year.

- Enter the amount you plan to pay with the form, ensuring it meets the minimum requirement.

- Review the completed form for accuracy before submitting.

Legal Use of the NYS IT 2105 Fillable

The NYS IT 2105 fillable form is legally recognized for making estimated tax payments. When filled out correctly and submitted on time, it serves as a formal declaration of your tax obligations to the state. It is important to ensure that all information provided is accurate and complete to avoid potential penalties or legal issues. The form must be submitted by the specified deadlines to maintain compliance with New York State tax regulations.

Filing Deadlines / Important Dates

Timely submission of the NYS IT 2105 is crucial for compliance. The deadlines for estimated tax payments typically coincide with the following dates:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Failing to meet these deadlines can result in penalties and interest on unpaid taxes, so it is essential to mark these dates on your calendar.

Form Submission Methods

The NYS IT 2105 fillable form can be submitted in several ways:

- Online: You can submit the form electronically through the New York State Department of Taxation and Finance website.

- By Mail: Print the completed form and send it to the appropriate address provided on the form.

- In-Person: Visit a local tax office to submit the form directly.

Choosing the right submission method can enhance the efficiency of your tax payment process.

Key Elements of the NYS IT 2105 Fillable

Understanding the key elements of the NYS IT 2105 fillable form is essential for accurate completion. Key components include:

- Personal Information: Name, address, and Social Security number.

- Estimated Tax Calculation: A section to calculate your expected tax liability for the year.

- Payment Amount: The total amount you plan to pay with the form.

- Signature: Your signature certifying that the information provided is accurate.

These elements ensure that the form is complete and compliant with state requirements.

Quick guide on how to complete nys it 2105 fillable

Effortlessly Prepare Nys It 2105 Fillable on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without delays. Handle Nys It 2105 Fillable on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Nys It 2105 Fillable with Ease

- Find Nys It 2105 Fillable and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to preserve your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and eSign Nys It 2105 Fillable to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys it 2105 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NYS estimated tax forms and why do I need them?

NYS estimated tax forms are documents used by taxpayers in New York State to report income and calculate estimated tax payments. Businesses and individuals who expect to owe tax on income not subject to withholding must file these forms to avoid penalties. Using airSlate SignNow, you can easily prepare and eSign these forms, streamlining the process.

-

How does airSlate SignNow facilitate the completion of NYS estimated tax forms?

airSlate SignNow streamlines the process of completing NYS estimated tax forms by providing an easy-to-use platform for document preparation and eSignature. Users can create and modify forms electronically, ensuring accuracy and efficiency. This allows you to focus on your financial planning rather than the complexities of paperwork.

-

Are there any costs associated with using airSlate SignNow for NYS estimated tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on the plan you choose, you can access unlimited document signing and additional features. Investing in airSlate SignNow can save you time and assist in the proper filing of NYS estimated tax forms.

-

Can I integrate airSlate SignNow with other accounting software for NYS estimated tax forms?

Absolutely! airSlate SignNow supports integrations with numerous accounting and financial software solutions, making it easier to manage your NYS estimated tax forms along with your overall finances. This integration allows for seamless data exchange, ensuring all necessary financial information is readily available and accurate.

-

What features does airSlate SignNow offer for managing NYS estimated tax forms?

airSlate SignNow provides essential features like template creation, eSigning, and document tracking specifically for NYS estimated tax forms. Users can easily customize forms according to their tax situations, ensuring compliance with New York regulations. Enhanced security measures also help protect your sensitive information throughout the process.

-

How can airSlate SignNow improve the accuracy of my NYS estimated tax forms?

By using airSlate SignNow, you can ensure the accuracy of your NYS estimated tax forms through its guided workflows and intuitive interface. The platform allows users to review documents before submission, helping to catch any errors. This reduces the risk of inaccuracies that could lead to additional taxes or penalties.

-

Is there customer support available for help with NYS estimated tax forms via airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist users with questions regarding NYS estimated tax forms. Whether you need help navigating the platform or have specific questions about the forms, the support team is available to provide timely and helpful assistance. You're never alone in the eSigning process!

Get more for Nys It 2105 Fillable

- Florida 4000a 155 form

- Number of copies etc forms sc egov usda

- Wasatch front regional mls listing input form nvs real estate

- License identification application form

- Individual graduation plan igp worksheet individual graduation plan igp worksheet form

- 20222023 standard verification worksheet v1 independent student form

- Download the o jak coast guard form

- Form approved omb no 09100396 expiration date m

Find out other Nys It 2105 Fillable

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document