Huntington Dispute Form 2015-2026

What is the Huntington Dispute Form

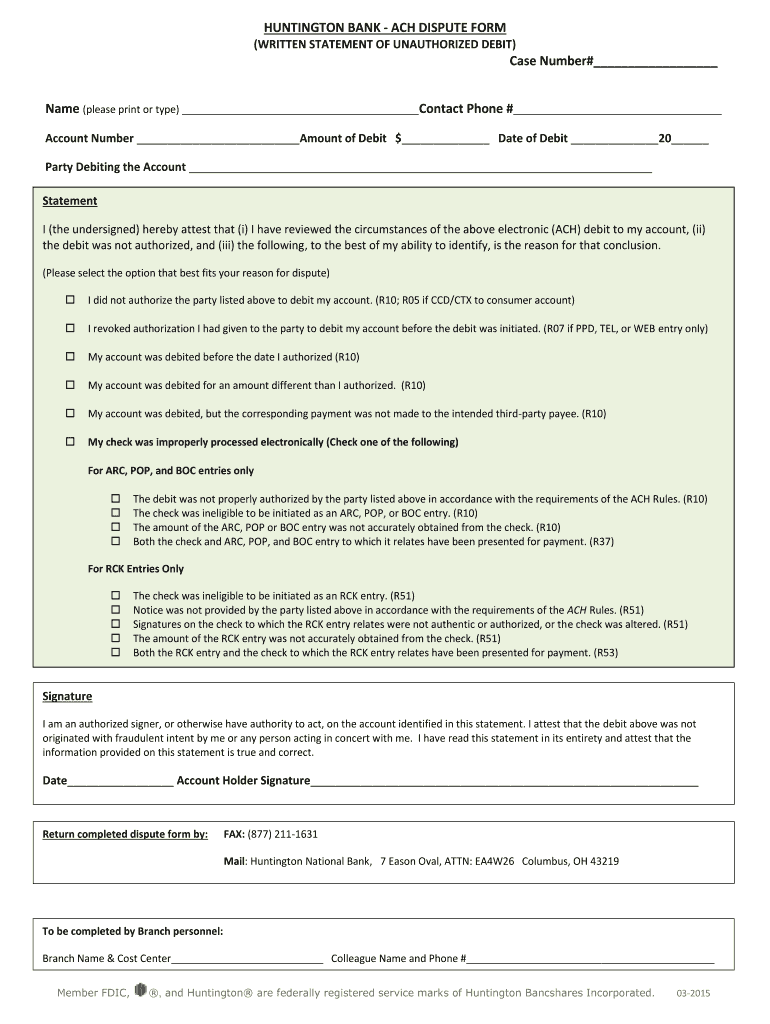

The Huntington Dispute Form is a specific document used by customers of Huntington Bank to formally contest charges on their accounts. This form is essential for initiating the dispute process regarding unauthorized transactions or errors in billing. By completing this form, customers can provide necessary details about the disputed charge, ensuring that their concerns are officially recorded and addressed by the bank.

How to use the Huntington Dispute Form

To effectively use the Huntington Dispute Form, customers should first gather all relevant information regarding the disputed charge. This includes the transaction date, amount, and any supporting documentation. Once the form is obtained, fill it out completely, ensuring that all sections are accurately completed. After filling out the form, submit it through the preferred method outlined by Huntington Bank, which may include online submission, mailing, or in-person delivery.

Steps to complete the Huntington Dispute Form

Completing the Huntington Dispute Form involves several key steps:

- Gather all necessary information about the disputed transaction, including dates, amounts, and merchant details.

- Obtain the Huntington Dispute Form from the bank’s website or a local branch.

- Carefully fill out the form, providing clear and concise details about the dispute.

- Attach any supporting documents, such as receipts or statements, that validate your claim.

- Review the completed form for accuracy before submission.

- Submit the form according to the instructions provided by Huntington Bank.

Legal use of the Huntington Dispute Form

The Huntington Dispute Form is legally recognized as a formal request to challenge a transaction. By submitting this form, customers invoke their rights under the Fair Credit Billing Act, which protects consumers from unfair billing practices. It is important for customers to understand that providing false information on the form can have legal consequences, so accuracy and honesty are crucial.

Key elements of the Huntington Dispute Form

Key elements of the Huntington Dispute Form typically include:

- Customer's account information, including name and account number.

- Details of the disputed transaction, such as date, amount, and merchant name.

- Reason for the dispute, which may include unauthorized charges or billing errors.

- Signature of the customer, confirming the accuracy of the information provided.

Form Submission Methods

Customers have various options for submitting the Huntington Dispute Form. These methods may include:

- Online submission through the Huntington Bank website or mobile app.

- Mailing the completed form to the designated address provided by the bank.

- Visiting a local Huntington Bank branch to submit the form in person.

Quick guide on how to complete huntington bank dispute form

The most effective method to obtain and endorse Huntington Dispute Form

At the size of an entire organization, ineffective procedures regarding document approval can consume a signNow amount of working hours. Endorsing documents like Huntington Dispute Form is a fundamental component of operations in any enterprise, which is why the efficiency of each agreement’s lifecycle has a substantial impact on the company's overall productivity. With airSlate SignNow, endorsing your Huntington Dispute Form can be as straightforward and rapid as possible. You will receive with this platform the latest version of almost any form. Even better, you can endorse it instantly without the need for installing external software on your device or printing any hard copies.

Steps to obtain and endorse your Huntington Dispute Form

- Browse our collection by category or utilize the search bar to find the document you require.

- Review the form preview by clicking on Learn more to ensure it is the correct one.

- Click Get form to initiate editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click the Sign tool to endorse your Huntington Dispute Form.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything required to manage your documentation effectively. You can find, fill, modify, and even send your Huntington Dispute Form in one tab seamlessly. Enhance your procedures with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

-

How do I fill out the Allahabad Bank account opening form?

Follow the step by step process for filling up the Allahabad Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Allahabad Bank Account Opening Minimum Balance:The minimum amount required to open a savings account is as follows: The minimum balance to open an account in rural and sub-urban branches isRs.500The minimum balance to open an account in all other branches isRs.1,000For issue of cheque book, an additional Rs.100 is to be paid in rural and sub-urban branches.Allahabad Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)Step 1:Continue Reading…

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

Create this form in 5 minutes!

How to create an eSignature for the huntington bank dispute form

How to make an electronic signature for your Huntington Bank Dispute Form in the online mode

How to create an eSignature for your Huntington Bank Dispute Form in Chrome

How to generate an electronic signature for signing the Huntington Bank Dispute Form in Gmail

How to generate an electronic signature for the Huntington Bank Dispute Form from your smart phone

How to make an eSignature for the Huntington Bank Dispute Form on iOS

How to make an eSignature for the Huntington Bank Dispute Form on Android OS

People also ask

-

What is airSlate SignNow's pricing structure for Huntington Bank customers?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those of Huntington Bank customers. With tiered options, you can choose the plan that best fits your volume of eSigning requirements. Additionally, Huntington Bank clients can benefit from exclusive discounts when they sign up for the service.

-

How does airSlate SignNow integrate with Huntington Bank services?

airSlate SignNow seamlessly integrates with Huntington Bank services to streamline your document management processes. By linking your airSlate SignNow account with Huntington Bank, you can easily manage financial documents while ensuring secure and efficient eSigning. This integration enhances productivity and ensures your transactions are processed with ease.

-

What key features does airSlate SignNow offer for Huntington Bank users?

Huntington Bank users can take advantage of airSlate SignNow's robust features, including customizable templates, advanced security options, and real-time tracking of document statuses. These features simplify the eSigning process, allowing businesses to conduct transactions efficiently and securely. With airSlate SignNow, Huntington Bank clients can enhance their operational workflows signNowly.

-

Can airSlate SignNow help businesses that collaborate with Huntington Bank?

Yes, airSlate SignNow is designed to facilitate collaboration for businesses working with Huntington Bank. The platform allows multiple users to collaborate on documents simultaneously, speeding up the review and signing processes. This is particularly beneficial for businesses that regularly engage with Huntington Bank for financial transactions.

-

What are the benefits of using airSlate SignNow for Huntington Bank transactions?

Using airSlate SignNow for Huntington Bank transactions provides numerous benefits, including enhanced efficiency, reduced paper usage, and streamlined workflows. Businesses can sign and send documents electronically, saving time and costs associated with traditional document handling. Additionally, airSlate SignNow's compliance guarantees ensure that all transactions are secure and legally binding.

-

Is there any mobile access for airSlate SignNow users who bank with Huntington Bank?

Absolutely! airSlate SignNow offers a mobile-friendly platform that allows Huntington Bank users to manage their documents on the go. Whether you need to send, sign, or review documents, the mobile access feature ensures that you can handle your tasks anytime, anywhere, right from your smartphone or tablet.

-

How does airSlate SignNow ensure the security of documents for Huntington Bank clients?

airSlate SignNow employs industry-leading security measures to protect documents for all users, including those from Huntington Bank. With features like encryption, secure data storage, and authentication checks, you can be confident that your sensitive information is safeguarded at all times. This level of security is essential for maintaining trust in financial transactions.

Get more for Huntington Dispute Form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return washington form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return washington form

- Letter from tenant to landlord containing request for permission to sublease washington form

- Wa sublease form

- Letter landlord rent template 497429677 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable washington form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497429679 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497429680 form

Find out other Huntington Dispute Form

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online