Sales Tax Chart Form

What is the Sales Tax Chart

The sales tax chart is a comprehensive tool that outlines the various sales tax rates applicable in Texas, specifically the 8.25 percent rate. This chart serves as a reference for businesses and individuals to determine the correct amount of sales tax to apply to transactions. It is essential for ensuring compliance with state tax regulations and for accurate financial planning.

How to use the Sales Tax Chart

Using the sales tax chart involves identifying the applicable rate for your specific transaction. Begin by locating the category of goods or services you are selling or purchasing. The chart will provide the corresponding sales tax percentage. To calculate the total sales tax, multiply the sale amount by the tax rate. For example, if you are selling an item for $100, the sales tax would be $8.25, making the total $108.25.

Steps to complete the Sales Tax Chart

To complete the sales tax chart, follow these steps:

- Identify the type of goods or services being sold.

- Refer to the sales tax chart to find the corresponding tax rate.

- Calculate the sales tax by multiplying the sale price by the tax rate.

- Document the total amount, including the sales tax, for your records.

- Ensure compliance by keeping a copy of the completed chart for tax purposes.

Legal use of the Sales Tax Chart

The sales tax chart is legally recognized as a valid resource for determining tax obligations in Texas. It is important to use the most current version of the chart to ensure compliance with state tax laws. Proper use of the chart can help prevent penalties associated with incorrect tax calculations and filings.

Key elements of the Sales Tax Chart

Key elements of the sales tax chart include:

- Tax rate percentages for different categories of goods and services.

- Exemptions or special rates applicable to certain items.

- Clear definitions of taxable and non-taxable items.

- Guidelines for applying the tax rate to various transaction types.

State-specific rules for the Sales Tax Chart

Each state has its own rules regarding sales tax, and Texas is no exception. The sales tax chart reflects these state-specific regulations, including exemptions and special rates that may apply to certain transactions. It is crucial for users to familiarize themselves with these rules to ensure accurate tax compliance.

Quick guide on how to complete sales tax chart

Effortlessly Prepare Sales Tax Chart on Any Device

The management of online documents has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Sales Tax Chart on any device using airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The Easiest Way to Modify and eSign Sales Tax Chart with Ease

- Locate Sales Tax Chart and click Retrieve Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive data with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Finish button to save your changes.

- Select your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Sales Tax Chart to guarantee outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax chart

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

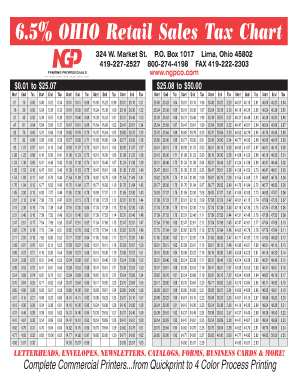

What is the Ohio tax table and how does it impact my business?

The Ohio tax table provides the necessary tax rates for individuals and businesses operating in Ohio. Understanding the Ohio tax table is crucial as it helps in determining the correct amount of taxes owed, ensuring compliance with state regulations and avoiding penalties.

-

How can airSlate SignNow help with managing documents related to the Ohio tax table?

airSlate SignNow offers a simple solution for sending and eSigning tax-related documents, including those that reference the Ohio tax table. Our platform streamlines the document management process, allowing businesses to focus on compliance and accuracy when referencing tax rates.

-

Is there an integration available for Ohio tax table resources?

Yes, airSlate SignNow integrates with various accounting and tax software that provide access to the Ohio tax table. These integrations allow for seamless updates and references, ensuring users stay compliant with the latest tax regulations without leaving the platform.

-

What are the pricing options for using airSlate SignNow to manage Ohio tax documents?

airSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial. Our plans are designed to be cost-effective, providing access to features that assist in managing documents related to the Ohio tax table and other compliance needs.

-

What features does airSlate SignNow provide for Ohio tax table compliance?

With airSlate SignNow, users can easily create, send, and track documents necessary for Ohio tax table compliance. Features like customizable templates, real-time tracking, and eSignature capabilities ensure that all necessary tax documents are managed efficiently and securely.

-

Can I access the Ohio tax table through airSlate SignNow's platform?

While airSlate SignNow does not provide the Ohio tax table directly, it allows users to upload and manage their own files containing the tax information. This ensures that businesses can keep their tax documents organized and easily accessible in relation to the Ohio tax table.

-

How does eSigning documents related to the Ohio tax table benefit my business?

eSigning documents related to the Ohio tax table can signNowly expedite the approval and filing process. airSlate SignNow helps streamline this process, reducing delays and ensuring that your tax documents are completed and submitted on time, reducing the risk of penalties.

Get more for Sales Tax Chart

- Title order form for oil format

- Nc plr form

- Roommate matching form evolve apartments

- Sample rental agreement self storage association of michigan form

- 283406305 passport aganapcg dfa gov form

- Rabies serology certificate 487926034 form

- Sample daily work report form

- Boring pcbtp3 1lambada hail dslam never ma form

Find out other Sales Tax Chart

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself