Hardin County Homestead Exemption Form

What is the Hardin County Homestead Exemption

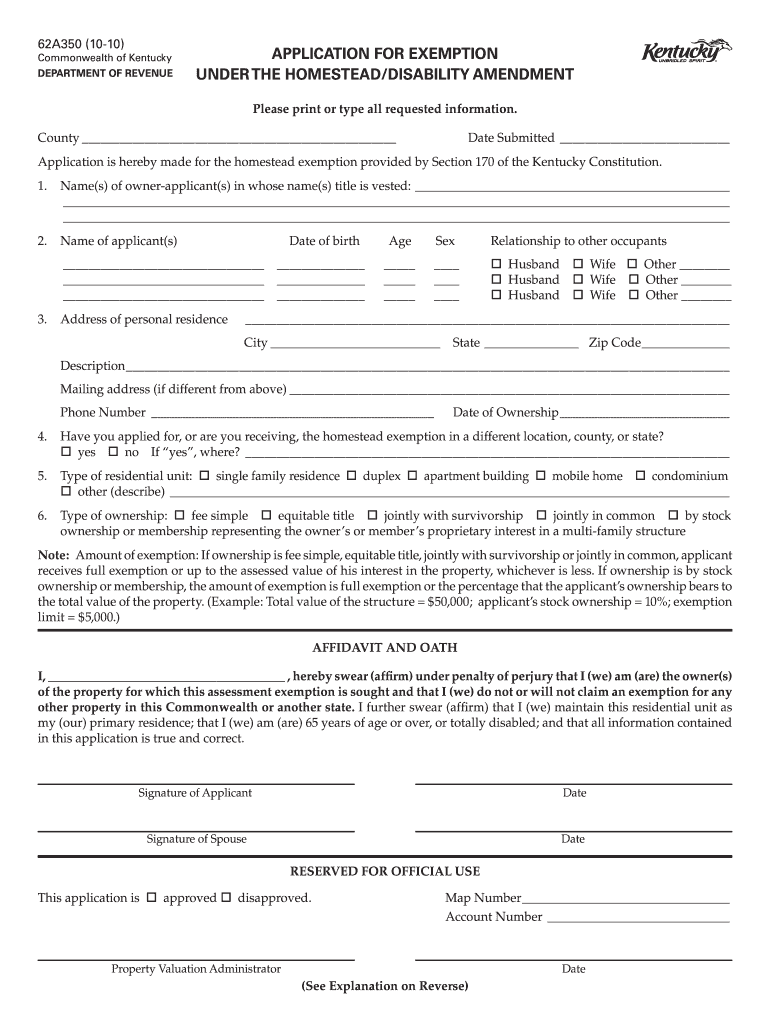

The Hardin County Homestead Exemption is a property tax benefit designed to reduce the taxable value of a primary residence in Hardin County. This exemption aims to provide financial relief to homeowners, enabling them to retain more of their income for other expenses. By applying for this exemption, eligible homeowners can lower their property tax bills, making homeownership more affordable.

Eligibility Criteria

To qualify for the Hardin County Homestead Exemption, applicants must meet specific criteria. Generally, the homeowner must occupy the property as their primary residence. Additionally, applicants should be able to demonstrate ownership of the property and may need to provide proof of residency. It is essential to check local guidelines for any additional requirements, such as income limits or age restrictions.

Steps to Complete the Hardin County Homestead Exemption

Completing the Hardin County Homestead Exemption form involves several steps. First, gather all necessary documentation, including proof of ownership and residency. Next, fill out the application form accurately, ensuring all information is complete. Once the form is filled out, submit it to the appropriate county office, either online, by mail, or in person, depending on the available options. It is crucial to keep a copy of the submitted form for your records.

Required Documents

When applying for the Hardin County Homestead Exemption, specific documents may be required to support your application. Commonly requested documents include:

- Proof of ownership, such as a deed or title

- Identification, such as a driver's license or state ID

- Proof of residency, which may include utility bills or lease agreements

- Any additional forms specified by the county

Form Submission Methods

Homeowners can submit the Hardin County Homestead Exemption form through various methods. Common submission options include:

- Online submission via the county's official website

- Mailing the completed form to the designated county office

- In-person submission at the county tax office

Each method has its advantages, so homeowners should choose the one that best fits their needs and preferences.

Legal Use of the Hardin County Homestead Exemption

The Hardin County Homestead Exemption is legally binding once approved. Homeowners must adhere to the rules and regulations governing the exemption to maintain its benefits. This includes notifying the county of any changes in residency or ownership status. Failure to comply with these legal requirements may result in penalties or the loss of the exemption.

Quick guide on how to complete hardin county homestead exemption

Effortlessly Prepare Hardin County Homestead Exemption on Any Device

Digital document management has gained traction among enterprises and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Hardin County Homestead Exemption on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related activity today.

How to Alter and eSign Hardin County Homestead Exemption with Ease

- Find Hardin County Homestead Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Hardin County Homestead Exemption while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hardin county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hardin County Homestead Exemption?

The Hardin County Homestead Exemption is a property tax relief program that helps homeowners reduce their tax liability on their primary residence. To qualify, you must meet specific eligibility criteria, such as residency and income requirements. This exemption can signNowly lower your property taxes, making homeownership more affordable.

-

How do I apply for the Hardin County Homestead Exemption?

To apply for the Hardin County Homestead Exemption, you need to complete an application form available from the Hardin County tax office or their website. Ensure you provide all necessary documentation, such as proof of residency and income. Applications must typically be submitted by a specific deadline to qualify for the exemption.

-

What are the benefits of the Hardin County Homestead Exemption?

The benefits of the Hardin County Homestead Exemption include reduced property taxes, which can lead to signNow savings for homeowners. Additionally, it helps stabilize housing costs and makes homeownership accessible for more residents. By participating in this exemption program, you contribute to the local economy by fostering long-term residency.

-

Is there a fee to apply for the Hardin County Homestead Exemption?

There is no fee to apply for the Hardin County Homestead Exemption. The application process is designed to be accessible for homeowners, allowing you to submit your form without incurring any costs. Always check for the latest guidelines from the Hardin County tax office to ensure a smooth application process.

-

Can I combine the Hardin County Homestead Exemption with other tax exemptions?

Yes, you can often combine the Hardin County Homestead Exemption with other tax relief programs, such as senior or disability exemptions. This combination can maximize your tax savings and provide further relief on your property taxes. Be sure to check with the Hardin County tax office for specific rules regarding combination eligibility.

-

What documents are required for the Hardin County Homestead Exemption application?

When applying for the Hardin County Homestead Exemption, you will typically need to provide proof of ownership, a valid photo ID, and documentation verifying your residency. It's essential to refer to the specific guidelines issued by the Hardin County tax office to ensure you gather all necessary documentation for a successful application.

-

How does the Hardin County Homestead Exemption affect my property value?

The Hardin County Homestead Exemption does not directly affect your property's market value; however, it reduces the taxable value. This reduction in taxable value leads to lower property taxes, which can make your home more financially manageable. Homeowners often find that maintaining lower expenses helps sustain property value over time.

Get more for Hardin County Homestead Exemption

- Memorandum for appraisal the claims pages the insurance form

- Ftb heavy use tax form dmv

- Facilities use form tennessee tech university

- Illinois drivers license medical report osf healthcare form

- Consumer directed care plus form

- Mr 505 ohio department of transportation dot state oh form

- Legal due diligence commercial review contract template form

- Legal loan contract template form

Find out other Hardin County Homestead Exemption

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed