Blank Credit Application Form

What is the Blank Credit Application

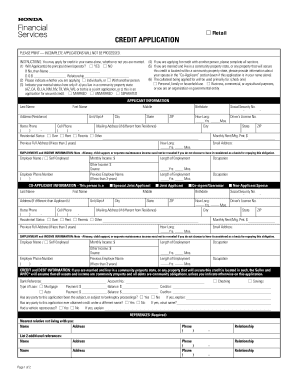

The blank credit application is a standardized form used by individuals seeking credit from financial institutions or retailers. This document gathers essential information about the applicant, including personal details, financial history, and employment status. It serves as a foundational tool for lenders to assess creditworthiness and make informed decisions regarding credit approvals.

How to Use the Blank Credit Application

Using the blank credit application involves several straightforward steps. First, download the care credit application PDF from a reliable source. Next, fill in the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the application according to the lender's specified method, whether online, by mail, or in person.

Steps to Complete the Blank Credit Application

Completing the blank credit application requires careful attention to detail. Follow these steps for a successful submission:

- Download the care credit application PDF.

- Provide your personal information, including your name, address, and Social Security number.

- Detail your employment information, including your employer's name and your job title.

- Disclose your income and any additional financial information requested.

- Review the form thoroughly before submitting it.

Legal Use of the Blank Credit Application

The blank credit application must be filled out in compliance with relevant laws and regulations. In the United States, electronic submissions are considered legally binding when they meet specific criteria, such as obtaining an electronic signature. Utilizing a reliable platform ensures that your submission adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Key Elements of the Blank Credit Application

Understanding the key elements of the blank credit application is crucial for effective completion. Important components typically include:

- Personal identification information

- Employment and income details

- Credit history and existing debts

- Signature section for authorization

Eligibility Criteria

Eligibility criteria for submitting a blank credit application often vary by lender. Generally, applicants must be at least eighteen years old, possess a valid Social Security number, and have a stable income source. Some lenders may also consider credit history and existing debt levels when evaluating eligibility.

Quick guide on how to complete blank credit application

Complete Blank Credit Application effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without any delays. Manage Blank Credit Application on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign Blank Credit Application without stress

- Locate Blank Credit Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Blank Credit Application and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank credit application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the care credit application pdf?

The care credit application pdf is a downloadable file that allows customers to apply for care credit financing. This PDF version is perfect for those who prefer to fill out the application offline or need a physical copy for their records.

-

How can I get the care credit application pdf?

You can easily obtain the care credit application pdf by visiting our website and navigating to the downloads section. It is available for immediate download, allowing you to complete your application at your convenience.

-

What are the benefits of using the care credit application pdf?

Using the care credit application pdf provides a straightforward approach to applying for financing. It allows you to take your time filling out the application without being rushed, ensuring that all necessary information is accurately submitted.

-

Are there any fees associated with submitting the care credit application pdf?

There are no fees for downloading or submitting the care credit application pdf. This makes it a cost-effective solution for individuals looking to secure financing through care credit.

-

Can I submit the care credit application pdf online?

While the care credit application pdf is designed for offline use, you can also submit your application online through our platform. Simply fill out the online form to expedite the process and receive quick feedback on your financing options.

-

What information is needed to complete the care credit application pdf?

To complete the care credit application pdf, you will need to provide personal information such as your name, address, and financial details. Ensure that you have all necessary documents ready to make the process seamless.

-

Is the care credit application pdf secure?

Yes, the care credit application pdf complies with security standards to protect your personal information. When submitting the application, you can trust that your data will be handled securely and confidentially.

Get more for Blank Credit Application

- Dmv 65 mcp rev 9 form

- British territory form

- Gemoney com au secureupload form

- Patient registration amp health questionnaire form

- Shellys science spot earthworm dissection answers form

- Monitoring indicators of scholarly language form

- Affidavit under california probate code section form

- Chapter 253 permit applications 1 cover sheet check form

Find out other Blank Credit Application

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple