Fillable Va Tax Form 763 S

What is the Fillable Va Tax Form 763 S

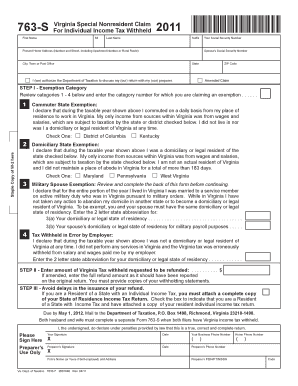

The Fillable Va Tax Form 763 S is a state-specific tax document used by Virginia residents to report their income and calculate their tax liability. This form is particularly designed for individuals who qualify for certain tax benefits, such as those with income from various sources, including wages, self-employment, and other earnings. It is essential for taxpayers to accurately complete this form to ensure compliance with Virginia tax laws and to take advantage of any potential deductions or credits.

How to use the Fillable Va Tax Form 763 S

Using the Fillable Va Tax Form 763 S involves several key steps. First, taxpayers should download the form from the official Virginia Department of Taxation website. After obtaining the form, individuals need to fill in their personal information, including name, address, and Social Security number. Next, they should report their income, deductions, and any applicable credits. It is crucial to review the completed form for accuracy before submission. Finally, taxpayers can submit the form electronically or via mail, depending on their preference.

Steps to complete the Fillable Va Tax Form 763 S

Completing the Fillable Va Tax Form 763 S requires careful attention to detail. Here are the steps to follow:

- Download the form from the Virginia Department of Taxation website.

- Provide your personal information in the designated fields.

- Report all sources of income accurately, including wages and self-employment earnings.

- Claim any deductions you qualify for, such as those for dependents or specific expenses.

- Calculate your total tax liability based on the information provided.

- Review the form thoroughly to ensure all information is correct.

- Submit the completed form electronically or by mailing it to the appropriate tax office.

Legal use of the Fillable Va Tax Form 763 S

The legal use of the Fillable Va Tax Form 763 S is governed by Virginia tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Electronic signatures are accepted, provided they comply with the requirements set forth by the state. It is important to retain a copy of the submitted form for personal records, as it may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Va Tax Form 763 S are crucial for compliance. Typically, the form must be submitted by May 1 of the year following the tax year being reported. If May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, allowing for additional time to file without incurring penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Fillable Va Tax Form 763 S. The form can be submitted electronically through the Virginia Department of Taxation's online portal, which is a convenient and efficient method. Alternatively, individuals may choose to print the completed form and mail it to the appropriate tax office. In-person submissions are generally not common for this form, but taxpayers can visit local tax offices if they require assistance or have specific inquiries regarding their submissions.

Quick guide on how to complete fillable va tax form 763 s

Effortlessly Prepare Fillable Va Tax Form 763 S on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without delays. Manage Fillable Va Tax Form 763 S on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related procedure today.

How to Modify and eSign Fillable Va Tax Form 763 S with Ease

- Find Fillable Va Tax Form 763 S and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Revise and eSign Fillable Va Tax Form 763 S while ensuring outstanding communication throughout every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable va tax form 763 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillable Va Tax Form 763 S and why is it important?

The Fillable Va Tax Form 763 S is a specific document required for certain tax filings in Virginia. It allows taxpayers to report their income and calculate their tax obligations efficiently. By utilizing the Fillable Va Tax Form 763 S, you can ensure compliance with state tax laws and potentially maximize your deductions.

-

How can airSlate SignNow help me with the Fillable Va Tax Form 763 S?

airSlate SignNow offers a user-friendly platform to create, fill, and eSign the Fillable Va Tax Form 763 S seamlessly. With our intuitive interface, you can easily input your information and ensure your form is accurate before submission. This makes the tax filing process faster and more reliable.

-

Is there a cost associated with using airSlate SignNow for the Fillable Va Tax Form 763 S?

Yes, airSlate SignNow provides various pricing plans tailored to meet the needs of individuals and businesses. You can choose a plan that best fits your needs while managing the cost effectively. With our solutions, you'll find that the investment enhances your ability to handle the Fillable Va Tax Form 763 S efficiently.

-

Can I save my progress while working on the Fillable Va Tax Form 763 S?

Absolutely! airSlate SignNow allows you to save your progress when completing the Fillable Va Tax Form 763 S. This feature provides convenience, enabling you to return to your form at any time without losing your entered information, ensuring a smooth filing experience.

-

What features does airSlate SignNow offer for managing the Fillable Va Tax Form 763 S?

airSlate SignNow offers robust features for managing the Fillable Va Tax Form 763 S, including eSigning, document sharing, and secure storage. These tools facilitate collaboration with your accountant or tax preparer, ensuring your form is completed accurately and efficiently. Our platform enhances your overall document management process.

-

Is my information secure when using the Fillable Va Tax Form 763 S on airSlate SignNow?

Yes, your information is secure when using the Fillable Va Tax Form 763 S on airSlate SignNow. We implement industry-standard security measures, including encryption, to protect your sensitive data. You can trust that your personal and financial information is kept safe while you use our services.

-

Does airSlate SignNow integrate with other tools for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your experience with the Fillable Va Tax Form 763 S. These integrations can streamline your tax preparation process, allowing for easier data transfer and improved efficiencies. This makes managing your taxes more convenient.

Get more for Fillable Va Tax Form 763 S

- Essential documents for the organized traveler package with personal organizer maine form

- Postnuptial agreements package maine form

- Letters of recommendation package maine form

- Me lien form

- Maine construction or mechanics lien package corporation or llc maine form

- Storage business package maine form

- Child care services package maine form

- Special or limited power of attorney for real estate sales transaction by seller maine form

Find out other Fillable Va Tax Form 763 S

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement