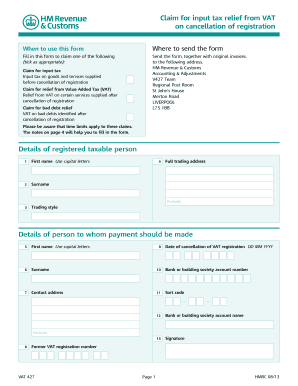

Hmrc Vat 427 Form

What is the Hmrc Vat 427

The Hmrc Vat 427 is a tax form used in the United Kingdom for businesses to claim a refund of VAT (Value Added Tax) that has been overpaid. This form is particularly relevant for businesses that have incurred VAT on goods or services but are not registered for VAT themselves. The Hmrc Vat 427 allows these businesses to recover the VAT they have paid, ensuring they are not financially disadvantaged due to VAT regulations.

How to use the Hmrc Vat 427

To use the Hmrc Vat 427, businesses must first complete the form accurately, providing all necessary information about the VAT they wish to claim. This includes details such as the amount of VAT paid, the nature of the goods or services, and any relevant invoices. Once completed, the form can be submitted to HMRC for processing. It is essential to ensure that all information is correct to avoid delays in processing the claim.

Steps to complete the Hmrc Vat 427

Completing the Hmrc Vat 427 involves several key steps:

- Gather all relevant invoices and receipts that show the VAT paid.

- Fill out the form with accurate details, including your business information and the VAT amounts.

- Review the completed form for any errors or omissions.

- Submit the form to HMRC either online or via mail, depending on your preference.

Legal use of the Hmrc Vat 427

The legal use of the Hmrc Vat 427 is governed by UK tax laws. It is important for businesses to understand that submitting this form constitutes a formal request for a VAT refund. Any false information or fraudulent claims can result in penalties, including fines or legal action. Therefore, businesses should ensure compliance with all relevant regulations when completing and submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Hmrc Vat 427 can vary based on the specific circumstances of the business. Generally, it is advisable to submit the form as soon as the VAT has been overpaid and all necessary documentation is available. Keeping track of any updates from HMRC regarding deadlines is crucial to ensure timely submissions and avoid potential penalties.

Required Documents

When submitting the Hmrc Vat 427, businesses must include certain documents to support their claim. These typically include:

- Invoices or receipts showing the VAT paid.

- Any correspondence with HMRC regarding VAT matters.

- Proof of business registration, if applicable.

Examples of using the Hmrc Vat 427

Examples of using the Hmrc Vat 427 include scenarios where a business has purchased equipment or supplies and paid VAT but is not VAT registered. For instance, a small business that buys office supplies from a VAT-registered supplier can claim back the VAT paid using this form. Another example is a non-profit organization that incurs VAT on services related to its charitable activities, allowing it to recover those costs through the Hmrc Vat 427.

Quick guide on how to complete hmrc vat 427

Effortlessly Prepare Hmrc Vat 427 on Any Device

The usage of online document management has surged among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow offers all the tools needed to swiftly create, edit, and electronically sign your documents without any complications. Manage Hmrc Vat 427 on any device with the airSlate SignNow apps for Android or iOS and simplify any document-centric task today.

The Easiest Way to Edit and Electronically Sign Hmrc Vat 427 with Ease

- Obtain Hmrc Vat 427 and click on Retrieve Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Signature tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Finish button to save the modifications.

- Select your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign Hmrc Vat 427 and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hmrc vat 427

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 427 and how does airSlate SignNow help with it?

Form 427 is a specific document required for certain applications and processes. airSlate SignNow simplifies the completion and submission of form 427 by allowing users to easily fill, sign, and send the document electronically from any device.

-

What features does airSlate SignNow offer for managing form 427?

airSlate SignNow offers a variety of features for managing form 427, including customizable templates, automated workflows, and secure eSigning capabilities. These features streamline the process, making it more efficient for users to handle form 427 and similar documents.

-

Is there a cost associated with using airSlate SignNow for form 427?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be budget-friendly. Various pricing plans are available to suit different business needs, ensuring that users get the best value for managing form 427 and other documents.

-

Can I integrate airSlate SignNow with other applications when working with form 427?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing users to link their workflows efficiently. This is particularly beneficial for managing form 427, as it enables better coordination across tools that your team may already be using.

-

What are the benefits of eSigning form 427 with airSlate SignNow?

eSigning form 427 with airSlate SignNow offers numerous benefits, including speed, security, and convenience. Users can sign the document from anywhere, eliminating the need for printing or mailing, which speeds up the overall process signNowly.

-

How can I track the status of form 427 submissions in airSlate SignNow?

airSlate SignNow provides robust tracking features that allow users to monitor the status of form 427 submissions in real time. Users receive notifications about when the document is viewed, signed, or completed, ensuring transparency throughout the signing process.

-

Is it easy to set up airSlate SignNow for using form 427?

Yes, setting up airSlate SignNow for using form 427 is user-friendly and straightforward. The platform offers guided setup instructions, enabling users to quickly start sending and managing their form 427 without any technical expertise.

Get more for Hmrc Vat 427

- Games of chance raffles bingo etc what you need form

- Medical necessity formhealth medicare pdfs

- Forms for guardianship of individual with developmental

- Fmcsa form mcs 150b

- My child care benefit missouri department of social services form

- Pd306 application for a permit to acquire a firearm master revised 572017 pdf form

- Sample passport application page pdf form

- Business structures key tax obligations form

Find out other Hmrc Vat 427

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure