Pinjaman Bank Islam Form

What is the Pinjaman Bank Islam

The Pinjaman Bank Islam is a personal loan product offered by Bank Islam, designed to provide financial assistance to individuals for various purposes, such as home renovations, education, or debt consolidation. This type of financing is structured to comply with Islamic financial principles, ensuring that it adheres to Sharia law. The loan typically features competitive interest rates, flexible repayment terms, and a straightforward application process, making it accessible for eligible applicants.

Eligibility Criteria

To qualify for the Pinjaman Bank Islam, applicants must meet specific eligibility requirements. These often include:

- Minimum age of eighteen years.

- Proof of stable income, such as salary slips or bank statements.

- Good credit history, demonstrating responsible borrowing behavior.

- Employment status, with preference given to those in permanent positions.

Additional criteria may apply based on the loan amount and purpose, so it is advisable to check with Bank Islam for detailed eligibility guidelines.

Steps to complete the Pinjaman Bank Islam

The application process for the Pinjaman Bank Islam involves several key steps:

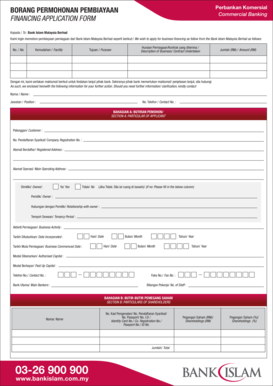

- Gather necessary documentation, including identification, proof of income, and any other required paperwork.

- Complete the application form, ensuring all information is accurate and up-to-date.

- Submit the application online or in-person at a Bank Islam branch.

- Await approval, which may take a few days depending on the bank's processing times.

- Upon approval, review the loan agreement carefully before signing.

Following these steps can streamline the application process and increase the chances of approval.

Required Documents

When applying for the Pinjaman Bank Islam, applicants need to provide several documents to verify their identity and financial status. Commonly required documents include:

- National identification card or passport.

- Recent payslips or income statements.

- Bank statements for the last three to six months.

- Proof of employment or business registration, if applicable.

Having these documents ready can facilitate a smoother application process.

Legal use of the Pinjaman Bank Islam

The Pinjaman Bank Islam is governed by specific legal frameworks that ensure compliance with both Islamic finance principles and local regulations. It is crucial for borrowers to understand their rights and obligations under the loan agreement. This includes being aware of the terms regarding repayment, interest rates, and any fees associated with the loan. Additionally, borrowers should ensure that the loan is used for its intended purpose, as stipulated in the agreement.

How to obtain the Pinjaman Bank Islam

Obtaining the Pinjaman Bank Islam involves a straightforward process. Interested individuals can start by visiting the Bank Islam website or a local branch to access the application form. After filling out the form and submitting the required documents, applicants will undergo a review process. Once approved, funds will be disbursed according to the terms outlined in the loan agreement. It is advisable to consult with a bank representative for personalized guidance throughout the process.

Quick guide on how to complete pinjaman bank islam

Complete Pinjaman Bank Islam with ease on any device

Online document management has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Pinjaman Bank Islam on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Pinjaman Bank Islam effortlessly

- Find Pinjaman Bank Islam and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Pinjaman Bank Islam to ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pinjaman bank islam

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key syarat pinjaman peribadi bank islam that I should know?

The syarat pinjaman peribadi bank islam typically includes being a Malaysian citizen or permanent resident, having a minimum monthly income, and being between a specified age range. It's essential to check with the specific bank for their detailed criteria and documentation requirements before applying.

-

How can I apply for a syarat pinjaman peribadi bank islam?

You can apply for a syarat pinjaman peribadi bank islam online or by visiting a bank branch. The application process usually involves filling out a form, submitting required documents, and then waiting for the bank's assessment. Make sure you fulfill all the criteria to increase your chances of approval.

-

What documents are needed to meet the syarat pinjaman peribadi bank islam?

Common documents required include your identification card, proof of income, and bank statements. Additional documents may vary depending on the bank's specific syarat pinjaman peribadi bank islam, so it’s best to check directly with your chosen bank for their complete list.

-

Are there any fees associated with the syarat pinjaman peribadi bank islam?

Yes, there may be processing fees or administrative charges when applying for a syarat pinjaman peribadi bank islam. These fees vary by bank, so always review their terms and conditions carefully to understand any associated costs.

-

What are the benefits of a syarat pinjaman peribadi bank islam?

The syarat pinjaman peribadi bank islam provides several benefits, including competitive interest rates and flexible repayment terms. Additionally, these loans are structured to meet the needs of personal financing, allowing for better financial management.

-

Can I use personal loans for business purposes under the syarat pinjaman peribadi bank islam?

Typically, personal loans under the syarat pinjaman peribadi bank islam are intended for individual use, such as personal expenses or emergencies. However, it's advisable to consult with the bank to explore if there are any options for business-related financial needs.

-

How long does it take to process a syarat pinjaman peribadi bank islam application?

The processing time for a syarat pinjaman peribadi bank islam application can vary, but it usually takes between 3 to 5 business days. Factors such as document completeness and the bank's internal procedures can affect the overall processing duration.

Get more for Pinjaman Bank Islam

- Chapter 16 properties of atoms and the periodic table answer key pdf form

- Vfw hall rental agreement form

- Rivermead head injury service follow up questionnaire rhfuq form

- Lapm chapter 10 exhibit 10 h1 h3 cost proposal form

- Form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year 772081742

- Meal prep contract template form

- Mean contract template form

- Floor installation floor contract template form

Find out other Pinjaman Bank Islam

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document