5564 Notice Deficiency Form

What is the 5564 Notice Deficiency Form

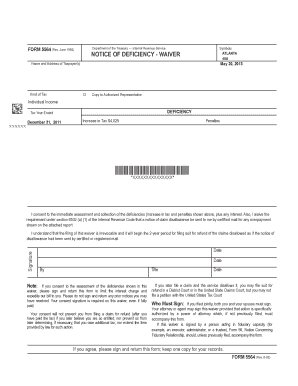

The 5564 notice deficiency form is an official document issued by the Internal Revenue Service (IRS) to inform taxpayers of discrepancies in their tax returns. This form serves as a notification that the IRS has identified potential issues with the reported income, deductions, or credits. Understanding this form is crucial for taxpayers, as it outlines the specific areas where the IRS believes corrections are necessary. It is essential to address the concerns raised in the notice promptly to avoid further complications, such as penalties or additional interest charges.

Steps to complete the 5564 Notice Deficiency Form

Completing the 5564 notice deficiency form involves several key steps to ensure accuracy and compliance. First, carefully read the notice to understand the discrepancies highlighted by the IRS. Next, gather all relevant documentation, such as tax returns, W-2 forms, and any supporting evidence that can validate your claims. After that, fill out the form with the correct information, providing clear explanations for any adjustments made. Finally, review the completed form for accuracy before submitting it to the IRS, ensuring that all required signatures are included.

How to obtain the 5564 Notice Deficiency Form

Taxpayers can obtain the 5564 notice deficiency form directly from the IRS. The form is typically sent to taxpayers via mail when the IRS identifies discrepancies in their tax filings. However, if you need a copy for any reason, it can also be requested through the IRS website or by contacting their customer service. It is important to ensure that you have the most current version of the form to avoid any compliance issues.

Legal use of the 5564 Notice Deficiency Form

The legal use of the 5564 notice deficiency form is primarily to respond to IRS inquiries regarding tax discrepancies. This form is legally binding, meaning that any information provided must be accurate and truthful. Misrepresentation or failure to address the issues outlined in the notice can lead to legal repercussions, including penalties or audits. Taxpayers should ensure that they understand their rights and responsibilities when dealing with this form and seek professional advice if needed.

Examples of using the 5564 Notice Deficiency Form

Examples of using the 5564 notice deficiency form can vary based on individual taxpayer situations. For instance, a self-employed individual may receive this notice if the IRS finds discrepancies between reported income and third-party information. Similarly, a taxpayer who claimed deductions that the IRS deems excessive may also receive this form. In each case, the taxpayer must respond with accurate information and documentation to resolve the discrepancies effectively.

Filing Deadlines / Important Dates

Filing deadlines associated with the 5564 notice deficiency form are critical for taxpayers to observe. Typically, the IRS provides a specific timeframe within which taxpayers must respond to the notice, often ranging from thirty to ninety days. Missing this deadline can result in additional penalties or a default judgment against the taxpayer. It is essential to mark these dates on your calendar and ensure that all responses are submitted promptly to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 5564 notice deficiency form. The form can be submitted online through the IRS e-file system, ensuring a quick and efficient process. Alternatively, it can be mailed to the address specified in the notice. In some cases, taxpayers may also choose to deliver the form in person at their local IRS office. Each submission method has its advantages, and taxpayers should select the one that best fits their needs while ensuring compliance with IRS requirements.

Quick guide on how to complete 5564 notice deficiency form

Effortlessly Complete 5564 Notice Deficiency Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage 5564 Notice Deficiency Form effortlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Alter and eSign 5564 Notice Deficiency Form Without Effort

- Locate 5564 Notice Deficiency Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mishandled documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 5564 Notice Deficiency Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5564 notice deficiency form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5564 and why is it important?

IRS Form 5564 is used to request a copy of your tax return for the purposes of providing documentation to the IRS or other entities. Understanding this form is crucial for businesses and individuals who need to verify their filing history and ensure compliance with tax requirements. Utilizing airSlate SignNow can streamline the process of managing and eSigning this document efficiently.

-

How can airSlate SignNow help me with IRS Form 5564?

AirSlate SignNow offers an intuitive platform that allows you to send, eSign, and store IRS Form 5564 electronically. With our solution, you can easily manage the workflow involved with this form, ensuring that it is signed and submitted quickly. This can save you time and reduce the risk of errors typically associated with paper documents.

-

Is there a fee to use airSlate SignNow for IRS Form 5564?

Yes, there is a cost associated with using airSlate SignNow for IRS Form 5564, but we offer various pricing plans tailored to meet different business needs. Our service is designed to be cost-effective, providing excellent value for the features and benefits it offers. You can choose a plan that fits your volume of document management and eSigning needs.

-

Can I integrate airSlate SignNow with other software for handling IRS Form 5564?

Absolutely! AirSlate SignNow seamlessly integrates with numerous software applications, allowing you to manage IRS Form 5564 alongside your existing systems. This integration ensures a smooth workflow and can enhance your productivity by connecting various tools you already use for document management.

-

What are the benefits of eSigning IRS Form 5564 with airSlate SignNow?

eSigning IRS Form 5564 with airSlate SignNow provides numerous benefits, including faster processing times and enhanced security for your sensitive information. Our platform ensures that your signatures are legally binding and comply with all regulatory requirements. Additionally, you can track the status of your document, ensuring peace of mind throughout the signing process.

-

How does airSlate SignNow ensure the security of my IRS Form 5564?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like IRS Form 5564. We employ industry-standard encryption methods and secure access controls to protect your data throughout the entire signing process. This ensures that your information remains confidential and safe from unauthorized access.

-

Can I access IRS Form 5564 from mobile devices using airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform that allows you to access IRS Form 5564 from your smartphone or tablet. This flexibility means you can manage your documents and eSign them on the go, making it convenient to handle your tax-related documentation anytime and anywhere. Our mobile app ensures that all features are easily accessible.

Get more for 5564 Notice Deficiency Form

- Prostart i final practice exam docx form

- Rdmr form

- Income tax forms department of taxation and finance ny gov

- Title and registration oregon department of transportation odot state or form

- 4 h country ham clubs auction nets thousands of dollars form

- Nactep application form

- Competitive edge volleyball form

- Southern union state community college certification of form

Find out other 5564 Notice Deficiency Form

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement