Deferred Payment Letter of Credit Example Form

What is the Deferred Payment Letter of Credit Example

A deferred payment letter of credit is a financial instrument used in international trade that allows a buyer to defer payment for goods or services until a specified future date. This type of letter of credit provides assurance to the seller that they will receive payment, while the buyer gains time to manage their cash flow. The deferred payment letter of credit example outlines the terms under which the payment will be made, including the timeline and conditions for payment release. It serves as a guarantee from the issuing bank to the seller, ensuring that funds will be available at the agreed-upon time.

Steps to Complete the Deferred Payment Letter of Credit Example

Completing a deferred payment letter of credit involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information, including the buyer's and seller's details, the amount, and the terms of the transaction.

- Clearly specify the payment terms, including the deferred payment date and any conditions that must be met before payment is released.

- Ensure that all parties involved understand their obligations under the letter of credit.

- Review the document for accuracy and completeness before submission.

- Submit the completed letter of credit to the issuing bank for approval.

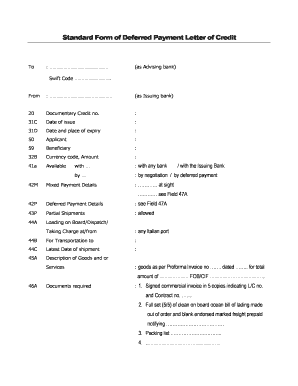

Key Elements of the Deferred Payment Letter of Credit Example

Understanding the key elements of a deferred payment letter of credit is crucial for effective use. The main components include:

- Parties Involved: Clearly identify the buyer, seller, and issuing bank.

- Amount: Specify the total amount covered by the letter of credit.

- Payment Terms: Detail the deferred payment schedule and any conditions for release.

- Expiration Date: Include a date by which the letter of credit must be executed.

- Documents Required: List any documents that must be submitted to trigger payment.

Legal Use of the Deferred Payment Letter of Credit Example

The legal use of a deferred payment letter of credit is governed by specific regulations and practices in international trade. It is essential to ensure compliance with the Uniform Customs and Practice for Documentary Credits (UCP) and applicable local laws. This legal framework provides guidelines for the issuance, use, and enforcement of letters of credit, ensuring that all parties fulfill their obligations. Failure to comply with these regulations can result in disputes or non-payment.

How to Use the Deferred Payment Letter of Credit Example

Using a deferred payment letter of credit involves several practical steps to facilitate smooth transactions. First, the buyer should request the letter of credit from their bank, specifying the terms agreed upon with the seller. Once issued, the seller must review the document to ensure it aligns with their expectations. Upon shipment of goods or completion of services, the seller submits the required documents to the bank for payment. The bank will then verify the documents against the terms of the letter of credit before releasing the funds to the seller.

Examples of Using the Deferred Payment Letter of Credit Example

Examples of using a deferred payment letter of credit can vary across industries. For instance, in the manufacturing sector, a company may use this instrument to purchase raw materials from an overseas supplier, allowing them time to produce and sell finished goods before payment is due. In real estate, developers might use a deferred payment letter of credit to secure financing for projects, enabling them to manage cash flow effectively while meeting construction deadlines. Each scenario highlights the flexibility and utility of this financial tool in facilitating trade and investment.

Quick guide on how to complete deferred payment letter of credit example

Effortlessly prepare Deferred Payment Letter Of Credit Example on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as it allows you to obtain the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Deferred Payment Letter Of Credit Example on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Deferred Payment Letter Of Credit Example without hassle

- Find Deferred Payment Letter Of Credit Example and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you prefer to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Deferred Payment Letter Of Credit Example to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deferred payment letter of credit example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a deferred letter of credit sample and how is it used?

A deferred letter of credit sample is a financial document that allows a buyer to delay payment to the seller until a specified future date. This arrangement provides the buyer with time to arrange the necessary funds while ensuring the seller's payment is secure. It's commonly used in international trade to facilitate transactions.

-

What are the key features of airSlate SignNow for managing deferred letters of credit?

AirSlate SignNow offers powerful features for managing deferred letters of credit, including customizable templates and secure electronic signatures. Users can efficiently send, track, and manage documents from anywhere, ensuring compliance and security. The platform's user-friendly interface simplifies the process, making it ideal for businesses of all sizes.

-

How does airSlate SignNow ensure the security of deferred letter of credit samples?

AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect deferred letter of credit samples. The platform complies with industry standards to ensure that sensitive information remains confidential and secure. Additionally, electronic signatures are legally binding, providing further security in transactions.

-

Is there a cost associated with creating a deferred letter of credit sample on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Pricing varies based on the plan selected, with options that cater to different needs and budgets. Given the features and efficiency gains, many users find it a worthwhile investment for managing deferred letters of credit.

-

Can airSlate SignNow integrate with other financial software for managing letters of credit?

Absolutely! AirSlate SignNow offers seamless integrations with various financial and ERP software systems. This allows businesses to streamline their workflow and manage deferred letter of credit samples efficiently alongside their other financial documents, enhancing productivity.

-

What benefits come with using airSlate SignNow for deferred letters of credit?

Using airSlate SignNow for deferred letters of credit allows businesses to save time and resources through automation and document tracking. The platform enhances collaboration by enabling multiple parties to review and sign documents electronically, reducing the need for physical paperwork. Overall, it accelerates the transaction process while maintaining security.

-

How can I create a deferred letter of credit sample using airSlate SignNow?

Creating a deferred letter of credit sample with airSlate SignNow is simple. You can start by selecting a template or creating a custom document within the platform. From there, you can add the necessary details, invite signers, and send it out for signatures, all within a user-friendly interface.

Get more for Deferred Payment Letter Of Credit Example

- Individual credit application missouri form

- Interrogatories to plaintiff for motor vehicle occurrence missouri form

- Interrogatories to defendant for motor vehicle accident missouri form

- Llc notices resolutions and other operations forms package missouri

- Notice of commencement compensation payments for workers compensation missouri form

- Residential real estate sales disclosure statement missouri form

- Notice of dishonored check civil keywords bad check bounced check missouri form

- Stopped payment 497313240 form

Find out other Deferred Payment Letter Of Credit Example

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity