Tax Agreement Form

What is the Tax Agreement Form

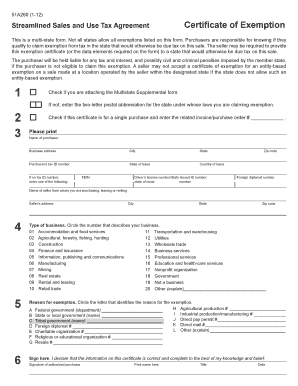

The Kentucky form 51A260, also known as the Kentucky sales exempt form, is utilized by businesses and individuals to claim tax exemptions on certain purchases. This form is essential for those who qualify for tax-exempt status under specific conditions, such as non-profit organizations, government entities, or businesses purchasing items for resale. Understanding the purpose of this form is crucial for ensuring compliance with Kentucky tax regulations.

Steps to complete the Tax Agreement Form

Completing the Kentucky form 51A260 involves several straightforward steps:

- Gather necessary information, including the purchaser's name, address, and tax identification number.

- Provide details about the seller, including their name and address.

- Specify the type of exemption being claimed, along with a brief description of the items being purchased.

- Sign and date the form to validate the information provided.

- Submit the completed form to the seller to ensure that no sales tax is charged on the exempt purchases.

Legal use of the Tax Agreement Form

The Kentucky form 51A260 is legally binding when completed correctly and submitted to the appropriate parties. To ensure its legal validity, it must comply with Kentucky's tax laws and regulations. This includes providing accurate information and ensuring that the claim for exemption is legitimate. Misuse or fraudulent claims can lead to penalties or legal repercussions.

Key elements of the Tax Agreement Form

Important components of the Kentucky form 51A260 include:

- Purchaser Information: Name, address, and tax identification number.

- Seller Information: Name and address of the seller.

- Exemption Type: The specific exemption being claimed.

- Signature: The signature of the purchaser or an authorized representative.

- Date: The date when the form is completed and signed.

Who Issues the Form

The Kentucky form 51A260 is issued by the Kentucky Department of Revenue. It is important for users to ensure they are using the most current version of the form, as regulations and requirements may change. The Department of Revenue provides resources and guidance on how to properly complete and submit the form.

Filing Deadlines / Important Dates

While the Kentucky form 51A260 does not have a specific filing deadline, it is essential to submit the form to the seller at the time of purchase to avoid being charged sales tax. Keeping track of any changes in tax laws or deadlines set by the Kentucky Department of Revenue is also advisable to maintain compliance.

Quick guide on how to complete tax agreement form

Complete Tax Agreement Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the proper form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Tax Agreement Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The simplest way to edit and eSign Tax Agreement Form with ease

- Obtain Tax Agreement Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Agreement Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax agreement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 51a260 ky product from airSlate SignNow?

The 51a260 ky is a highly efficient eSignature solution offered by airSlate SignNow. It allows users to electronically sign documents securely and streamline their document workflow. This solution is tailored for businesses looking to enhance their efficiency while reducing paper usage.

-

How does the pricing structure work for 51a260 ky?

airSlate SignNow offers a competitive pricing structure for the 51a260 ky solution, with various plans to suit different business needs. You can choose from monthly or annual subscriptions, ensuring flexibility depending on your usage. Each plan includes essential features to help you manage eSignatures effectively.

-

What features are included in the 51a260 ky solution?

The 51a260 ky solution includes a range of features designed to facilitate smooth document signing processes. Key features consist of document templates, real-time tracking, and authentication options. These features make it easier for businesses to handle eSignatures while maintaining compliance.

-

What benefits does the 51a260 ky provide for businesses?

Using the 51a260 ky from airSlate SignNow offers numerous benefits, including time savings and enhanced workflow efficiency. Businesses can signNowly reduce the turnaround time for document approvals and minimize administrative burdens. This ultimately leads to better productivity and faster decision-making.

-

Can 51a260 ky integrate with other software?

Yes, 51a260 ky is designed for easy integration with various third-party applications. This capability enables users to connect their favorite tools, such as CRM systems or document management software. Such integrations optimize workflows and enhance overall productivity for businesses.

-

Is the 51a260 ky solution secure and compliant?

Absolutely, the 51a260 ky solution prioritizes security and compliance. It employs advanced encryption protocols to protect sensitive data during transmission and storage. Additionally, airSlate SignNow complies with various regulations, ensuring that your eSignatures meet legal standards.

-

How can I get started with 51a260 ky?

Getting started with the 51a260 ky solution is straightforward. You can sign up for a free trial on the airSlate SignNow website, allowing you to explore its features without commitment. Once you're ready, integrating it into your business processes is quick and simple.

Get more for Tax Agreement Form

- Www nycers orgonline servicesonline services new york city employees retirement system form

- Staffing plan and instructions form

- Wcs section b26 ai form

- Fillable online arizona form a1 apr ftpzillionformscom

- 5 easy steps bintegra flexcomb form

- Request for hearing form 2839

- Guam employment application form

- Fair employment practice office inquiry questionnaire guam form

Find out other Tax Agreement Form

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer