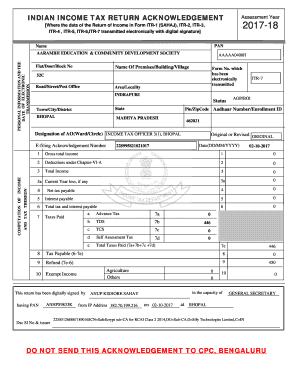

Itr Certificate Sample Form

What is the income tax certificate?

The income tax certificate is a crucial document that verifies an individual's or business entity's tax filings and payments to the Internal Revenue Service (IRS). This certificate serves as proof of compliance with federal tax obligations and can be required for various purposes, including loan applications, financial audits, and legal proceedings. It typically includes information such as the taxpayer's name, Social Security number or Employer Identification Number (EIN), and the tax year in question.

How to obtain the income tax certificate

To obtain an income tax certificate, individuals or businesses must request it from the IRS. This can be done by submitting Form 4506-T, Request for Transcript of Tax Return, which allows taxpayers to receive a transcript of their tax return. In some cases, a formal request for a tax return copy may be necessary. It's important to provide accurate information to ensure timely processing. The IRS typically processes these requests within five to ten business days.

Steps to complete the income tax certificate

Completing the income tax certificate involves several key steps. First, gather all necessary documentation, including previous tax returns and supporting financial records. Next, accurately fill out the required forms, ensuring that all information matches IRS records. After completing the forms, review them for accuracy and completeness. Finally, submit the forms to the IRS or the relevant state tax authority as required. Utilizing electronic filing options can streamline this process and provide confirmation of submission.

Key elements of the income tax certificate

Several key elements must be included in an income tax certificate to ensure its validity. These elements typically consist of:

- Taxpayer Information: Name, Social Security number or EIN, and address.

- Tax Year: The specific year for which the certificate is issued.

- Filing Status: Indication of whether the taxpayer filed as single, married, or head of household.

- Income Details: Summary of reported income and any taxes paid.

- Signature: The taxpayer's signature or electronic signature for verification.

Legal use of the income tax certificate

The income tax certificate holds legal significance as it serves as proof of a taxpayer's compliance with federal tax laws. It can be used in various legal contexts, such as during audits, disputes with the IRS, or when applying for loans and financial assistance. Properly issued and completed certificates can help protect taxpayers from legal repercussions and demonstrate their financial responsibility.

IRS Guidelines

The IRS provides specific guidelines regarding the issuance and use of income tax certificates. Taxpayers should familiarize themselves with these guidelines to ensure compliance. Key points include the types of documents that can be requested, the process for obtaining transcripts, and the timeframes for processing requests. Adhering to IRS guidelines helps maintain accurate tax records and supports taxpayers in fulfilling their obligations.

Quick guide on how to complete tax refund certificate

Effortlessly Prepare tax refund certificate on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any obstacles. Manage income tax certificate on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign income tax return certificate with Ease

- Find it return certificate sample and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, shared link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Modify and eSign itr report sample to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to itr certificate image

Create this form in 5 minutes!

How to create an eSignature for the sample of income tax return certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask income tax certificate format

-

What is an income tax certificate and why do I need one?

An income tax certificate is a document issued by tax authorities that certifies your income and tax liabilities for a specific period. This certificate is crucial for various purposes, including loan applications, tax filings, and verifying income for property transactions. With airSlate SignNow, you can easily prepare and eSign your income tax certificate digitally.

-

How can airSlate SignNow help me with my income tax certificate process?

airSlate SignNow simplifies the process of creating and eSigning your income tax certificate. Our platform allows you to fill in necessary details, add signatures, and securely send the document to relevant parties all in one place. This streamlines your workflow and saves you time during tax season.

-

Is there a cost associated with using airSlate SignNow for an income tax certificate?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs. Our affordable subscription includes features that help you manage documents efficiently, including income tax certificates. Check our pricing page to find a plan that suits your requirements.

-

What features does airSlate SignNow offer for creating income tax certificates?

airSlate SignNow offers features such as customizable templates, advanced eSignature options, and secure document storage, which make creating income tax certificates straightforward. You can also track document status in real-time, ensuring you stay on top of important tax documentation.

-

Can I customize the income tax certificate template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize the income tax certificate template according to your specific requirements. You can add sections, logos, and signatures to ensure that the document meets your preferences and legal standards.

-

How does airSlate SignNow ensure the security of my income tax certificate?

Security is a top priority at airSlate SignNow. We use industry-leading encryption and secure access protocols to protect your income tax certificate and other sensitive documents. You can trust that your information remains confidential and secure during the entire signing process.

-

Are there any integrations available for managing my income tax certificate?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and more, providing you with a seamless way to manage your income tax certificates. These integrations enhance your productivity and ensure that you can store and access your documents conveniently.

Get more for income tax certificate sample

- Horse lease agreement example form

- Waiver of lien individual form

- Consumer loan application peoples bank texas form

- Waiver of lien corporation form

- Waiver of stop lending notice rights individual form

- Full text of ampquotcalifornia department of business oversight form

- Motor vehicle interrogatories to defendants form

- Alaska limited liability company operating agreement form

Find out other itr document sample

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast