Employee's Withholding Allowance Certificate Form

What is the Employee's Withholding Allowance Certificate

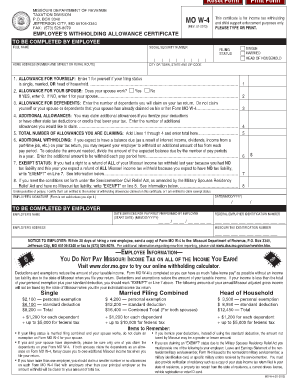

The Employee's Withholding Allowance Certificate, commonly referred to as the W-4 form, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form enables employees to indicate the number of allowances they wish to claim, which directly affects the amount of federal income tax withheld from their paychecks. Understanding this form is essential for employees to ensure that they are not over- or under-withheld, which can impact their tax obligations at the end of the year.

Steps to complete the Employee's Withholding Allowance Certificate

Completing the Employee's Withholding Allowance Certificate involves a few straightforward steps:

- Obtain the W-4 form: This form can be downloaded from the IRS website or obtained from your employer.

- Fill out personal information: Provide your name, address, Social Security number, and filing status.

- Determine allowances: Use the worksheet provided in the form to calculate the number of allowances you can claim based on your personal situation, such as dependents and other deductions.

- Sign and date the form: Make sure to sign and date your completed W-4 to validate it.

- Submit to your employer: Return the completed form to your employer's payroll department for processing.

Legal use of the Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate is legally binding when filled out accurately and submitted to the employer. It serves as a declaration of the employee's tax withholding preferences and must be completed in compliance with IRS regulations. Employers are required to honor the information provided in the form, which means that employees should ensure their entries are correct to avoid potential tax liabilities or penalties. Additionally, the form can be updated at any time to reflect changes in personal circumstances, such as marriage or the birth of a child.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Employee's Withholding Allowance Certificate. Employees are encouraged to review the IRS instructions to ensure they understand how to calculate their allowances accurately. The IRS also advises employees to use the Tax Withholding Estimator tool available on their website, which can help determine the appropriate number of allowances based on individual financial situations. Staying informed about IRS guidelines is essential for proper tax planning and compliance.

Form Submission Methods

Employees can submit the Employee's Withholding Allowance Certificate in several ways, depending on their employer's policies. Common submission methods include:

- Online: Many employers allow employees to complete and submit the W-4 form electronically through their payroll systems.

- Mail: Employees can print the completed form and mail it directly to their employer's human resources or payroll department.

- In-Person: Employees may also choose to deliver the form in person to ensure it is received and processed promptly.

Examples of using the Employee's Withholding Allowance Certificate

Understanding how to use the Employee's Withholding Allowance Certificate can be illustrated through various scenarios:

- New Job: A new employee completes the W-4 form upon hiring to establish their tax withholding preferences.

- Change in Family Status: An employee who gets married may wish to update their W-4 to reflect a change in filing status, potentially increasing their allowances.

- Additional Income: If an employee takes on a second job, they might need to adjust their withholding on the W-4 to account for the combined income.

Quick guide on how to complete employees withholding allowance certificate

Complete Employee's Withholding Allowance Certificate seamlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Employee's Withholding Allowance Certificate on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Employee's Withholding Allowance Certificate effortlessly

- Obtain Employee's Withholding Allowance Certificate and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of your documents or black out confidential information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Employee's Withholding Allowance Certificate while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employees withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an employee's withholding allowance certificate?

An employee's withholding allowance certificate, also known as Form W-4, is a document that employees use to communicate their tax withholding preferences to their employer. This form helps determine how much tax should be withheld from an employee's paycheck, ensuring accurate tax contributions. Completing this certificate is crucial for properly managing your tax liabilities.

-

How can airSlate SignNow help with employee's withholding allowance certificates?

airSlate SignNow streamlines the process of creating, sending, and signing employee's withholding allowance certificates with ease. Our platform allows you to securely manage these documents electronically, ensuring quick turnaround and compliance. The user-friendly interface simplifies the task and enhances efficiency for both employers and employees.

-

Is the employee's withholding allowance certificate customizable in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the employee's withholding allowance certificate to meet your organization’s specific requirements. You can easily modify the form layout, add company branding, or include any additional information necessary. This customization capability helps ensure that the document aligns with your business needs.

-

What are the benefits of using airSlate SignNow for employee's withholding allowance certificates?

Using airSlate SignNow for employee's withholding allowance certificates offers several benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows for real-time tracking and reminders, minimizing delays in document processing. This is especially important for timely payroll and tax compliance.

-

Are there integrations available with airSlate SignNow for handling employee's withholding allowance certificates?

Absolutely! airSlate SignNow offers various integrations with popular HR and payroll systems to seamlessly manage employee's withholding allowance certificates. These integrations facilitate automatic updates and data synchronization, which helps maintain accurate records without manual intervention.

-

What is the cost structure for using airSlate SignNow for employee's withholding allowance certificates?

airSlate SignNow offers a cost-effective pricing model designed to accommodate businesses of all sizes. We provide flexible subscription plans that allow users to pay for the features they need specifically for processing employee’s withholding allowance certificates. This approach ensures you get the best value for your investment.

-

Can I track the status of an employee's withholding allowance certificate sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of employee's withholding allowance certificates sent for signature. You will receive notifications when the document is opened, signed, or completed, giving you full visibility into the document workflow and ensuring timely processing.

Get more for Employee's Withholding Allowance Certificate

Find out other Employee's Withholding Allowance Certificate

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online