Amended North Carolina Individual Income Tax Return Dor State Nc Form

What is the Amended North Carolina Individual Income Tax Return?

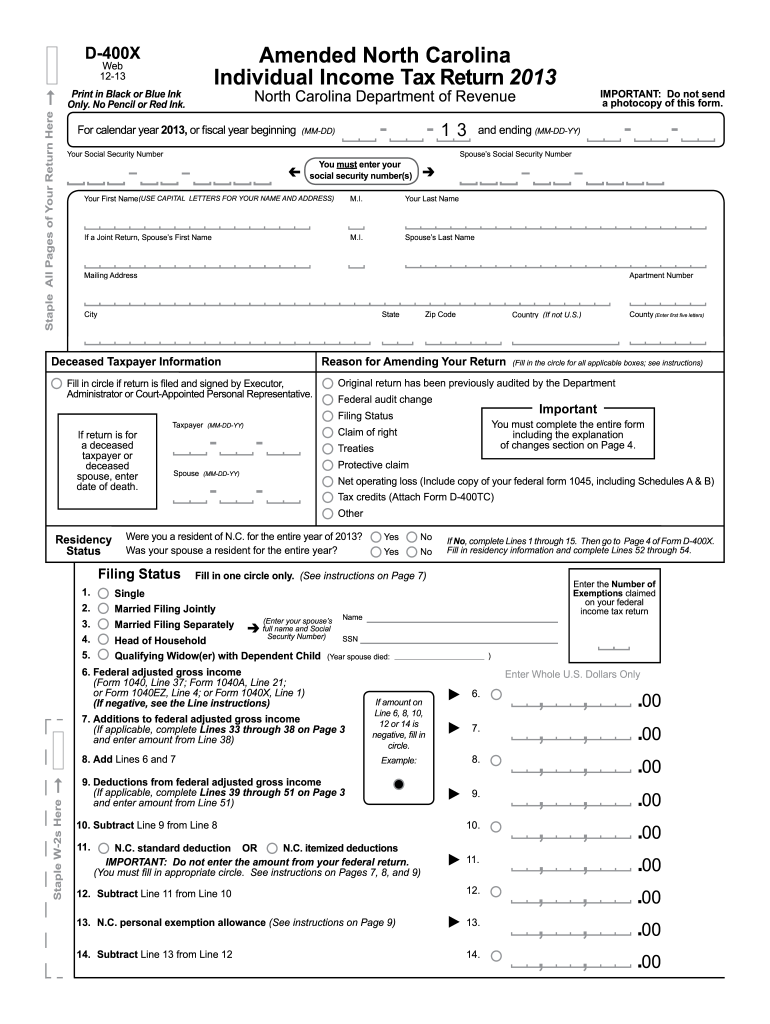

The Amended North Carolina Individual Income Tax Return, often referred to as the DOR Form D-400A, is used by taxpayers to make corrections to their previously filed North Carolina individual income tax returns. This form allows individuals to report changes in income, deductions, or credits that may affect their tax liability. It is essential for ensuring that the state tax records are accurate and up to date, reflecting any adjustments necessary due to errors or changes in financial circumstances.

Steps to Complete the Amended North Carolina Individual Income Tax Return

Filling out the Amended North Carolina Individual Income Tax Return involves several key steps:

- Gather all relevant documents, including your original tax return, W-2s, 1099s, and any other income statements.

- Clearly indicate the changes being made on the form, including the specific lines where corrections are necessary.

- Provide a detailed explanation of the reasons for the amendments, ensuring clarity for the tax authorities.

- Calculate any additional tax owed or refund due as a result of the amendments.

- Sign and date the form before submission to validate the changes.

Legal Use of the Amended North Carolina Individual Income Tax Return

The Amended North Carolina Individual Income Tax Return is legally binding once submitted and must comply with state tax regulations. It is crucial that taxpayers provide accurate information, as any fraudulent claims can lead to penalties. The form must be filed within the specified time frame to ensure that the amendments are accepted by the North Carolina Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers should be aware of the deadlines associated with filing the Amended North Carolina Individual Income Tax Return. Generally, the amended return must be filed within three years from the original due date of the tax return. This timeline is critical to ensure that any potential refunds or adjustments are processed in a timely manner. Keeping track of these deadlines helps avoid unnecessary penalties or complications.

Required Documents

When preparing the Amended North Carolina Individual Income Tax Return, several documents are necessary to support the changes being made. These typically include:

- The original tax return (D-400 or D-400EZ).

- Any W-2 forms or 1099 forms reflecting income.

- Supporting documentation for deductions or credits being claimed.

- Any correspondence from the North Carolina Department of Revenue related to the original filing.

Form Submission Methods

Taxpayers have several options for submitting the Amended North Carolina Individual Income Tax Return. The form can be filed electronically through approved tax software, mailed directly to the North Carolina Department of Revenue, or submitted in person at designated offices. Each method has its own guidelines and processing times, so it is advisable to choose the one that best suits the individual's needs.

Quick guide on how to complete amended north carolina individual income tax return 2012 dor state nc

Complete Amended North Carolina Individual Income Tax Return Dor State Nc effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary resources to create, modify, and electronically sign your documents swiftly without any delays. Manage Amended North Carolina Individual Income Tax Return Dor State Nc on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign Amended North Carolina Individual Income Tax Return Dor State Nc with ease

- Locate Amended North Carolina Individual Income Tax Return Dor State Nc and then click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the data and then click on the Done button to save your changes.

- Select your preferred delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign Amended North Carolina Individual Income Tax Return Dor State Nc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Create this form in 5 minutes!

How to create an eSignature for the amended north carolina individual income tax return 2012 dor state nc

How to generate an electronic signature for the Amended North Carolina Individual Income Tax Return 2012 Dor State Nc online

How to create an electronic signature for your Amended North Carolina Individual Income Tax Return 2012 Dor State Nc in Google Chrome

How to create an electronic signature for putting it on the Amended North Carolina Individual Income Tax Return 2012 Dor State Nc in Gmail

How to make an electronic signature for the Amended North Carolina Individual Income Tax Return 2012 Dor State Nc from your smartphone

How to generate an eSignature for the Amended North Carolina Individual Income Tax Return 2012 Dor State Nc on iOS devices

How to create an eSignature for the Amended North Carolina Individual Income Tax Return 2012 Dor State Nc on Android

People also ask

-

What is North Carolina state tax and how is it calculated?

North Carolina state tax is a tax levied on the income of residents. It is calculated based on your taxable income through a progressive tax rate structure. Understanding how North Carolina state tax affects your overall finances is vital, especially when filing your annual tax returns.

-

How can airSlate SignNow help with managing North Carolina state tax documents?

airSlate SignNow streamlines the process of managing documents related to North Carolina state tax. With our electronic signature capabilities, you can easily send and eSign tax documents, ensuring they are filed correctly and in a timely manner. This helps reduce the stress associated with tax season and increases compliance.

-

What pricing plans does airSlate SignNow offer for tax document management?

airSlate SignNow offers competitive pricing plans to fit various business needs. Whether you are an individual or a large enterprise, our plans cater to all budgets. This cost-effective solution ensures that you can manage North Carolina state tax documents without breaking the bank.

-

Are there any features in airSlate SignNow specifically useful for North Carolina state tax purposes?

Yes, airSlate SignNow includes several features beneficial for North Carolina state tax documentation, such as customizable templates and automated workflows. These features allow users to create, send, and track tax documents efficiently, ensuring compliance with state regulations and reducing errors.

-

Can I integrate airSlate SignNow with my existing accounting software for North Carolina state tax?

AirSlate SignNow seamlessly integrates with many popular accounting software systems, making it easier to manage North Carolina state tax documents. By integrating our solution into your existing workflow, you can efficiently handle eSigning and document management, enhancing your overall tax filing process.

-

Does airSlate SignNow provide support for North Carolina state tax inquiries?

Absolutely! Our support team is well-equipped to assist you with any inquiries related to North Carolina state tax. Whether you have questions about document templates or signing processes, we are here to ensure you have all the information you need for successful compliance.

-

What are the benefits of using airSlate SignNow for tax-related documentation?

Using airSlate SignNow offers numerous benefits for managing tax-related documents, especially regarding North Carolina state tax. Our platform provides enhanced security, real-time document tracking, and easy collaboration, which can signNowly streamline your tax preparation and filing processes while reducing the risk of errors.

Get more for Amended North Carolina Individual Income Tax Return Dor State Nc

Find out other Amended North Carolina Individual Income Tax Return Dor State Nc

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template