Mortgage Loan Process Flow Chart PDF Form

What is the Mortgage Loan Process Flow Chart PDF

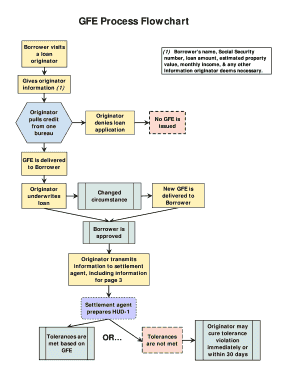

The mortgage loan process flow chart PDF is a visual representation that outlines the steps involved in obtaining a mortgage loan. This document serves as a guide for borrowers, illustrating the entire loan process from application to closing. It typically includes key stages such as pre-approval, documentation, underwriting, and final approval. By providing a clear overview, the flow chart helps borrowers understand what to expect during the mortgage process, making it easier to navigate each phase effectively.

How to Use the Mortgage Loan Process Flow Chart PDF

Using the mortgage loan process flow chart PDF effectively involves following the outlined steps in the document. Start by reviewing the chart to familiarize yourself with the entire process. As you progress through each stage, refer back to the chart to ensure you have completed all necessary tasks. This can include gathering required documents, submitting forms, and meeting deadlines. By using the flow chart as a checklist, borrowers can stay organized and ensure they do not overlook any important steps in their loan application.

Steps to Complete the Mortgage Loan Process Flow Chart PDF

Completing the mortgage loan process flow chart PDF involves several key steps. First, begin with the pre-approval stage, where you assess your financial situation and gather necessary documents such as income verification and credit history. Next, submit your loan application along with the required paperwork. Once submitted, the lender will review your application, which leads to underwriting. During underwriting, the lender evaluates your creditworthiness and the property’s value. After approval, you will proceed to closing, where you finalize the loan agreement and complete the transaction.

Key Elements of the Mortgage Loan Process Flow Chart PDF

The mortgage loan process flow chart PDF includes several key elements that are crucial for understanding the loan process. These elements typically feature stages such as:

- Pre-approval: Initial assessment of financial eligibility.

- Application: Submission of required documents and forms.

- Underwriting: Evaluation of creditworthiness and property value.

- Approval: Final decision on loan application.

- Closing: Signing of documents and transfer of funds.

These components provide a comprehensive overview of the mortgage process, helping borrowers visualize their journey from start to finish.

Legal Use of the Mortgage Loan Process Flow Chart PDF

The legal use of the mortgage loan process flow chart PDF is significant in ensuring compliance with various regulations. It is important for borrowers to understand that while the flow chart serves as a guide, all actions taken during the mortgage process must adhere to local and federal laws. This includes ensuring that all documentation is accurate and submitted within required timelines. Utilizing a legally compliant flow chart can help prevent issues that may arise from improper documentation or failure to meet legal requirements.

Examples of Using the Mortgage Loan Process Flow Chart PDF

Examples of using the mortgage loan process flow chart PDF can vary based on individual circumstances. For instance, first-time homebuyers may use the chart to understand the steps they need to take before making an offer on a property. Alternatively, real estate agents may use the flow chart to educate clients about the mortgage process, ensuring they are informed and prepared. Additionally, lenders can utilize the flow chart as a training tool for new employees, helping them grasp the essential steps involved in processing mortgage applications.

Quick guide on how to complete mortgage loan process flow chart pdf

Effortlessly prepare Mortgage Loan Process Flow Chart Pdf on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Mortgage Loan Process Flow Chart Pdf on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest method to modify and eSign Mortgage Loan Process Flow Chart Pdf seamlessly

- Find Mortgage Loan Process Flow Chart Pdf and click Get Form to begin.

- Make use of the available tools to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Mortgage Loan Process Flow Chart Pdf and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan process flow chart pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mortgage loan process flow chart?

The mortgage loan process flow chart visually outlines the steps involved in obtaining a mortgage. It typically includes stages such as application, approval, underwriting, and closing. Understanding this flow chart can help borrowers navigate the mortgage process more effectively and reduce potential delays.

-

How can airSlate SignNow help with the mortgage loan process flow chart?

airSlate SignNow simplifies the mortgage loan process flow chart by enabling digital document signing and management. With our platform, users can easily track each step of the mortgage process, ensuring that all necessary documents are signed and submitted in a timely manner. This streamlines workflows and enhances overall efficiency.

-

What features does airSlate SignNow offer for handling the mortgage loan process?

airSlate SignNow offers a variety of features designed for the mortgage loan process flow chart, including customizable templates, bulk sending of documents, and real-time tracking. These tools help ensure that all parties involved in the mortgage process stay informed and engaged, reducing bottlenecks and potential errors.

-

Can airSlate SignNow integrate with other mortgage software solutions?

Yes, airSlate SignNow offers integration capabilities with various mortgage software solutions. This means that you can seamlessly connect your existing tools to the airSlate platform, allowing for a more efficient mortgage loan process flow chart. Integrations help streamline communications and data transfers between systems.

-

Is airSlate SignNow cost-effective for managing the mortgage loan process?

Absolutely! airSlate SignNow offers a cost-effective solution for managing the mortgage loan process flow chart. With flexible pricing plans, businesses can choose an option that best fits their budget while still benefiting from advanced eSigning features and document management capabilities.

-

How does airSlate SignNow ensure the security of mortgage documents?

airSlate SignNow is committed to ensuring the security of your mortgage documents throughout the loan process flow chart. Our platform employs advanced encryption technologies, secure access controls, and compliance with regulations to protect sensitive information, giving you peace of mind while managing your mortgage transactions.

-

What are the benefits of using airSlate SignNow for the mortgage loan process?

Using airSlate SignNow for the mortgage loan process flow chart offers numerous benefits including faster document turnaround times, improved accuracy, and enhanced customer satisfaction. By minimizing physical paperwork and facilitating easy eSignatures, the platform signNowly speeds up the overall mortgage process.

Get more for Mortgage Loan Process Flow Chart Pdf

- Signature affidavit guide pompano beach form

- Fence checklist form

- City of lakeland building inspection divisionally form

- Inside the vault entrepreneurship lesson plan financeintheclassroom form

- Missouri department of transportation instructions for completing a blanket permit application form

- Notice of intent to obtain title state nj form

- Swimmer registration packet home city swim project form

- Lettervote yes for the si view metropolitan parks district form

Find out other Mortgage Loan Process Flow Chart Pdf

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement