720vi Form

What is the form 720b vi?

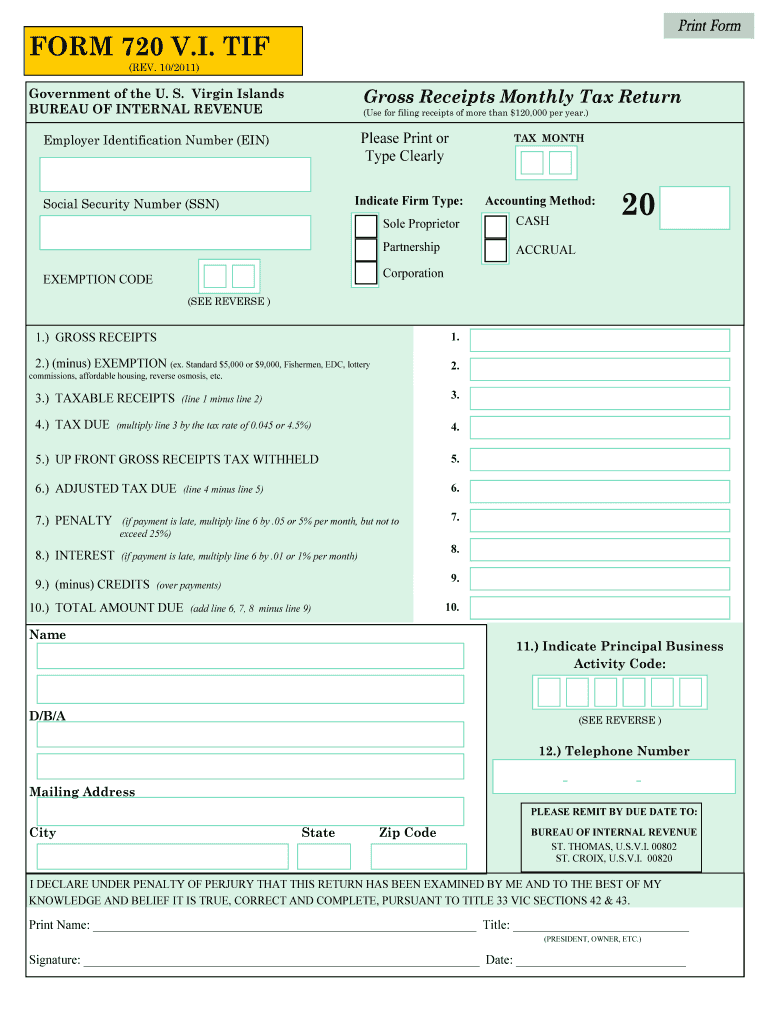

The form 720b vi is a tax document used primarily in the U.S. Virgin Islands. It is designed for businesses and individuals to report specific gross receipts and other relevant financial information. This form is essential for compliance with local tax regulations and helps ensure that taxpayers meet their obligations accurately. Understanding the purpose and requirements of the 720b vi is crucial for anyone operating within the jurisdiction.

Steps to complete the 720b vi

Completing the form 720b vi involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including records of gross receipts and any applicable deductions. Next, carefully fill out each section of the form, ensuring that all figures are correct. Pay special attention to the calculations, as errors can lead to penalties. After completing the form, review it thoroughly before submitting it to ensure all information is accurate and complete.

Legal use of the 720b vi

The legal use of the form 720b vi is governed by specific regulations in the U.S. Virgin Islands. To be considered valid, the form must be filled out completely and accurately, reflecting the taxpayer's financial situation. Compliance with local tax laws is essential, as failure to submit the form correctly can result in penalties or legal repercussions. Additionally, using a reliable eSignature solution, like signNow, can enhance the legal standing of the completed document by providing secure and verifiable signatures.

Filing Deadlines / Important Dates

Filing deadlines for the form 720b vi are critical for taxpayers to observe. Typically, the form must be submitted by the end of the tax year, but specific dates may vary based on local regulations. It is advisable to check with the Virgin Islands Bureau of Internal Revenue for the most current deadlines to avoid late filing penalties. Keeping track of these important dates ensures that taxpayers remain compliant and avoid unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

The form 720b vi can be submitted through various methods, providing flexibility for taxpayers. Options typically include online submission via the Virgin Islands Bureau of Internal Revenue's website, mailing a physical copy of the form, or delivering it in person to the appropriate tax office. Each method has its advantages, and taxpayers should choose the one that best suits their needs while ensuring timely submission.

Required Documents

To complete the form 720b vi accurately, several documents are required. Taxpayers should gather financial statements that detail gross receipts, any relevant invoices, and records of deductions or credits claimed. Having these documents on hand will facilitate the completion of the form and help ensure that all information reported is accurate and compliant with local tax laws.

Quick guide on how to complete 720vi

Effortlessly prepare 720vi on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly option compared to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage 720vi on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Streamlined process to modify and eSign 720vi with ease

- Find 720vi and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Indicate important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a handwritten signature.

- Review all the details and click the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in a few clicks from a device of your preference. Modify and eSign 720vi and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 720vi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 720b vi and how can airSlate SignNow help with it?

Form 720b vi is a crucial document used in various business transactions. airSlate SignNow simplifies the process of handling form 720b vi by providing an intuitive platform that allows users to send and eSign the document electronically, ensuring quick and secure transactions.

-

What features does airSlate SignNow offer for managing form 720b vi?

airSlate SignNow offers a range of features for managing form 720b vi, including customizable templates, real-time tracking, and secure storage. These features enable users to streamline their document processes and ensure that form 720b vi is completed efficiently.

-

Is there a cost associated with using airSlate SignNow for form 720b vi?

Yes, there is a pricing structure for using airSlate SignNow. The platform offers various plans that cater to different business needs, ensuring a cost-effective solution for processing form 720b vi and other documents, making it accessible for all sizes of businesses.

-

Can I integrate airSlate SignNow with other software for processing form 720b vi?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications and software, allowing users to incorporate form 720b vi into their existing workflows. This compatibility enhances productivity and simplifies the management of documents.

-

How does airSlate SignNow ensure the security of form 720b vi?

airSlate SignNow employs robust security measures, including encryption and secure access controls, to protect your form 720b vi and sensitive data. This ensures that all documents are stored securely and that only authorized users can access them.

-

What are the benefits of using airSlate SignNow for electronic signatures on form 720b vi?

Using airSlate SignNow for electronic signatures on form 720b vi offers several benefits, including faster turnaround times and reduced paper usage. The platform simplifies the signing process, making it easy to manage approvals and ensuring compliance.

-

Can I access airSlate SignNow on mobile devices for form 720b vi?

Yes, airSlate SignNow is mobile-friendly, allowing users to access and manage form 720b vi on smartphones and tablets. This accessibility ensures that you can handle your important documents on-the-go, enhancing flexibility and efficiency.

Get more for 720vi

- Form 5513 natcep request to take the competency evaluation program

- Texas childrens doctors excuse 448541680 form

- Equipment performance evaluation texas

- Fort dearborn life insurance company death claim form 50778

- 30th annual pediatric conference brochure form

- Advance care planning baylor scott amp white health form

- Wwwbamymyersmdbbcomb form

- Provider agency model service backup plan form 3628

Find out other 720vi

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document