Pc 258 Form

What is the PC 258?

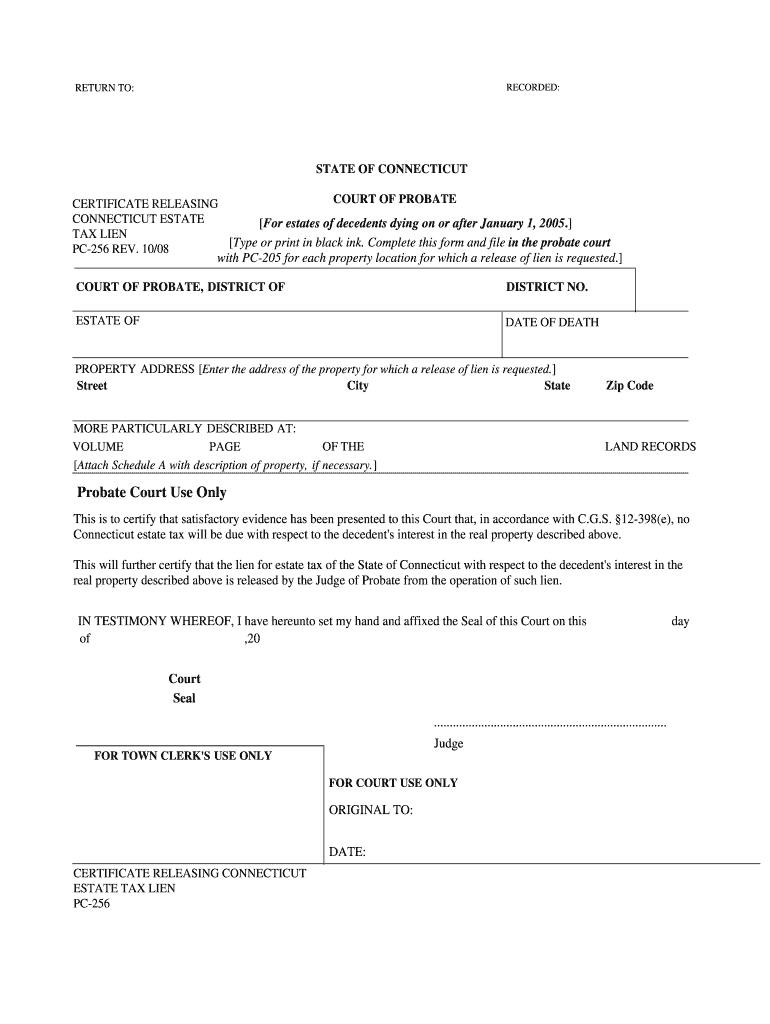

The PC 258 form, also known as the Connecticut Certificate for Releasing Succession and Estate Tax Liens, is a legal document used in the state of Connecticut. It serves to release any liens associated with succession and estate taxes on a property, ensuring that the estate is clear of any tax obligations before the transfer of ownership. This form is essential for executors and administrators managing estates, as it provides proof that all tax liabilities have been settled, facilitating a smoother transition of assets to beneficiaries.

How to Use the PC 258

Using the PC 258 involves several key steps. First, the executor or administrator must gather all necessary information regarding the estate and any outstanding tax obligations. Next, they need to complete the form accurately, ensuring all required details are provided. Once the form is filled out, it must be submitted to the appropriate Connecticut probate court. After approval, the court will issue a certificate confirming the release of any liens, which can then be presented during the transfer of property ownership.

Steps to Complete the PC 258

Completing the PC 258 form requires careful attention to detail. Here are the essential steps:

- Gather all relevant estate documents, including tax returns and proof of payments.

- Fill out the PC 258 form with accurate information about the estate and the decedent.

- Review the completed form for any errors or missing information.

- Submit the form to the probate court along with any required fees.

- Wait for the court to process the form and issue the certificate of release.

Legal Use of the PC 258

The legal use of the PC 258 is crucial for ensuring compliance with Connecticut estate laws. This form is recognized by courts as a valid document that releases any liens related to estate taxes. By obtaining and submitting the PC 258, executors and administrators can demonstrate that all tax obligations have been fulfilled, protecting the estate from future claims and facilitating the distribution of assets to beneficiaries.

State-Specific Rules for the PC 258

Connecticut has specific rules governing the use of the PC 258 form. It is essential for users to be aware of these regulations to ensure compliance. For instance, the form must be filed within a certain timeframe after the estate tax has been paid. Additionally, the probate court may require supporting documentation to accompany the PC 258, such as proof of tax payments or an estate inventory. Understanding these state-specific requirements can help streamline the process and avoid potential delays.

Examples of Using the PC 258

There are various scenarios where the PC 258 form is utilized. For example, if an individual passes away and leaves behind an estate with tax obligations, the executor must file the PC 258 after settling those taxes. Another instance might involve a property being sold or transferred to a beneficiary, where the new owner must present the PC 258 to confirm that no liens exist. These examples illustrate the form's importance in ensuring legal compliance and facilitating asset transfers.

Quick guide on how to complete pc 258

Effortlessly Prepare Pc 258 on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Pc 258 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Pc 258 with ease

- Find Pc 258 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Pc 258 and ensure superior communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pc 258

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pc258 and how does it relate to airSlate SignNow?

The pc258 is a powerful feature within airSlate SignNow that enhances document management efficiency. This solution allows users to easily send and eSign documents, ensuring a seamless workflow for businesses. By utilizing pc258, you can simplify your document processes and save valuable time.

-

What pricing plans are available for airSlate SignNow with pc258?

airSlate SignNow offers various pricing plans that include the pc258 feature, catering to businesses of all sizes. Each plan is designed to fit different needs, from basic to advanced functionalities. You can check the pricing section on our website to find the perfect plan that includes pc258 for your business requirements.

-

What are the key features of airSlate SignNow's pc258 solution?

The pc258 solution in airSlate SignNow includes advanced eSigning capabilities, automated workflows, and document templates. These features help streamline your document signing processes and enhance collaboration among team members. With pc258, you can improve efficiency and maintain compliance effortlessly.

-

How does pc258 improve document security in airSlate SignNow?

The pc258 feature ensures top-notch document security by employing encryption and audit trails within the airSlate SignNow platform. This means your sensitive documents are protected while being sent and signed. With pc258, businesses can trust that their data remains secure throughout the document lifecycle.

-

Can I integrate pc258 with other software and applications?

Yes, airSlate SignNow's pc258 is designed to integrate with various popular applications such as CRM and document management systems. This enhances the overall functionality and ease of use, allowing businesses to connect their workflows seamlessly. You can explore our integration options to see how pc258 can complement your existing tools.

-

What are the benefits of using pc258 in airSlate SignNow for my business?

By using pc258 in airSlate SignNow, businesses can signNowly reduce the time spent on document processes and improve overall productivity. The user-friendly interface and automation features streamline workflows, making it easier for teams to focus on core tasks. Additionally, pc258 ensures that all documents are signed legally and securely.

-

Is pc258 suitable for small businesses?

Absolutely! The pc258 feature in airSlate SignNow is specifically designed to accommodate businesses of all sizes, including small enterprises. It provides cost-effective solutions that enhance document sending and eSigning, making it an ideal choice for small businesses looking to optimize their operations without breaking the bank.

Get more for Pc 258

Find out other Pc 258

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document