Conditions Terms Form

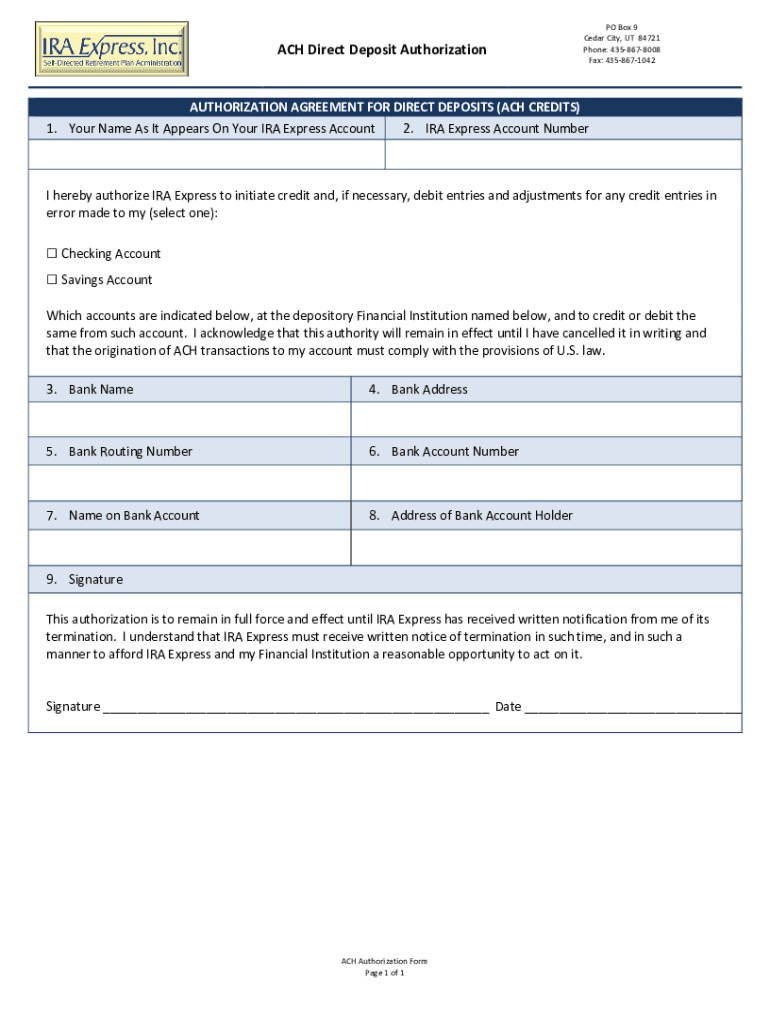

What is the ACH account number?

An ACH account number is a unique identifier assigned to a bank account that allows for electronic funds transfers through the Automated Clearing House (ACH) network. This number is essential for various transactions, including direct deposits, bill payments, and other electronic transfers. It typically consists of a series of digits that identify the specific bank and account, ensuring that funds are routed correctly during transactions.

How to use the ACH account number

Using an ACH account number involves providing it to entities that will initiate electronic transactions. For example, when setting up direct deposit with an employer, you will need to provide your ACH account number along with the bank's routing number. This allows your employer to deposit your paycheck directly into your bank account. Similarly, when paying bills electronically, you may need to enter your ACH account number to authorize the payment.

Steps to complete transactions using the ACH account number

To complete transactions using your ACH account number, follow these steps:

- Gather your bank account information, including the ACH account number and routing number.

- Provide this information to the entity initiating the transaction, such as your employer or a biller.

- Verify the details to ensure accuracy before submitting.

- Monitor your bank account to confirm that the transaction has been processed successfully.

Legal use of the ACH account number

The ACH account number must be used in compliance with federal regulations governing electronic funds transfers. These regulations ensure that transactions are secure and that consumers are protected from unauthorized transfers. It is important to safeguard your ACH account number and only share it with trusted entities to prevent fraud and unauthorized access to your funds.

Required documents for ACH transactions

When initiating ACH transactions, certain documents may be required to verify your identity and account information. Commonly needed documents include:

- Bank statements showing your account details.

- Identification documents, such as a driver's license or Social Security card.

- Authorization forms, if required by the entity processing the transaction.

Examples of using the ACH account number

ACH account numbers are commonly used in various scenarios, such as:

- Receiving direct deposits from employers or government benefits.

- Setting up automatic bill payments for utilities and loans.

- Transferring funds between bank accounts, either within the same bank or to different banks.

Quick guide on how to complete conditions terms

Prepare Conditions Terms effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Conditions Terms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Conditions Terms with ease

- Obtain Conditions Terms and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Modify and eSign Conditions Terms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the conditions terms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ACH account number and how is it used in airSlate SignNow?

An ACH account number is a unique identifier used in the Automated Clearing House network for processing electronic payments and transfers. In airSlate SignNow, you can input your ACH account number to facilitate seamless transactions and ensure secure handling of your financial documents.

-

How can I find my ACH account number?

You can find your ACH account number by checking your bank statements or contacting your bank's customer service. This number is essential for transactions within the airSlate SignNow platform, as it allows for accurate tracking and management of payments.

-

Is there a cost associated with using airSlate SignNow for ACH transactions?

While airSlate SignNow offers competitive pricing, there may be additional fees associated with ACH transactions based on your financial institution. It's recommended to review our pricing page and consult your bank to understand any potential costs related to using your ACH account number.

-

Can I integrate my bank's ACH features with airSlate SignNow?

Yes, airSlate SignNow supports various integrations that allow you to connect your bank's ACH features directly with our platform. This means you can easily sync your ACH account number for enhanced payment processing and document management.

-

What are the benefits of using ACH payments in airSlate SignNow?

Using ACH payments in airSlate SignNow provides several benefits, such as lower transaction fees compared to credit cards and faster processing times. Additionally, using your ACH account number enhances security and ensures that transactions are efficiently managed within your workflows.

-

Can I use multiple ACH account numbers with airSlate SignNow?

Yes, airSlate SignNow allows businesses to manage multiple ACH account numbers. This feature is particularly useful for companies dealing with various bank accounts, ensuring that you can streamline your payments and document processes effectively.

-

How does airSlate SignNow ensure the security of my ACH account number?

airSlate SignNow employs advanced encryption and secure data handling practices to protect your ACH account number. Your financial information is safeguarded throughout the signing and transaction process, ensuring peace of mind for all users.

Get more for Conditions Terms

Find out other Conditions Terms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors