Form Rd 111

What is the Form Rd 111

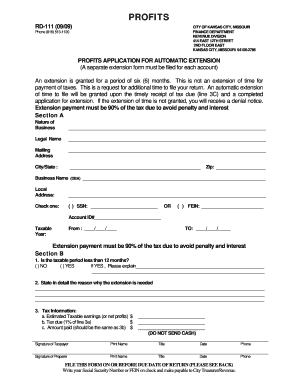

The Form Rd 111 is a specific document used within the Kansas City jurisdiction, serving various administrative and legal purposes. It is essential for individuals and businesses to understand its function and relevance in their respective situations. This form may be required for reporting, compliance, or other official processes, depending on the context in which it is utilized.

How to Obtain the Form Rd 111

Acquiring the Kansas City Form Rd 111 can be done through several channels. Individuals can typically access it via the official Kansas City government website or relevant municipal offices. Additionally, local libraries or community centers may provide copies. It is important to ensure that the most current version of the form is obtained to avoid any compliance issues.

Steps to Complete the Form Rd 111

Completing the Form Rd 111 involves several key steps to ensure accuracy and compliance. Begin by carefully reading the instructions that accompany the form. Gather all necessary information and documents required for completion. Fill out the form clearly, ensuring all fields are completed as necessary. After filling it out, review the information for any errors before submission.

Legal Use of the Form Rd 111

The Kansas City Form Rd 111 holds legal significance when completed correctly. It is crucial that the form adheres to the relevant laws and regulations governing its use. This includes ensuring that all signatures are valid and that the form is submitted within the required timelines. Understanding the legal implications of this form can help avoid potential disputes or penalties.

Key Elements of the Form Rd 111

Several key elements must be included in the Form Rd 111 for it to be considered complete. These elements typically include personal or business identification information, specific details regarding the purpose of the form, and any necessary signatures. Each section of the form should be filled out with accurate and truthful information to ensure its validity.

Form Submission Methods

The Kansas City Form Rd 111 can be submitted through various methods, including online, by mail, or in person. Each submission method may have different requirements and processing times. For online submissions, ensure that you have a reliable internet connection and follow the digital submission guidelines. If submitting by mail, use the correct address and consider using a tracking method to confirm receipt.

Quick guide on how to complete form rd 111

Prepare Form Rd 111 seamlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Form Rd 111 on any device with airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

How to adjust and eSign Form Rd 111 effortlessly

- Locate Form Rd 111 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to retain your adjustments.

- Choose your preferred method of sending your form, be it via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Adjust and eSign Form Rd 111 and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rd 111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to kansas city rd 111?

airSlate SignNow is an eSigning platform that empowers businesses in kansas city rd 111 to send and sign documents quickly and securely. It offers a user-friendly interface that simplifies the document signing process, making it easy for teams to collaborate. By utilizing airSlate SignNow, businesses can enhance their workflow efficiency and reduce turnaround times on essential documents.

-

What features does airSlate SignNow offer for businesses in kansas city rd 111?

airSlate SignNow provides several key features, including customizable templates, real-time tracking, and mobile accessibility, all designed to serve businesses in kansas city rd 111. Additionally, users can automate workflows and integrate with various third-party applications, strengthening productivity. These features collectively help streamline the eSigning process for any organization.

-

How much does airSlate SignNow cost for users in kansas city rd 111?

The pricing for airSlate SignNow is flexible and designed to meet the needs of businesses in kansas city rd 111. It offers various subscription plans, allowing organizations to choose one that best fits their budget and requirements. By providing a cost-effective solution, airSlate SignNow ensures that businesses can access premium eSigning capabilities without overspending.

-

Can airSlate SignNow integrate with other software for users in kansas city rd 111?

Yes, airSlate SignNow seamlessly integrates with various software solutions that many businesses in kansas city rd 111 already use. This includes popular tools like Google Drive, Salesforce, and Microsoft Office, making it easy to incorporate into existing workflows. These integrations enhance efficiency by allowing users to manage their documents without switching between platforms.

-

What are the benefits of using airSlate SignNow for companies in kansas city rd 111?

Using airSlate SignNow provides several benefits for companies in kansas city rd 111, including faster document processing times and improved security for sensitive information. It reduces the hassle of paperwork by enabling electronic signatures and allows for better tracking of documents throughout the signing process. Additionally, businesses experience cost savings by reducing printing and postage expenses.

-

Is airSlate SignNow secure for users in kansas city rd 111?

Absolutely, airSlate SignNow prioritizes the security of its users in kansas city rd 111 by employing encryption and authentication measures. These safeguard documents and ensure that only authorized individuals can access or sign them. The platform meets industry standards and regulations, providing peace of mind for businesses handling confidential information.

-

What types of documents can be signed using airSlate SignNow in kansas city rd 111?

AirSlate SignNow allows users in kansas city rd 111 to sign various types of documents, including contracts, agreements, forms, and more. This versatility makes it suitable for multiple industries, accommodating diverse business needs. Whether it's a simple approval or a complex contract, airSlate SignNow simplifies the signing process.

Get more for Form Rd 111

- Mid point evaluation form wb psu

- Dea fellowship guidelines fall fiu university graduate form

- Contamination survey report form uvm

- To be completed by the student page 1 recommending stem form

- Release and hold harmless agreement texas tech university homecoming form

- Ferpa request form

- Fillable online crouse pomeroy college of nursing at form

- Florida am universityacademic advisement form fam

Find out other Form Rd 111

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free