Form 4923

What is the Form 4923

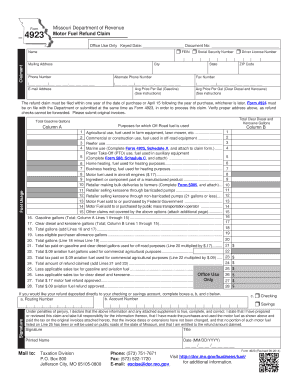

The Form 4923, also known as the Missouri Form 4923, is a document utilized primarily for tax-related purposes in the state of Missouri. It is issued by the Missouri Department of Revenue and serves as a means for individuals and businesses to report specific financial information. This form is crucial for ensuring compliance with state tax regulations and is often required during the filing of various tax returns.

How to obtain the Form 4923

To obtain the Form 4923, individuals can visit the official website of the Missouri Department of Revenue. The form is typically available for download in a fillable PDF format, allowing users to complete it electronically. Additionally, physical copies of the form may be available at local Department of Revenue offices or through authorized tax preparation services. Ensuring you have the most current version of the form is important, as updates may occur annually.

Steps to complete the Form 4923

Completing the Form 4923 involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the Form 4923 from the Missouri Department of Revenue website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form, if required.

- Submit the completed form according to the instructions provided, either online or via mail.

Legal use of the Form 4923

The legal use of the Form 4923 is essential for maintaining compliance with Missouri tax laws. When filled out correctly, this form can serve as a legally binding document. It is important to ensure that all information provided is accurate and truthful, as discrepancies may lead to penalties or legal repercussions. Utilizing electronic signature solutions, such as those offered by signNow, can enhance the legal standing of the submitted form.

Key elements of the Form 4923

Key elements of the Form 4923 include:

- Taxpayer Information: This section requires personal or business identification details.

- Income Reporting: Accurate reporting of income is crucial for tax calculations.

- Deductions and Credits: Claiming eligible deductions can reduce overall tax liability.

- Signature Section: A signature may be required to validate the submission.

Form Submission Methods

The Form 4923 can be submitted through various methods, including:

- Online Submission: Many users prefer to submit the form electronically through the Missouri Department of Revenue’s online portal.

- Mail: Completed forms can be mailed to the appropriate address as specified in the filing instructions.

- In-Person: Individuals may also choose to deliver the form in person at local Department of Revenue offices.

Quick guide on how to complete form 4923

Complete Form 4923 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without any hold-ups. Handle Form 4923 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Form 4923 with ease

- Locate Form 4923 and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Edit and eSign Form 4923 and guarantee outstanding communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4923

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 4923 and why do I need it?

The form 4923 is a crucial document for specific business transactions and compliance requirements. Understanding how to complete and manage the form 4923 is essential for businesses to ensure legal protection and streamlined operations. Using airSlate SignNow can simplify the process of eSigning and managing your form 4923 efficiently.

-

How does airSlate SignNow streamline the process of filling out form 4923?

airSlate SignNow offers a user-friendly platform that allows you to fill out the form 4923 electronically. With customizable templates and easy navigation, users can quickly enter necessary information, reducing errors and saving time. This ensures that the form 4923 is completed accurately and filed on time.

-

What features does airSlate SignNow offer for managing form 4923?

AirSlate SignNow provides a variety of features to manage the form 4923, including eSignature capabilities, document tracking, and cloud storage. These features not only enhance security but also allow you to access your form 4923 anywhere, anytime. This makes it easier to collaborate and finalize documents quickly.

-

Is there a cost associated with using airSlate SignNow for form 4923?

Yes, airSlate SignNow operates on a subscription-based pricing model, which can vary depending on the features you need for managing form 4923. However, the cost is competitive and often lower than traditional document handling methods. Investing in airSlate SignNow can lead to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other tools for form 4923 management?

Absolutely! airSlate SignNow offers seamless integrations with various applications to enhance your form 4923 management experience. Whether you are using CRM software or cloud storage services, integration allows you to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for form 4923?

Using airSlate SignNow for managing your form 4923 offers several benefits, including increased efficiency and reduced paper use. The electronic eSigning process ensures faster turnaround times, while cloud storage provides easy access and sharing capabilities. Overall, it enhances collaboration among team members.

-

Is my data secure when using airSlate SignNow for form 4923?

Yes, security is a top priority for airSlate SignNow. All data, including your form 4923, is protected with industry-leading encryption and security measures. This ensures that your sensitive information remains confidential and safe from unauthorized access.

Get more for Form 4923

- Hicc registration form revised docx

- Art release form

- Utility outages request form pdf physical plant division university ppd ufl

- Forums att comconversationsatt email andatt bellsouth net email subaccount needs password reset form

- Glock parts order form 508923013

- Bona fide non profit charitable and civic organizations form

- Www hallcounty org form

- Application for original contractor s license form

Find out other Form 4923

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now