Colorado Springs Sales Tax Form

What is the Colorado Springs Sales Tax

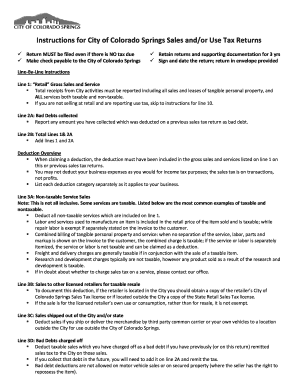

The Colorado Springs sales tax is a local tax imposed on the sale of goods and services within the city. This tax is collected by businesses at the point of sale and is a crucial source of revenue for local government services, infrastructure, and community programs. The current sales tax rate in Colorado Springs includes both state and local components, making it essential for residents and businesses to understand how it affects their transactions.

Steps to complete the Colorado Springs Sales Tax

Completing the Colorado Springs sales tax involves several key steps to ensure compliance and accuracy. First, gather all necessary sales records and receipts for the reporting period. Next, calculate the total sales amount, including taxable and non-taxable sales. After determining the total taxable sales, apply the appropriate sales tax rate to calculate the total sales tax due. Finally, complete the required sales tax return form, ensuring all information is accurate and submitted by the deadline.

Legal use of the Colorado Springs Sales Tax

The legal use of the Colorado Springs sales tax is governed by state and local laws. Businesses must collect sales tax on taxable goods and services sold within the city limits. It is important to maintain accurate records of sales and tax collected to comply with audit requirements. Additionally, businesses should be aware of exemptions that may apply to certain products or services, ensuring they do not over-collect tax from customers.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Colorado Springs sales tax return can be done through various methods to accommodate different preferences. Online submission is the most efficient option, allowing businesses to complete and file their forms electronically through the official city website. Alternatively, forms can be mailed to the Colorado Springs sales tax office or submitted in person at designated locations. Each method has specific guidelines and deadlines that must be followed to ensure timely processing.

Required Documents

When filing the Colorado Springs sales tax return, certain documents are required to support your submission. These typically include sales records, receipts, and any relevant exemption certificates. It is advisable to keep detailed records of all transactions and tax collected to facilitate accurate reporting and compliance with local tax laws. Having these documents readily available will streamline the filing process and help address any inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Springs sales tax return are crucial for maintaining compliance and avoiding penalties. Generally, returns are due on a monthly or quarterly basis, depending on the volume of sales. It is important to be aware of specific due dates to ensure timely submission. Additionally, businesses should keep track of any changes in tax laws or filing requirements that may affect their obligations.

Penalties for Non-Compliance

Failure to comply with Colorado Springs sales tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential for businesses to understand their obligations and maintain accurate records to mitigate the risk of penalties. Regular training and updates on tax regulations can help ensure all staff are informed and compliant.

Quick guide on how to complete colorado springs sales tax

Effortlessly Prepare Colorado Springs Sales Tax on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents swiftly without hindrances. Handle Colorado Springs Sales Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Colorado Springs Sales Tax without Stress

- Locate Colorado Springs Sales Tax and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then press the Done button to save your changes.

- Select your preferred method to send your form, such as email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Colorado Springs Sales Tax and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado springs sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Colorado Springs sales tax online and how does it work?

Colorado Springs sales tax online refers to the ability to manage and pay sales tax through an online platform. This service streamlines filing processes by allowing businesses to calculate, report, and remit taxes electronically. With airSlate SignNow, users can easily submit their sales tax forms, making compliance more efficient and less time-consuming.

-

How does airSlate SignNow help with Colorado Springs sales tax online?

airSlate SignNow simplifies the process of handling Colorado Springs sales tax online by providing an intuitive platform for sending and signing documents. Our solution integrates seamlessly with various tax systems, ensuring accurate calculations and timely submissions. Users can easily track their sales tax obligations and manage their financial documentation from any device.

-

What are the costs associated with using airSlate SignNow for Colorado Springs sales tax online?

While specific pricing may vary, airSlate SignNow offers competitive plans that cater to different business needs. Each plan provides access to features essential for managing Colorado Springs sales tax online effectively. Whether you are a small business or a large enterprise, there are affordable options available that help you streamline your tax processes.

-

Is airSlate SignNow suitable for small businesses needing Colorado Springs sales tax online services?

Yes, airSlate SignNow is especially suitable for small businesses looking for Colorado Springs sales tax online solutions. Its user-friendly interface and cost-effective pricing make it accessible for businesses of all sizes. Small business owners can enhance their operational efficiency and ensure compliance without overwhelming complexity.

-

What features does airSlate SignNow offer for managing Colorado Springs sales tax online?

airSlate SignNow offers a range of features designed for effective management of Colorado Springs sales tax online. This includes automated tax calculations, document tracking, eSignature capabilities, and secure cloud storage. These tools allow businesses to streamline tax filing processes and maintain accurate records effortlessly.

-

Can airSlate SignNow integrate with my existing accounting software for Colorado Springs sales tax online?

Yes, airSlate SignNow supports integration with various accounting software to facilitate Colorado Springs sales tax online management. This integration helps synchronize financial data, reducing errors and saving time on manual entries. Users can connect their existing tools, making it easier to manage sales tax alongside other business operations.

-

How can I ensure compliance with Colorado Springs sales tax online when using airSlate SignNow?

To ensure compliance with Colorado Springs sales tax online, it's essential to utilize airSlate SignNow’s automated features that help streamline the filing process. The platform keeps you updated on tax regulations and deadlines, offering reminders and guidance. Users can also leverage accurate reporting tools to maintain records and documentation, ensuring adherence to local tax laws.

Get more for Colorado Springs Sales Tax

Find out other Colorado Springs Sales Tax

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document