it 558 2022

What is the IT-558?

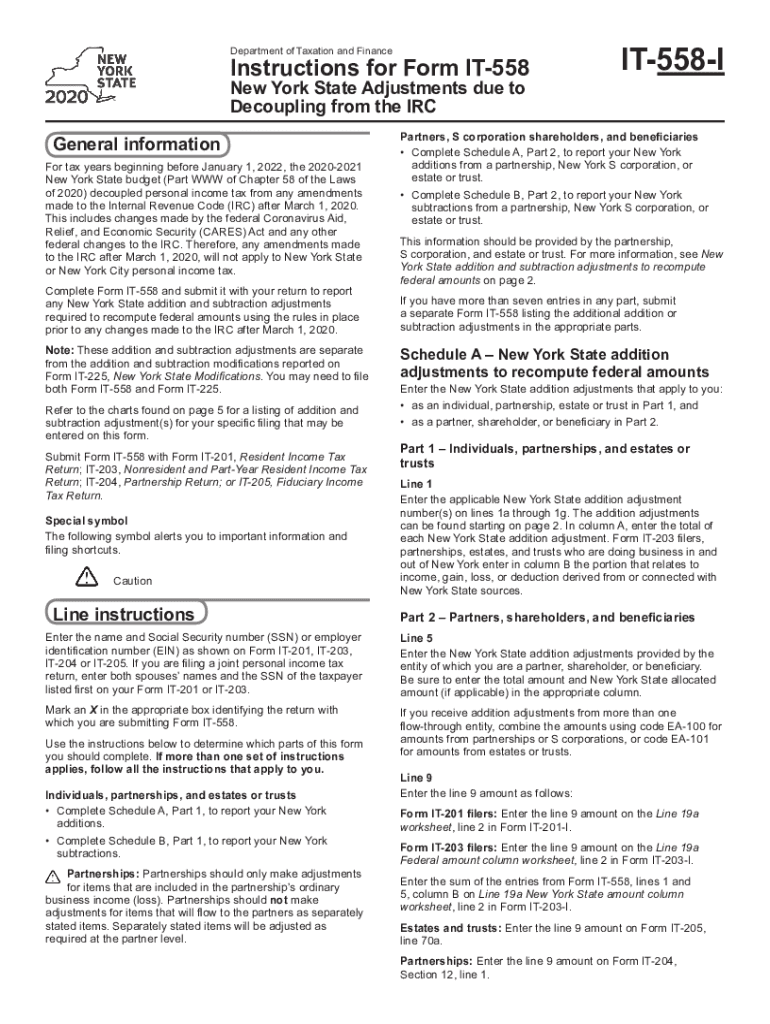

The IT-558, also known as the New York State Tax Form IT-558, is a tax form used by individuals and businesses to report adjustments related to decoupling from the Internal Revenue Code (IRC). This form is essential for taxpayers who need to make specific adjustments to their New York State taxable income. It is particularly relevant for those who have claimed certain federal tax deductions or credits that are not allowed under New York State law.

How to Use the IT-558

To effectively use the IT-558, taxpayers must first gather all necessary financial documents and information related to their income and deductions. The form requires detailed reporting of adjustments to income, which may include modifications for state-specific tax laws. It is important to follow the instructions carefully to ensure accurate reporting and compliance with New York State tax regulations.

Steps to Complete the IT-558

Completing the IT-558 involves several key steps:

- Begin by entering your personal information, including name, address, and Social Security number.

- Report your federal adjusted gross income as a starting point for calculations.

- Identify and list any adjustments required due to New York State tax laws, such as disallowed federal deductions.

- Calculate your New York State taxable income by applying the necessary adjustments.

- Review the completed form for accuracy before submission.

Legal Use of the IT-558

The IT-558 is legally binding when completed and submitted in accordance with New York State tax laws. To ensure its validity, the form must be signed and dated by the taxpayer. Additionally, it is crucial to maintain accurate records of all income and deductions reported, as these may be subject to review by tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IT-558. Generally, the form is due on the same date as the New York State personal income tax return, which is typically April fifteenth. However, if additional time is needed, taxpayers can request an extension, allowing them to file the IT-558 later, but it is essential to pay any taxes owed by the original deadline to avoid penalties.

Form Submission Methods

The IT-558 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a completed paper form to the appropriate address specified in the instructions.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete it 558 545450396

Effortlessly Manage It 558 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to access the correct template and securely retain it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents rapidly without any hold-ups. Manage It 558 on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and eSign It 558 with Ease

- Find It 558 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Form your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form scanning, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign It 558 and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 558 545450396

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS Form IT 558?

The NYS Form IT 558 is a tax form used in New York State for reporting personal income tax adjustments. It allows taxpayers to claim various credits and adjustments on their tax returns. Understanding how to correctly fill out the NYS Form IT 558 is essential for accurate tax filing.

-

How can airSlate SignNow help with NYS Form IT 558?

airSlate SignNow simplifies the process of sending and electronically signing documents, including the NYS Form IT 558. With its user-friendly interface, you can easily share the form with multiple parties and ensure secure e-signatures. This makes handling your tax forms more efficient and streamlined.

-

Is airSlate SignNow cost-effective for handling NYS Form IT 558?

Yes, airSlate SignNow offers a cost-effective solution for managing the NYS Form IT 558. With various pricing plans, you can choose one that fits your business needs without breaking the bank. This affordability, combined with robust features, makes it an ideal choice for e-signing tax documents.

-

What features does airSlate SignNow offer for NYS Form IT 558?

airSlate SignNow provides features such as document templates, real-time tracking, and secure storage for your NYS Form IT 558. These tools ensure that you can efficiently handle your tax forms and maintain compliance. Additionally, the platform supports multiple file formats, making it easy to upload your documents.

-

Can airSlate SignNow integrate with other software for NYS Form IT 558 processing?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions to enhance the processing of the NYS Form IT 558. Whether you use accounting software or CRMs, these integrations can help streamline your workflow. This ensures that all aspects of your tax preparation are cohesive and efficient.

-

What are the benefits of using airSlate SignNow for NYS Form IT 558?

Using airSlate SignNow for your NYS Form IT 558 provides numerous benefits, including enhanced efficiency and improved security. You can easily manage signatures and document flow, reducing turnaround time signNowly. Moreover, the cloud-based platform ensures that you can access your forms anywhere, anytime.

-

How secure is airSlate SignNow for filing NYS Form IT 558?

airSlate SignNow prioritizes security, using industry-standard encryption to protect your NYS Form IT 558 and other sensitive documents. The platform is compliant with various regulations, ensuring that your information remains confidential and secure. You can trust airSlate SignNow for safe e-signing and document management.

Get more for It 558

- Wb 25 bill of sale upon the effective date below seller conveys form

- State v cent council of tlingit amp haida indian tribes form

- Application for judgment lien on motor vehicle or vessel form

- Tn self certification 100313566 form

- Moisture and density determination mdotcfstatemius form

- Glenelg hopkins cma gunditjmara country po box 502 form

- Moisture and density determination moisture and density determination form

- Application for floodplain advice and information ghcma

Find out other It 558

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe