Form 42 1 Wyoming

What is the Form 42 1 Wyoming

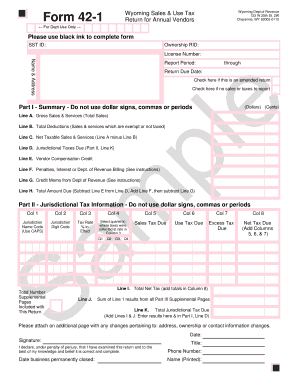

The Form 42 1 Wyoming is a specific document used within the state of Wyoming for various administrative purposes. It is often utilized for reporting or compliance related to state regulations. Understanding the purpose and requirements of this form is essential for individuals and businesses operating in Wyoming.

How to use the Form 42 1 Wyoming

Using the Form 42 1 Wyoming involves several steps to ensure accurate completion and submission. First, gather all necessary information that pertains to the form's requirements. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. After filling out the form, review it for any errors before submission. Depending on the specific use case, the form may need to be submitted online, by mail, or in person.

Steps to complete the Form 42 1 Wyoming

Completing the Form 42 1 Wyoming requires attention to detail. Here are the steps to follow:

- Gather necessary documents and information relevant to the form.

- Fill in personal or business details as required.

- Ensure all sections are completed accurately.

- Review the form for any mistakes or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 42 1 Wyoming

The legal use of the Form 42 1 Wyoming is governed by state laws and regulations. To be considered valid, the form must be completed in accordance with these legal standards. This includes ensuring that all required signatures are obtained and that the form is submitted within any specified deadlines. Adhering to these legal guidelines helps maintain compliance and avoids potential penalties.

Key elements of the Form 42 1 Wyoming

Key elements of the Form 42 1 Wyoming include specific fields that must be filled out, such as identification information, purpose of the form, and any relevant dates. Additionally, there may be sections that require signatures or certifications to validate the information provided. Understanding these elements is crucial for proper completion and submission.

State-specific rules for the Form 42 1 Wyoming

Each state has its own rules regarding the use of forms like the Form 42 1 Wyoming. These rules may dictate how the form should be completed, what information is required, and the submission process. Familiarizing oneself with these state-specific regulations is essential for ensuring compliance and avoiding issues during the filing process.

Quick guide on how to complete form 42 1 wyoming

Effortlessly prepare Form 42 1 Wyoming on any device

Digital document management has gained signNow traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hurdles. Manage Form 42 1 Wyoming on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to modify and eSign Form 42 1 Wyoming with ease

- Locate Form 42 1 Wyoming and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 42 1 Wyoming to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 42 1 wyoming

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 42 1 Wyoming and how is it used?

The form 42 1 Wyoming is a crucial document used for specific legal and business purposes within the state. It allows businesses to outline their operational structures and is often required for compliance. Utilizing airSlate SignNow, you can easily fill out and eSign the form 42 1 Wyoming, ensuring a smooth submission process.

-

How can airSlate SignNow help me fill out form 42 1 Wyoming?

airSlate SignNow provides a user-friendly platform for completing form 42 1 Wyoming efficiently. With customizable templates and intuitive design, you can streamline the completion process. The tool also allows for seamless electronic signatures, making it easier to finalize your document.

-

What features of airSlate SignNow are most beneficial for handling form 42 1 Wyoming?

Key features of airSlate SignNow that assist with form 42 1 Wyoming include real-time document collaboration, secure storage, and automated workflows. These features make it easy to gather signatures and keep track of your form's status. This efficiency can signNowly reduce the time required for compliance.

-

Is there a cost associated with using airSlate SignNow for form 42 1 Wyoming?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. You can choose a plan that corresponds to the frequency and volume at which you intend to use form 42 1 Wyoming. The cost-effective solutions provided by airSlate SignNow ensure that your business remains compliant without breaking the bank.

-

Can I integrate airSlate SignNow with other software for form 42 1 Wyoming?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to access and manage your saved form 42 1 Wyoming alongside your other important documents easily, fostering a more efficient workflow.

-

What are the advantages of using airSlate SignNow for eSigning form 42 1 Wyoming?

Using airSlate SignNow for eSigning form 42 1 Wyoming offers numerous advantages, including enhanced security, compliance, and ease of use. Electronic signatures are legally binding and provide a reliable way to finalize your documents quickly. Additionally, the platform maintains a comprehensive audit trail for transparency.

-

How does airSlate SignNow ensure the security of my form 42 1 Wyoming?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. Your form 42 1 Wyoming is protected during transmission and storage, ensuring that sensitive information is safe from unauthorized access. You can have peace of mind while using the platform.

Get more for Form 42 1 Wyoming

- Essentials of human anatomy and physiology 11e marieb chapter 7 form

- Sample nurse agreement between nursing agency and a self employed nurse contractordoc form

- Mad 313 form nm

- How to fill form 4 for driving licence

- Dependencia declaraci n responsable de patrimonio benestar culleredo form

- Home depot tax exempt id california form

- Co owner business contract template form

- Co own dog contract template form

Find out other Form 42 1 Wyoming

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form