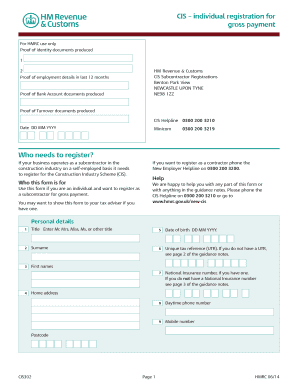

Cis301 Form

What is the Cis301 Form

The Cis301 form is a crucial document used primarily for reporting certain types of income and payments in the United States. It is often utilized by businesses to report payments made to independent contractors or service providers. Understanding the purpose of the Cis301 form is essential for ensuring compliance with tax regulations and maintaining accurate financial records.

How to use the Cis301 Form

Using the Cis301 form involves several key steps. First, gather all necessary information about the payee, including their name, address, and taxpayer identification number. Next, accurately report the total amount paid during the tax year. Once completed, the form must be submitted to the Internal Revenue Service (IRS) and a copy provided to the payee. This ensures that both parties have the necessary documentation for tax purposes.

Steps to complete the Cis301 Form

Completing the Cis301 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Cis301 form from the IRS website.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- Enter the payee's details accurately.

- Report the total amount paid during the tax year in the appropriate section.

- Review the form for accuracy before submission.

Legal use of the Cis301 Form

The Cis301 form serves a legal purpose by documenting payments made to individuals or entities. It is essential for compliance with IRS regulations. When properly filled out and submitted, the form helps ensure that both the payer and payee fulfill their tax obligations. Failure to use the form correctly can lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Cis301 form are critical for compliance. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. Additionally, copies must be provided to payees by the same date. Staying aware of these deadlines helps avoid potential penalties.

Who Issues the Form

The Cis301 form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. Understanding the role of the IRS in relation to the Cis301 form is important for ensuring compliance and proper filing.

Quick guide on how to complete cis301 form

Complete Cis301 Form smoothly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Cis301 Form on any device with airSlate SignNow apps for Android or iOS and simplify any document-based task today.

How to modify and electronically sign Cis301 Form with ease

- Obtain Cis301 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that require printing fresh copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Cis301 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cis301 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cis301 and how does it relate to airSlate SignNow?

Cis301 is a comprehensive tool within airSlate SignNow that enhances document automation and signing workflows. It enables businesses to streamline their processes, making it easy to send and eSign important documents efficiently. Understanding how cis301 works can greatly improve your organizational efficiency.

-

What features does cis301 offer for document management?

Cis301 includes features such as customizable templates, real-time tracking of document status, and advanced eSignature capabilities. These features are designed to enhance your document management experience, ensuring that you can easily manage, send, and receive signed documents. With cis301, organizations can signNowly reduce paperwork and improve productivity.

-

How much does it cost to use cis301 with airSlate SignNow?

The pricing for cis301 within airSlate SignNow is competitive and depends on the subscription plan you choose. Typically, users can opt for monthly or annual billing, which can further enhance cost-effectiveness. By leveraging cis301, businesses can expect a strong return on investment due to increased efficiency.

-

Can I integrate cis301 with other applications?

Yes, cis301 supports integrations with a variety of applications, including CRM systems, cloud storage solutions, and project management tools. This feature allows for seamless workflow automation and data transfer between platforms. By integrating cis301, organizations can optimize their document processes even further.

-

What are the benefits of using cis301 for my business?

Using cis301 can result in numerous benefits, including faster document turnaround times and reduced operational costs. The user-friendly interface simplifies the eSigning process, which can increase employee productivity and customer satisfaction. Businesses often find that cis301 signNowly enhances their operational efficiency.

-

Is cis301 secure for sensitive documents?

Absolutely, cis301 prioritizes the security of your documents. It incorporates advanced encryption protocols and complies with industry standards to keep your sensitive information safe. Businesses can trust that their data is protected when using cis301 for eSigning.

-

How can I get started with cis301 on airSlate SignNow?

Getting started with cis301 is simple! You can sign up for a free trial on the airSlate SignNow website, which allows you to explore its features without any commitment. Once familiarized, you can select the plan that best suits your business needs and start utilizing cis301 effectively.

Get more for Cis301 Form

- Ml application form doc

- Adult family home initial licensure checklist f 62671 1100 form

- Fillable online toastmasters form 3 charter membership

- Indiabulls account closure form fill out ampamp sign online

- Pharmacists manual section ix xiv dea diversion control form

- State of new hampshire258 berts form 258

- Alaska housing finance corporation pur form

- My voice my choice idaho 611257867 form

Find out other Cis301 Form

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF