Gra Tax Clearance Certificate Form

What is the GRA Tax Clearance Certificate?

The GRA Tax Clearance Certificate is an official document issued by the Ghana Revenue Authority (GRA) that certifies an individual or business’s tax compliance status. This certificate is essential for various transactions, including securing loans, bidding for contracts, and other financial engagements. It confirms that the taxpayer has fulfilled their tax obligations, ensuring that they are in good standing with the tax authorities. The certificate typically includes the taxpayer's identification details, the period covered, and a statement of compliance.

How to Obtain the GRA Tax Clearance Certificate

To obtain the GRA Tax Clearance Certificate, individuals or businesses must follow a specific process. First, ensure that all tax returns are filed and that any outstanding tax liabilities are settled. After confirming compliance, you can apply for the certificate through the GRA's online portal or visit a local GRA office. The application may require supporting documents, such as proof of tax payments and identification. Once submitted, the GRA will review the application and issue the certificate if all requirements are met.

Steps to Complete the GRA Tax Clearance Certificate

Completing the GRA Tax Clearance Certificate involves several steps. Start by gathering necessary documents, including tax returns and payment receipts. Next, access the GRA online portal or visit an office to fill out the application form. Ensure that all information is accurate and complete to avoid delays. After submitting the application, monitor its status through the portal. If approved, you will receive the certificate via email or can collect it in person, depending on your chosen method.

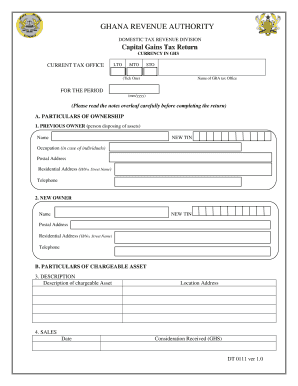

Key Elements of the GRA Tax Clearance Certificate

The GRA Tax Clearance Certificate contains several key elements that validate its authenticity. These include:

- Taxpayer Identification: The name and tax identification number of the individual or business.

- Period Covered: The specific tax period for which compliance is confirmed.

- Certification Statement: A declaration of compliance with tax obligations.

- Issuing Authority: Information about the Ghana Revenue Authority.

- Date of Issue: The date when the certificate was issued.

Legal Use of the GRA Tax Clearance Certificate

The legal use of the GRA Tax Clearance Certificate is crucial for various business and financial transactions. It serves as proof of tax compliance, which is often a requirement for government contracts, loans, and other financial dealings. Using the certificate inappropriately or presenting a fraudulent document can lead to severe penalties, including fines and legal action. Therefore, it is essential to ensure that the certificate is obtained and used in accordance with the law.

Examples of Using the GRA Tax Clearance Certificate

The GRA Tax Clearance Certificate is used in multiple scenarios, including:

- Applying for government contracts where proof of tax compliance is mandatory.

- Securing loans from financial institutions that require verification of tax status.

- Conducting business transactions that necessitate proof of good standing with tax authorities.

- Participating in public tenders or bids that require tax clearance documentation.

Quick guide on how to complete gra tax clearance certificate

Complete Gra Tax Clearance Certificate effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gra Tax Clearance Certificate on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Gra Tax Clearance Certificate without stress

- Locate Gra Tax Clearance Certificate and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Modify and eSign Gra Tax Clearance Certificate and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gra tax clearance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax clearance certificate in Ghana?

A tax clearance certificate in Ghana is an official document that certifies that an individual or business has fulfilled its tax obligations. It is a crucial requirement for various transactions, such as government contracts, loan applications, and business registrations. Understanding the tax clearance certificate ghana sample can guide you in preparing your documents correctly.

-

How can I obtain a tax clearance certificate in Ghana?

To obtain a tax clearance certificate in Ghana, you must first ensure that all your tax returns are filed and paid. You can then apply for the certificate through the Ghana Revenue Authority's online platform or in person at their offices. Referencing a tax clearance certificate ghana sample will help you understand the necessary steps and documentation required in your application.

-

How long does it take to receive a tax clearance certificate in Ghana?

The processing time for a tax clearance certificate in Ghana can vary, typically taking anywhere from 5 to 14 working days. However, this duration can be influenced by factors such as the completeness of your application and any outstanding tax issues. Always refer to a tax clearance certificate ghana sample to ensure you submit a complete application to avoid delays.

-

What are the costs associated with obtaining a tax clearance certificate in Ghana?

The costs associated with obtaining a tax clearance certificate in Ghana typically include any outstanding taxes or penalties that must be settled before application. Additionally, there may be minimal administrative fees charged by the Ghana Revenue Authority. An example of a tax clearance certificate ghana sample can give you an idea of the details included in the process, helping you budget accordingly.

-

What features should I look for in a tax clearance certificate application process?

When applying for a tax clearance certificate, look for a user-friendly interface, real-time tracking of your application, and clear instructions for submission. It’s essential to have access to customer support for any queries you may have during the process. Reviewing a tax clearance certificate ghana sample can help you understand these features better.

-

What are the benefits of having a tax clearance certificate in Ghana?

Having a tax clearance certificate in Ghana offers several benefits, such as eligibility for government contracts and securing loans from financial institutions. It also enhances your credibility with potential partners and clients as it demonstrates compliance with tax laws. The importance of a tax clearance certificate ghana sample cannot be overstated, as it highlights these advantages visibly.

-

Can I renew my tax clearance certificate online?

Yes, you can renew your tax clearance certificate online through the Ghana Revenue Authority's portal. This process is designed to be efficient and straightforward, allowing you to complete required renewals quickly. For additional clarity, examining a tax clearance certificate ghana sample can help you understand the renewal process better.

Get more for Gra Tax Clearance Certificate

- Parent company guarantee template word form

- Florida lottery claim form 6965266

- Vector magnitude and direction worksheet form

- Structure spacing and phasing of nucleosomes on isolated forms

- Fp contract gb november paul mitchell schools files paulmitchell form

- Adjunct faculty contract template form

- Admin contract template form

- Admin assistant contract template form

Find out other Gra Tax Clearance Certificate

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed