Dr 97 Form

What is the Dr 97

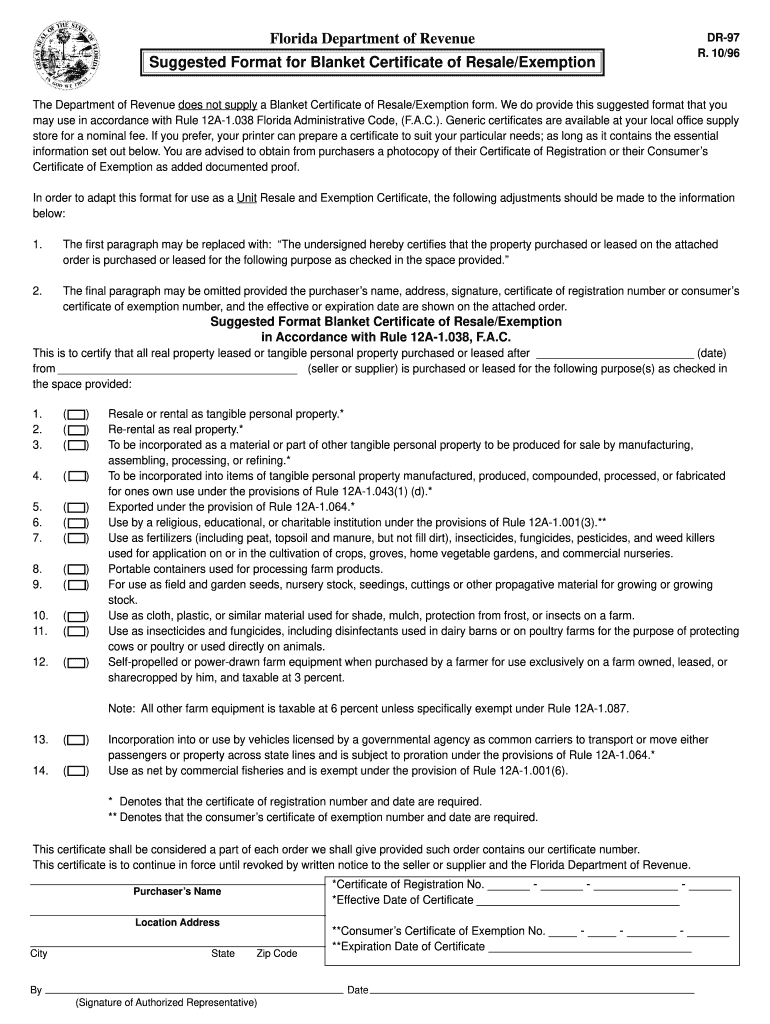

The Florida Department of Revenue DR 97 is a crucial document used for various tax-related purposes in the state of Florida. This form is primarily associated with the application for a sales tax exemption certificate. It allows businesses and individuals to claim exemptions on certain purchases, ensuring compliance with state tax regulations. Understanding the purpose and implications of the DR 97 is essential for taxpayers looking to navigate Florida's tax system effectively.

How to obtain the Dr 97

Obtaining the Florida DR 97 form is a straightforward process. Taxpayers can access the form directly from the Florida Department of Revenue's official website. It is available in a downloadable format, allowing users to print and fill it out at their convenience. Additionally, individuals may request a physical copy by contacting the Department of Revenue if they prefer a mailed version. Ensuring that you have the correct version of the form is vital for accurate submissions.

Steps to complete the Dr 97

Completing the DR 97 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports your claim for exemption. This may include business licenses, tax identification numbers, and any relevant purchase invoices. Next, fill out the form carefully, providing all required information, including your name, address, and the specific reason for the exemption. Once completed, review the form for any errors before submitting it to the Florida Department of Revenue.

Legal use of the Dr 97

The legal use of the DR 97 form is governed by Florida tax laws, which stipulate that the form must be used correctly to claim tax exemptions. It is essential for users to understand that misuse or fraudulent claims can result in penalties. The form must be completed accurately and submitted in accordance with state regulations to ensure that the exemptions are recognized legally. Familiarity with the legal implications of the DR 97 helps protect taxpayers from potential legal issues.

Key elements of the Dr 97

Several key elements are crucial for the proper completion and submission of the DR 97 form. These include the taxpayer's identification information, the specific exemption being claimed, and supporting documentation. Additionally, the form requires a signature to validate the claim. Each element plays a significant role in ensuring that the form is processed correctly and that the exemption is granted without complications.

Form Submission Methods

The DR 97 form can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to submit the form online via the Florida Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate address provided by the Department or submitted in person at designated locations. Each submission method has its own guidelines, so it is important to follow the instructions carefully to avoid delays.

Quick guide on how to complete dr 97

Complete Dr 97 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Dr 97 on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Dr 97 seamlessly

- Locate Dr 97 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to send the form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors needing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and eSign Dr 97 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 97

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 97, and how does it relate to airSlate SignNow?

Dr 97 is a key product feature in airSlate SignNow that streamlines the electronic signing process. It enhances user experience by providing a simple and efficient interface for document management and eSigning. With dr 97, businesses can easily send, sign, and manage documents securely.

-

How much does airSlate SignNow cost with the dr 97 feature?

AirSlate SignNow offers competitive pricing plans that include the dr 97 feature. Depending on the plan selected, users can benefit from various pricing tiers designed to meet different business needs. This ensures businesses can utilize dr 97 without straining their budgets.

-

What are the key features of dr 97 in airSlate SignNow?

Dr 97 in airSlate SignNow includes features like user-friendly eSigning, document tracking, and customizable templates. These features are designed to optimize the signing process, making it quick and efficient. Users will find that dr 97 elevates their document workflow signNowly.

-

How can dr 97 benefit my business?

The dr 97 feature offers numerous benefits for businesses, including increased efficiency in document processing and improved collaboration among team members. With dr 97, companies can minimize paper usage, streamline workflows, and ensure faster contract turnaround times, ultimately boosting productivity.

-

Are there integrations available with dr 97 in airSlate SignNow?

Yes, airSlate SignNow, featuring dr 97, supports integrations with various tools and platforms, enhancing its versatility. This allows businesses to connect their existing systems and automate workflows seamlessly. Users can integrate dr 97 with CRM, project management, and cloud storage solutions efficiently.

-

Is dr 97 secure for sensitive documents?

Absolutely, dr 97 in airSlate SignNow ensures the highest security standards for sensitive documents. The platform employs encryption, secure access controls, and compliance with regulations to protect your data. Businesses can confidently use dr 97 knowing their documents are secure during the signing process.

-

Can I use dr 97 on mobile devices?

Yes, the dr 97 feature in airSlate SignNow is fully optimized for mobile devices. This means users can send and eSign documents on the go, providing flexibility and convenience. With dr 97, businesses can operate from anywhere, ensuring that important documents are signed promptly.

Get more for Dr 97

Find out other Dr 97

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF