Credit Denial Notice Form

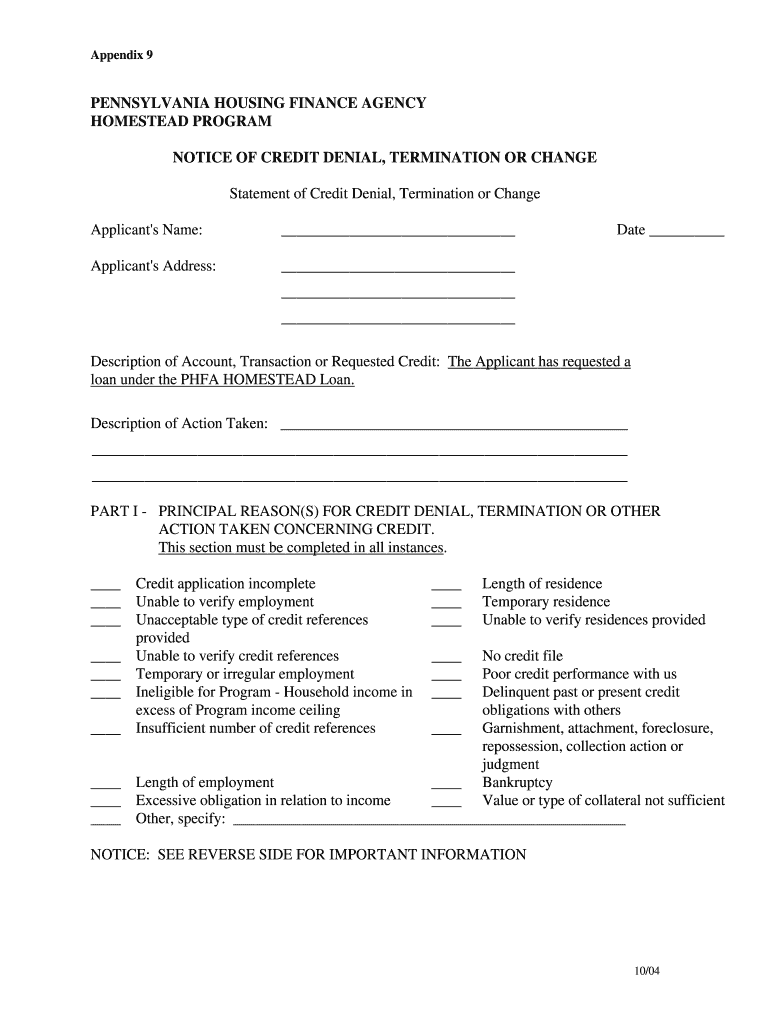

What is the statement of credit denial form?

The statement of credit denial form is a document that lenders provide to individuals when they are denied credit. This form outlines the reasons for the denial, which may include factors such as credit history, income level, or outstanding debts. Understanding this form is crucial for consumers as it provides insight into their creditworthiness and helps them identify areas for improvement.

Key elements of the statement of credit denial form

This form typically includes several important components:

- Applicant Information: Personal details of the individual applying for credit, including name, address, and Social Security number.

- Reasons for Denial: Specific reasons provided by the lender for the credit denial, which may reference credit reports or other financial information.

- Credit Reporting Agencies: Information on which credit reporting agency was used to assess the applicant’s creditworthiness.

- Rights of the Consumer: A statement informing the applicant of their rights, including the ability to request a free copy of their credit report.

Steps to complete the statement of credit denial form

Completing the statement of credit denial form involves several steps:

- Review the Denial Notice: Carefully read the information provided in the denial notice to understand the reasons for denial.

- Gather Necessary Information: Collect personal details and any supporting documents that may be relevant to your credit history.

- Complete the Form: Fill out the form accurately, ensuring all required fields are completed.

- Submit the Form: Follow the instructions for submitting the form, whether online, by mail, or in person.

Legal use of the statement of credit denial form

The statement of credit denial form serves a legal purpose by ensuring that consumers are informed about the reasons for credit denial. Under the Fair Credit Reporting Act (FCRA), lenders are required to provide this notice to protect consumer rights. This legal framework ensures transparency and allows individuals to address any inaccuracies in their credit reports.

How to obtain the statement of credit denial form

Individuals can obtain the statement of credit denial form directly from the lender that issued the credit denial. Many lenders provide this form as part of their denial notification process. If the form is not included, consumers can request it from the lender's customer service department. Additionally, some financial institutions may offer downloadable versions of the form on their websites.

Examples of using the statement of credit denial form

There are various scenarios in which the statement of credit denial form may be utilized:

- Loan Applications: When applying for a mortgage or personal loan, individuals may receive this form if their application is denied.

- Credit Card Applications: Consumers may encounter this form when they apply for a credit card and do not meet the lender's criteria.

- Rental Applications: Landlords may also issue a statement of credit denial when a prospective tenant's application is rejected based on credit history.

Quick guide on how to complete credit denial notice

Prepare Credit Denial Notice effortlessly on any device

Online documentation administration has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without unnecessary delays. Manage Credit Denial Notice on any platform with airSlate SignNow's Android or iOS applications and streamline any document-oriented procedure today.

How to edit and eSign Credit Denial Notice without difficulty

- Find Credit Denial Notice and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that task.

- Create your signature using the Sign tool, which takes a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your amendments.

- Choose how you would like to send your form—by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Credit Denial Notice and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit denial notice

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a statement of credit denial form?

A statement of credit denial form is a document issued by lenders to inform applicants about the reasons their credit applications were denied. This form is important for understanding one's credit score and improving future applications. Using airSlate SignNow, you can easily create, send, and eSign this form to ensure compliance and clarity.

-

How does airSlate SignNow help with the statement of credit denial form?

airSlate SignNow offers businesses a straightforward way to create and manage a statement of credit denial form. With our eSigning feature, you can send documents securely and receive signed copies instantly, making the process efficient and legally binding. Our platform ensures that all communications regarding the form are tracked and documented.

-

Is there a fee associated with the statement of credit denial form on airSlate SignNow?

While creating a statement of credit denial form through airSlate SignNow comes at no extra cost, our subscription plans start at an affordable rate. The pricing structure is designed to be cost-effective for businesses looking to streamline their document management needs. You can choose a plan that best fits your usage and budget.

-

Can I customize the statement of credit denial form with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your statement of credit denial form to suit your business's specific needs. You can add your company branding, modify fields, and include essential clauses. Our user-friendly interface makes it easy to tailor forms for optimal user experience.

-

What features does airSlate SignNow offer for managing documents like the statement of credit denial form?

airSlate SignNow offers a suite of features for managing documents, including templates, eSigning, and real-time tracking. You can store your statement of credit denial form securely and access it anytime. The platform also integrates with various applications, enhancing your workflow efficiency.

-

How secure is the statement of credit denial form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. When you generate a statement of credit denial form, it is encrypted and stored securely. Our platform complies with industry standards to protect sensitive information, ensuring that all documents remain confidential and accessible only to authorized users.

-

Can I integrate airSlate SignNow with other applications for managing the statement of credit denial form?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and manage your statement of credit denial form seamlessly alongside your other business processes. Integration enhances collaboration across your team.

Get more for Credit Denial Notice

- Chicago police report pdf form

- 25 team bracket form

- Conversation roundtable template form

- Visitor visa subclass 600 tourist stream application document form

- Hertfordshire blue badge application form

- Pneq application letter form

- Boys and girls club donation receipt form

- Advance notification form solicitors regulation authority

Find out other Credit Denial Notice

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application