Vermont Tax Clearance Request Form 2010

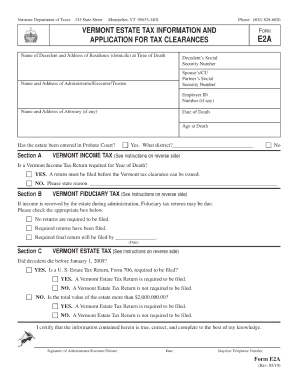

What is the Vermont Tax Clearance Request Form

The Vermont Tax Clearance Request Form is an official document used to verify that an individual or business has fulfilled all state tax obligations. This form is often required when applying for licenses, permits, or contracts within Vermont. It serves as proof that the taxpayer is in good standing with the Vermont Department of Taxes, ensuring compliance with state tax laws.

How to use the Vermont Tax Clearance Request Form

Using the Vermont Tax Clearance Request Form involves filling out the necessary information accurately to avoid delays. Taxpayers must provide personal or business identification details, including Social Security numbers or Employer Identification Numbers (EIN). Once completed, the form should be submitted to the appropriate state department for processing. It is important to keep a copy for personal records.

Steps to complete the Vermont Tax Clearance Request Form

To complete the Vermont Tax Clearance Request Form, follow these steps:

- Gather necessary information, including identification numbers and tax account details.

- Fill out the form with accurate personal or business information.

- Review the completed form for any errors or omissions.

- Submit the form either online, by mail, or in person, depending on your preference.

Legal use of the Vermont Tax Clearance Request Form

The legal use of the Vermont Tax Clearance Request Form is crucial for ensuring that all tax obligations are met. This form is recognized by various state agencies and is often required for legal transactions, such as securing business licenses or government contracts. Failure to provide a valid tax clearance can result in penalties or delays in processing applications.

Required Documents

When submitting the Vermont Tax Clearance Request Form, certain documents may be required to support your request. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Tax returns for the previous years, if applicable.

- Any correspondence from the Vermont Department of Taxes regarding your tax status.

Form Submission Methods

The Vermont Tax Clearance Request Form can be submitted through various methods, providing flexibility for taxpayers. The available options include:

- Online submission via the Vermont Department of Taxes website.

- Mailing the completed form to the designated tax office.

- Delivering the form in person at a local tax office.

Quick guide on how to complete vermont tax clearance request form

Effortlessly Complete Vermont Tax Clearance Request Form on Any Device

The management of documents online has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without delays. Manage Vermont Tax Clearance Request Form on any device with the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

Edit and eSign Vermont Tax Clearance Request Form with Ease

- Locate Vermont Tax Clearance Request Form and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to conserve your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Vermont Tax Clearance Request Form to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont tax clearance request form

Create this form in 5 minutes!

How to create an eSignature for the vermont tax clearance request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont Tax Clearance Request Form?

The Vermont Tax Clearance Request Form is a document that individuals or businesses need to submit to verify their tax status with the state of Vermont. This form ensures that all tax obligations are met before proceeding with various business transactions. Utilizing airSlate SignNow can simplify this process by allowing you to electronically sign and submit the form with ease.

-

How do I fill out the Vermont Tax Clearance Request Form?

Filling out the Vermont Tax Clearance Request Form requires accurate information about your tax status, including identification details and relevant tax accounts. With airSlate SignNow, you can efficiently complete the form using our intuitive interface which guides you through each necessary step. Additionally, you can securely save and access your forms whenever needed.

-

How much does it cost to use airSlate SignNow for Vermont Tax Clearance Request Form?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including options specifically for handling the Vermont Tax Clearance Request Form. Pricing typically varies based on the features you choose, but start-up costs are low compared to the traditional methods of document signing. Check our pricing page for specific details on subscription options.

-

Can I integrate airSlate SignNow with other software when submitting the Vermont Tax Clearance Request Form?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, enhancing your workflow when handling the Vermont Tax Clearance Request Form. Whether you use CRM systems, cloud storage, or project management tools, you can streamline your document management process. These integrations allow for a more cohesive way to manage your tax forms.

-

What are the benefits of using airSlate SignNow for the Vermont Tax Clearance Request Form?

Using airSlate SignNow for the Vermont Tax Clearance Request Form offers several benefits, including improved efficiency, remote access, and enhanced security. You can sign documents anywhere, anytime, which speeds up processing times for your clearance requests. The platform also provides advanced features like real-time tracking and reminders to ensure your forms are submitted on time.

-

Is airSlate SignNow safe for submitting the Vermont Tax Clearance Request Form?

Absolutely! AirSlate SignNow prioritizes the security of your documents, implementing advanced encryption and compliance measures when handling the Vermont Tax Clearance Request Form. Our platform adheres to industry standards to protect your sensitive information, giving you the peace of mind to conduct your transactions securely.

-

Can multiple users collaborate on the Vermont Tax Clearance Request Form using airSlate SignNow?

Yes, airSlate SignNow supports multi-user collaboration, making it easy for teams to work together on the Vermont Tax Clearance Request Form. Multiple users can access, edit, and sign the document simultaneously, which streamlines the process and enhances efficiency. This collaborative feature makes it easier for your business to manage important tax-related documents.

Get more for Vermont Tax Clearance Request Form

- Green line 3 pdf form

- Petition eviction case county of bexar texas bexar county form

- Criminal complaint form pdf

- Bmi part 1 student weight status category survey ny schoolwires form

- Olathe community center ru under minors waiver olatheks form

- Nebraska fillable 1040n form

- Making sense of documentary photography form

- Ecole dansereau meadows school form

Find out other Vermont Tax Clearance Request Form

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later