Inz 1006 Form

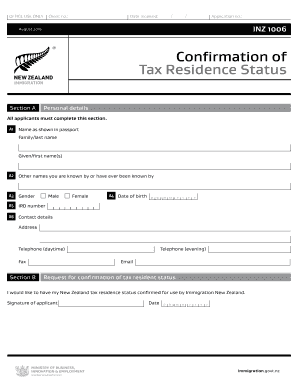

What is the Inz 1006?

The Inz 1006 form is a document used to confirm an individual's tax residence status. It serves as an important instrument for individuals who need to establish their residency for tax purposes, particularly in relation to international tax treaties. This form is essential for ensuring compliance with U.S. tax laws and regulations, particularly for non-residents and expatriates. Understanding the purpose of the Inz 1006 is crucial for anyone navigating the complexities of tax obligations in the United States.

Steps to Complete the Inz 1006

Completing the Inz 1006 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your full name, address, and taxpayer identification number. Next, provide details regarding your residency status, including the duration of your stay in the U.S. and any relevant tax treaty provisions. Carefully review the form for any additional requirements specific to your situation. Once completed, ensure that you sign and date the form to validate it before submission.

Legal Use of the Inz 1006

The Inz 1006 form holds legal significance as it is recognized by the IRS for establishing tax residency. To be considered legally binding, the form must be filled out accurately and submitted in accordance with IRS guidelines. Utilizing a reliable electronic signature platform can enhance the form's legitimacy, providing an electronic certificate that verifies the signer's identity and intent. This is particularly important for compliance with the ESIGN Act and UETA, which govern the use of electronic signatures in the United States.

Required Documents for the Inz 1006

When completing the Inz 1006 form, certain documents may be required to support your residency claim. These may include proof of identity, such as a passport or driver's license, and documentation that verifies your residency status, such as utility bills or lease agreements. Additionally, if applicable, include any tax treaty documentation that may affect your residency status. Ensuring that you have all necessary documents prepared can streamline the completion process and enhance the credibility of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Inz 1006 form can vary based on individual circumstances, such as the type of tax return being filed. Generally, it is advisable to submit the form as early as possible to avoid any potential issues with tax compliance. Be aware of key dates related to your tax filings, including the annual tax return deadline, which is typically April fifteenth for most taxpayers. Staying informed about these deadlines can help ensure that your Inz 1006 is submitted on time.

Examples of Using the Inz 1006

The Inz 1006 form may be utilized in various scenarios. For instance, a non-resident alien who has recently moved to the United States may need to complete the form to establish their tax residency status for the purpose of filing their income tax return. Similarly, expatriates who are returning to their home country may use the form to confirm their residency status for tax treaty benefits. Understanding these examples can help individuals recognize the importance of the Inz 1006 in their unique tax situations.

Quick guide on how to complete inz 1006

Effortlessly Prepare Inz 1006 on Any Device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Manage Inz 1006 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The Easiest Way to Edit and eSign Inz 1006 Without Stress

- Locate Inz 1006 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which requires mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Inz 1006 to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inz 1006

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INZ 1006 form and how does it relate to airSlate SignNow?

The INZ 1006 form is a vital document used in specific immigration processes within New Zealand. airSlate SignNow simplifies the process of filling out and signing the INZ 1006 form by providing a user-friendly platform that allows for secure electronic signatures and document management, helping you streamline your application process effectively.

-

Can I use airSlate SignNow to fill out the INZ 1006 form electronically?

Yes, airSlate SignNow fully supports the electronic filling and signing of the INZ 1006 form. With its intuitive interface, users can easily complete required fields and ensure their submissions meet all necessary guidelines without hassle.

-

What features does airSlate SignNow offer for managing the INZ 1006 form?

airSlate SignNow offers several features for managing the INZ 1006 form, including customizable templates, real-time collaboration, and secure cloud storage. These capabilities help users efficiently manage their document workflow while maintaining compliance with regulatory requirements.

-

Is airSlate SignNow a cost-effective solution for processing the INZ 1006 form?

Absolutely! airSlate SignNow provides a cost-effective solution for processing the INZ 1006 form, enabling users to save on printing and mailing costs. By digitizing the process, businesses can also reduce time spent on administrative tasks, allowing for greater focus on other priorities.

-

What integrations does airSlate SignNow offer to assist with the INZ 1006 form?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations facilitate easy document management and sharing, making it simpler to work with the INZ 1006 form alongside other business tools.

-

How secure is the signing process for the INZ 1006 form with airSlate SignNow?

Security is a top priority with airSlate SignNow, especially when handling important documents like the INZ 1006 form. The platform employs bank-level encryption and complies with industry standards to ensure that all eSignatures and data are kept secure throughout the signing process.

-

Can multiple users collaborate on the INZ 1006 form using airSlate SignNow?

Yes, multiple users can collaborate on the INZ 1006 form using airSlate SignNow. The platform allows for real-time collaboration, enabling teams to work together efficiently and make necessary adjustments or additions to the form without delays.

Get more for Inz 1006

- All information is confidential and will be released only as allowed through hipaa

- School and child care information idaho department of health and

- Homemetry comhouse1000 bestgate rd annapolis md1000 bestgate rd annapolis md owners history phone number form

- If you prefer you may complete this form online at httpdhr

- Schoolbased health center health visit report form well child exam only see attached physical exam form sbhc name ampamp mmcp

- Group therapy screening form 615858336

- School verification for elementary amp high school only form

- Adult case history form date completed name phone

Find out other Inz 1006

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement