Form 104pn

What is the Form 104pn

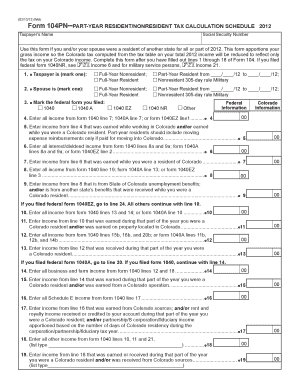

The 2015 Colorado 104pn is a state tax form used by part-year residents and non-residents to report income earned in Colorado. This form is specifically designed for individuals who only lived in Colorado for part of the tax year, allowing them to calculate their tax liability based on Colorado-sourced income. It is essential for accurately determining the amount of tax owed or any refund due to the state.

How to use the Form 104pn

To use the Colorado 104pn effectively, individuals must first gather all relevant income information from the tax year. This includes W-2 forms, 1099s, and any other documentation that reflects income earned while residing in Colorado. The form requires taxpayers to report their total income and then calculate the portion attributable to Colorado. It is important to follow the instructions carefully to ensure accurate reporting and compliance with state tax regulations.

Steps to complete the Form 104pn

Completing the 2015 Colorado 104pn involves several key steps:

- Begin by filling out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Calculate the portion of your income that is taxable in Colorado by using the provided worksheets.

- Apply any deductions or credits that you qualify for, as specified in the instructions.

- Determine your final tax liability and any amount owed or refund due.

Legal use of the Form 104pn

The 2015 Colorado 104pn is legally recognized for tax reporting purposes when completed accurately and submitted on time. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Colorado Department of Revenue. This includes maintaining records of all income and deductions claimed, as well as ensuring that the form is signed and dated appropriately. E-filing options may also be available, which can enhance the security and efficiency of the submission process.

Filing Deadlines / Important Dates

For the 2015 tax year, the filing deadline for the Colorado 104pn typically aligns with the federal tax deadline, which is usually April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to avoid penalties for late filing. Additionally, extensions may be available, but they must be requested in advance.

Form Submission Methods (Online / Mail / In-Person)

The 2015 Colorado 104pn can be submitted through various methods. Taxpayers may choose to file online using approved e-filing services, which can streamline the process and provide immediate confirmation of submission. Alternatively, the form can be printed and mailed to the appropriate Colorado Department of Revenue address. In-person submissions may also be accepted at designated state tax offices. It is important to check for the most current submission methods and guidelines to ensure compliance.

Quick guide on how to complete form 104pn

Effortlessly prepare Form 104pn on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 104pn from any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to edit and eSign Form 104pn with ease

- Locate Form 104pn and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 104pn and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 104pn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2015 Colorado 104PN and how does it function?

The 2015 Colorado 104PN is a tax form used for reporting non-resident income in the state of Colorado. It allows for streamlined filing of income tax for individuals who earn income from Colorado sources. Understanding this form is crucial for compliance and to avoid any penalties.

-

How can airSlate SignNow assist with the 2015 Colorado 104PN?

airSlate SignNow simplifies the process of signing and sending the 2015 Colorado 104PN documents electronically. With our platform, you can easily create, edit, and manage your tax documents, ensuring they are signed securely and sent promptly. This efficiency can save both time and resources during tax season.

-

Is there a cost associated with filing the 2015 Colorado 104PN using airSlate SignNow?

While airSlate SignNow offers competitive pricing, there are various subscription plans available to fit your needs. Depending on the plan you choose, you can eSign and manage documents related to the 2015 Colorado 104PN at an economical rate. Please visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for handling the 2015 Colorado 104PN?

Our platform provides key features such as document templates, customizable workflows, and real-time tracking for the 2015 Colorado 104PN. You can automate reminders for signatures, collaborate with your team, and ensure compliance with state tax regulations. These features enhance efficiency and accuracy in your tax filing process.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software and tools. This integration ensures that you can easily incorporate documents like the 2015 Colorado 104PN into your existing workflow. Our API allows for a customized experience tailored to your specific needs.

-

What are the benefits of using airSlate SignNow for my 2015 Colorado 104PN?

Using airSlate SignNow for your 2015 Colorado 104PN provides numerous benefits including improved security, reduced paperwork, and faster processing times. You can eSign documents from anywhere, allowing for greater flexibility and convenience. This ultimately leads to a more streamlined and efficient filing experience.

-

Is airSlate SignNow compliant with federal and state regulations for the 2015 Colorado 104PN?

Absolutely, airSlate SignNow adheres to all compliance regulations required for electronic signatures. This includes ensuring that the signing process for the 2015 Colorado 104PN meets both federal and Colorado state requirements, providing peace of mind that your documents are legally binding.

Get more for Form 104pn

- T his form may be used for annual reporting of regularly scheduled sos ok

- Irp6 form

- Ohf screening declaration form pdf

- Content creator contract template form

- Software service contract template form

- Software subscription contract template form

- Software support contract template form

- Software time and materials contract template form

Find out other Form 104pn

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement