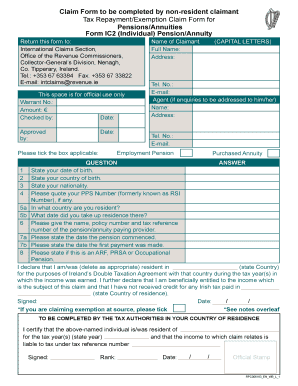

Ic2 Form

What is the IC2 Form

The IC2 form is a specific document used for international claims related to Irish tax. It is essential for individuals or businesses that need to claim relief or refunds for taxes paid in Ireland while residing or operating in the United States. This form is particularly relevant for U.S. taxpayers who have had income sourced from Ireland and wish to ensure compliance with both U.S. and Irish tax regulations.

How to Use the IC2 Form

Using the IC2 form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including proof of income and tax payments made in Ireland. Next, fill out the form with accurate information regarding your personal details and tax situation. It is crucial to review the form for completeness and accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set forth by the Irish tax authorities.

Steps to Complete the IC2 Form

Completing the IC2 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as pay stubs and tax statements from Ireland.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail your income sources and the taxes paid in Ireland.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form as directed, either online or by mailing it to the appropriate tax authority.

Legal Use of the IC2 Form

The legal use of the IC2 form is governed by both U.S. and Irish tax laws. To be considered valid, the form must be completed accurately and submitted within the required deadlines. Additionally, it must comply with the legal frameworks surrounding international tax claims. Failure to adhere to these regulations may result in penalties or denial of claims, making it essential to understand the legal implications of the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the IC2 form can vary based on the specific tax year and individual circumstances. Generally, taxpayers should be aware of the following important dates:

- The deadline for submitting the IC2 form is typically aligned with the annual tax return deadlines.

- Extensions may be available, but it is crucial to check specific regulations regarding international claims.

- Keep track of any changes to deadlines announced by the Irish tax authorities.

Required Documents

When completing the IC2 form, certain documents are required to substantiate your claims. These may include:

- Proof of income earned in Ireland, such as pay stubs or tax returns.

- Documentation of taxes paid in Ireland, including receipts or bank statements.

- Identification documents, such as a passport or social security number.

Eligibility Criteria

To be eligible to use the IC2 form, individuals must meet specific criteria set by the Irish tax authorities. Generally, eligibility includes:

- Having income sourced from Ireland while being a resident in the United States.

- Having paid taxes in Ireland that are eligible for refund or relief.

- Meeting any additional requirements outlined by the Irish tax authorities regarding international claims.

Quick guide on how to complete ic2 form

Effortlessly Complete Ic2 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Ic2 Form on any device using airSlate SignNow's Android or iOS applications and enhance any paper-based workflow today.

How to Modify and Electronically Sign Ic2 Form with Ease

- Obtain Ic2 Form and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Ic2 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ic2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC2 form, and why is it important?

The IC2 form is a crucial document used in various business and legal transactions. Understanding its importance can streamline your processes and ensure compliance. It serves to outline agreements and responsibilities, making it essential for effective communication.

-

How does airSlate SignNow support IC2 form signing?

airSlate SignNow provides a simple platform for sending and eSigning the IC2 form securely. With advanced features like template creation and automated workflows, users can handle document signing efficiently. This ensures that your IC2 form is completed quickly and accurately.

-

What pricing plans does airSlate SignNow offer for using the IC2 form?

airSlate SignNow offers various pricing plans tailored to fit individual and business needs when working with the IC2 form. Plans range from basic features to advanced capabilities, allowing users to choose based on their document management volume. Each plan provides valuable tools to enhance efficiency.

-

Can I integrate airSlate SignNow with other applications when handling the IC2 form?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing your capability to manage the IC2 form. Popular integrations include CRMs, cloud storage platforms, and productivity tools. This connectivity streamlines your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the IC2 form?

Using airSlate SignNow for the IC2 form offers benefits such as time savings, improved accuracy, and enhanced security. The platform allows for quick document turnaround and tracking, ensuring all parties are kept informed. Additionally, electronic signatures provide a legally binding and environmentally friendly solution.

-

Is the IC2 form legally binding when signed electronically?

Yes, the IC2 form is legally binding when signed electronically via airSlate SignNow. The platform complies with e-signature laws, ensuring that your signed documents hold up in court. It is a safe and recognized way to complete important agreements.

-

What features should I look for in airSlate SignNow for managing the IC2 form?

When looking for features in airSlate SignNow for managing the IC2 form, consider document templates, real-time collaboration tools, and secure storage options. These features enhance user experience and make it easier to streamline your workflows. Look for tools that facilitate easy access and tracking.

Get more for Ic2 Form

- Employee profile sheet form

- 461 visa form

- Bank details request form

- Patients hands pronated form

- Request for delivery information return receipt after usps com

- Ldss 5145 486344776 form

- How to create a digital signature in adobe reader xi and sign a document form

- Emotional and social competency inventory form

Find out other Ic2 Form

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free