Form 6166

What is the Form 6166

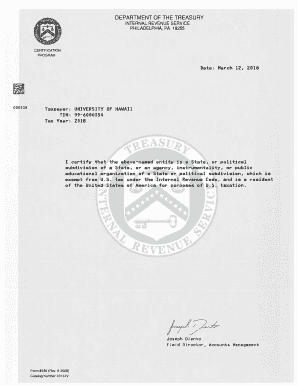

The Form 6166, also known as the Certification of U.S. Tax Residency, is an official document issued by the Internal Revenue Service (IRS). It certifies that an individual or business is a resident of the United States for tax purposes. This form is often required for U.S. citizens and residents who need to prove their residency to foreign tax authorities, particularly when claiming tax treaty benefits. The form ensures that individuals are not subject to double taxation on income earned abroad.

How to obtain the Form 6166

To obtain the Form 6166, individuals must submit a request to the IRS. This can be done by completing Form 4506-T, Request for Transcript of Tax Return, and specifying that a certification of residency is needed. The request can be submitted online, by mail, or by fax. It is important to provide accurate information to avoid delays. Typically, the IRS processes requests within a few weeks, but processing times can vary based on the volume of requests received.

Steps to complete the Form 6166

Completing the Form 6166 involves several steps. First, ensure you have the correct tax information, including your Social Security number or Employer Identification Number. Next, fill out Form 4506-T accurately, indicating the years for which you need the residency certification. After completing the form, submit it to the IRS via your chosen method. Once processed, the IRS will send you the Form 6166, which you can then present to foreign tax authorities as needed.

Legal use of the Form 6166

The Form 6166 is legally binding and serves as proof of U.S. residency for tax purposes. It is essential for individuals and businesses that wish to benefit from tax treaties between the U.S. and other countries. By providing this form to foreign tax authorities, taxpayers can avoid double taxation on income. It is crucial to ensure that the form is completed accurately and submitted in accordance with IRS guidelines to maintain its legal validity.

Key elements of the Form 6166

The key elements of the Form 6166 include the taxpayer's name, address, and taxpayer identification number, as well as the specific years for which residency is being certified. The form also includes the IRS's official seal and signature, which authenticate the document. These elements are vital for ensuring that the form is accepted by foreign tax authorities and that it serves its intended purpose of proving U.S. tax residency.

Filing Deadlines / Important Dates

There are no specific deadlines for submitting Form 4506-T to request Form 6166, but it is advisable to request the form well in advance of any tax obligations or deadlines in foreign jurisdictions. Taxpayers should be aware of the filing deadlines for their tax returns, as these dates may impact the processing time for Form 6166 requests. Keeping track of important tax dates can help ensure that all necessary documentation is submitted on time.

Quick guide on how to complete form 6166

Manage Form 6166 effortlessly on any device

Digital document administration has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 6166 on any platform using the airSlate SignNow applications for Android or iOS and streamline your document-related processes today.

The easiest way to modify and electronically sign Form 6166 with ease

- Find Form 6166 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign feature, which only takes seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 6166 to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6166

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 6166 form, and how can it be used?

The 6166 form is an official certification issued by the IRS, confirming a taxpayer's status and tax compliance. You can utilize the 6166 form when applying for tax treaty benefits or for certain foreign tax and financial regulations. Making use of airSlate SignNow facilitates the eSigning process for your 6166 form, ensuring security and efficiency.

-

How does airSlate SignNow help with the 6166 form eSigning process?

airSlate SignNow provides a seamless platform for electronically signing the 6166 form, saving you valuable time. With our intuitive interface, you can prepare, sign, and manage documents related to your 6166 form effortlessly. The service enhances collaboration while maintaining compliance and security.

-

What features does airSlate SignNow offer for handling the 6166 form?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and automated reminders specifically useful for managing the 6166 form. You can also integrate various tools to streamline your document workflows while ensuring all eSigned documents are securely stored. This makes the process straightforward and efficient.

-

Is there a cost associated with using airSlate SignNow for the 6166 form?

AirSlate SignNow provides a range of pricing plans that cater to different business needs, including the handling of the 6166 form. While there is a fee involved, our plans are designed to be cost-effective, especially when you factor in the time and resources saved. You can evaluate our pricing options on the website to find the best fit.

-

Can I integrate airSlate SignNow with other software for the 6166 form?

Yes, airSlate SignNow supports multiple integrations with third-party applications, making it easy to manage your 6166 form alongside your other business tools. This capability enhances workflow efficiency by allowing you to connect with CRMs, cloud storage solutions, and more. Integration ensures that your signing process is as streamlined as possible.

-

What are the benefits of using airSlate SignNow for the 6166 form?

Using airSlate SignNow for the 6166 form brings numerous benefits, including increased efficiency, enhanced security, and legally binding signatures. It eliminates the hassle of paper documents and enables you to manage your eSigning needs from anywhere. Moreover, our support team is available to assist you with any questions or issues.

-

How secure is the information submitted through the 6166 form via airSlate SignNow?

Security is a top priority at airSlate SignNow. All information submitted through the eSigning process of the 6166 form is protected using encryption to ensure your data remains confidential. Additionally, we adhere to industry-standard compliance measures to further safeguard your sensitive information.

Get more for Form 6166

- Ayso medical release form 366472601

- Superior court forms skagit county washington

- Echocardiography requisition please book at form

- Appointment requisitionnorthwest form

- Sourc agent contract template form

- Sourc contract template form

- Spay and neuter contract template form

- Spa membership contract template 787755580 form

Find out other Form 6166

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple